Hi guys i will be planning to purchase my very first home and its a rumahwip located in Danau Kota. (Vista Saujana). Price is RM300k

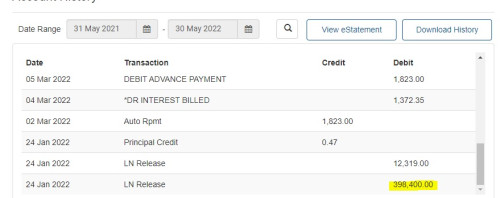

Have already submitted my loan application to Maybank, MBSB, and also RHB hoping for the best to secure a 100% loan.

Currently i do not have any commitment or whatsoever asides from PTPTN which i will pay around RM350 monthly.

My salary is around RM3900 (gross) Rm3400 (after deduction per month) and working in the IT industry.

Been working for a total of 2 and a half years since graduation.

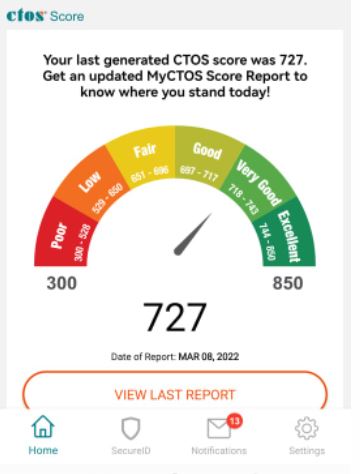

I do have a Hong Leong bank credit card as well which i applied few months ago in preparation to increase my credit score for property purchase.

So what are the chances do you think i will be eligible in securing a 100% loan?

Am i eligible for 100% loan?

May 31 2022, 04:33 PM, updated 4y ago

May 31 2022, 04:33 PM, updated 4y ago

Quote

Quote

0.0231sec

0.0231sec

0.64

0.64

5 queries

5 queries

GZIP Disabled

GZIP Disabled