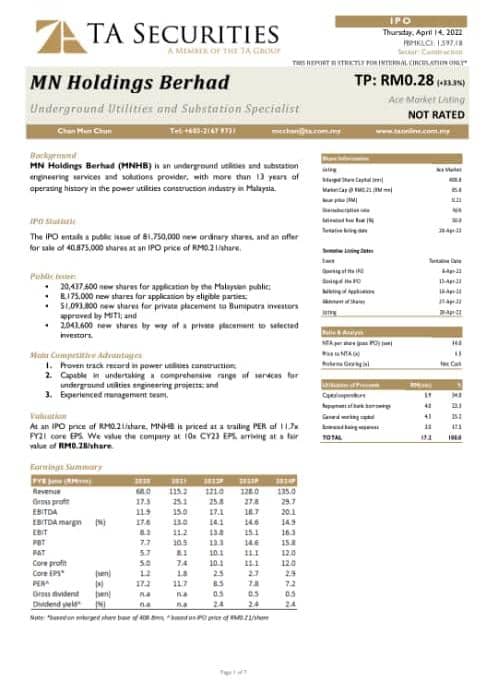

TA give RM0.28 as fair value. P/E only 10

IPO : MN Holding Berhad, For offer at 0.210

|

|

Apr 14 2022, 12:31 PM Apr 14 2022, 12:31 PM

Return to original view | IPv6 | Post

#1

|

Probation

33 posts Joined: Feb 2022 |

|

|

|

|

|

|

Apr 14 2022, 03:54 PM Apr 14 2022, 03:54 PM

Return to original view | IPv6 | Post

#2

|

Probation

33 posts Joined: Feb 2022 |

|

|

|

Apr 15 2022, 01:12 PM Apr 15 2022, 01:12 PM

Return to original view | IPv6 | Post

#3

|

Probation

33 posts Joined: Feb 2022 |

|

|

|

Apr 15 2022, 08:25 PM Apr 15 2022, 08:25 PM

Return to original view | IPv6 | Post

#4

|

Probation

33 posts Joined: Feb 2022 |

|

|

|

Apr 16 2022, 07:55 AM Apr 16 2022, 07:55 AM

Return to original view | IPv6 | Post

#5

|

Probation

33 posts Joined: Feb 2022 |

|

|

|

Apr 16 2022, 03:14 PM Apr 16 2022, 03:14 PM

Return to original view | IPv6 | Post

#6

|

Probation

33 posts Joined: Feb 2022 |

QUOTE(nexona88 @ Apr 16 2022, 11:25 AM) Peers comparison:1) PESTECH-RM0.60-PE 9.34 2) SAMAIDEN-RM1.16-PE 36.32 3) SLVEST-RM0.975-PE 50 nexona88 liked this post

|

|

|

|

|

|

Apr 16 2022, 03:28 PM Apr 16 2022, 03:28 PM

Return to original view | IPv6 | Post

#7

|

Probation

33 posts Joined: Feb 2022 |

|

|

|

Apr 21 2022, 07:38 AM Apr 21 2022, 07:38 AM

Return to original view | Post

#8

|

Probation

33 posts Joined: Feb 2022 |

|

|

|

Apr 27 2022, 01:03 AM Apr 27 2022, 01:03 AM

Return to original view | IPv6 | Post

#9

|

Probation

33 posts Joined: Feb 2022 |

KUALA LUMPUR: Bursa Malaysia's ACE Market-bound MN Holdings Bhd (MNHB) has secured RM32.5 million of underground utilities and substation engineering services and solutions contracts in Selangor and Johor.

MNHB's wholly-owned Mutu Nusantara Sdn Bhd received a Letter of Award from Syarikat Pembenaan Yeoh Tiong Lay Sdn Bhd, appointing it to be the sub-contractor to provide horizontal directional drilling (HDD) construction works for RM7.8 million. The contract comprises supply, deliver, install, test, commission and hand over of HDD construction works for the proposed two-storey ramp up warehouse in Klang. MN Power Transmission Sdn Bhd, another wholly-owned subsidiary, received two Letters of Awards from Syarikat Mohamad Salin Sdn Bhd. MN Power will carry out design works and drawing submission for the extension of a main substation in Johor for RM16.7 million. The third contract worth RM8.0 million will see MN Power undertake asset replacement and refurbishment for primary and combined equipment at a substation in Johor. MNHB managing director Loy Siong Hay said the contracts were a testament to its proven track record and ability to secure sizeable contracts. "We will continue to leverage on our core expertise to secure new projects." MNHB today also announced its second quarter ended December 31 2021 (2QFY21) financial results ahead of its listing on April 28. The company reported a net profit of RM2.5 million against a revenue of RM26.1 million. Its basic earnings per share (EPS) for the quarter was 0.77 sen. For the cumulative six months, MNHB achieved a net profit of RM4.8 million on a revenue of RM49.8 million. Basic EPS stood at 1.46 sen. No comparative figures were available as it was the first interim financial report released of MNHB in relation to its earnings, in compliance with the listing requirements. The company's revenues came mainly from its underground utilities engineering segment. For the current quarter and financial year-to-date, MNHB's revenue was contributed by customers from the power industry (about 99 per cent) followed by gas industry. Under its listing, MNHB expects to raise RM17.2 million from a public issue of 81.8 million new shares at 21 sen each. The listing also include an offer for sale of 40.9 million existing shares to selected investors by way of private placement. Based on the enlarged share capital of 408.75 million shares, MNHB is expected to have a market capitalisation of RM85.84 million. |

|

|

Apr 27 2022, 07:05 PM Apr 27 2022, 07:05 PM

Return to original view | IPv6 | Post

#10

|

Probation

33 posts Joined: Feb 2022 |

|

|

|

Apr 27 2022, 07:55 PM Apr 27 2022, 07:55 PM

Return to original view | IPv6 | Post

#11

|

Probation

33 posts Joined: Feb 2022 |

1st IPO PE below 10 this year

|

| Change to: |  0.0226sec 0.0226sec

0.32 0.32

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 23rd December 2025 - 04:23 AM |