UMediC Group Bhd, a manufacturer and distributor of medical devices, is seeking a listing on the ACE Market of Bursa Malaysia.

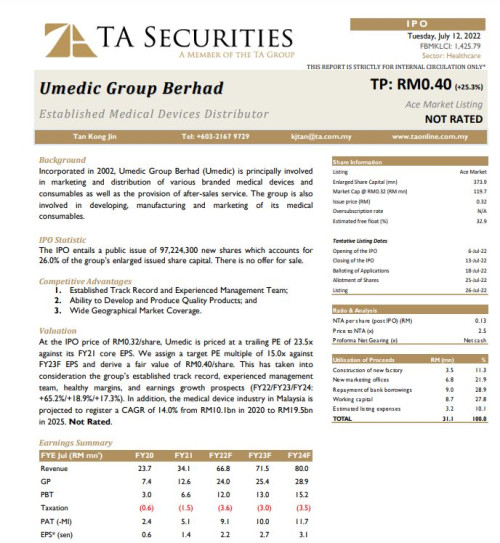

UMediC, whose factory in located in Batu Kawan, Penang, plans to use the proceeds of the IPO for capital expenditure to construct a new factory building there.

“The capex also will be allocated to set up new marketing and distribution offices in the central area of Kuala Lumpur and Johor Bahru,” it said.

The IPO proceeds will also be used for the repayment of bank borrowings, as well as working capital to expand its business into new markets and expand its product range, the company said.

For the financial year ended 2021 (FY21), UMediC posted a revenue of RM34.12 million, higher than RM23.68 million in FY20, and RM16.42 million in FY19, mainly due to an increase in revenue from its marketing and distribution segment.

“For FY21, we distributed our products to more than 400 customers, comprising public and private hospitals, other healthcare service providers such as medical centres and other healthcare-related facilities, as well as non-hospitals.

“Malaysia, being our principal market, contributed approximately RM28.56 million or 83.71% of our revenue for FY21, while the remaining revenue of approximately RM5.56 million or 16.29% was generated from the overseas market,” the company said.

UMediC said its board has not adopted a formal dividend payout policy, and any declarations of dividends in the future will be at the discretion of the directors.

UMediC is the authorised distributor of multiple established international medical device companies including Philips, Mindray, GE and Merit. It is also involved in the development, manufacturing and marketing of medical consumables, namely HydroX series prefilled humidifiers.

Affin Hwang Investment Bank Bhd is the principal adviser for the IPO exercise.

IPO comprising the public issue of 97,224,300 new ordinary shares in UMC (“IPO Shares”) in the following manner:

18,695,500 IPO Shares available for application by the Malaysian public;

13,086,800 IPO Shares available for application by eligible directors, employees and business associates who have contributed to the success of the Group; and

65,442,000 IPO Shares by way of private placement to selected investors.

This post has been edited by nexona88: Aug 9 2022, 06:17 PM

UMediC Group Berhad (0256), Ace Market

Mar 8 2022, 05:00 PM, updated 4y ago

Mar 8 2022, 05:00 PM, updated 4y ago

Quote

Quote

0.0199sec

0.0199sec

0.63

0.63

5 queries

5 queries

GZIP Disabled

GZIP Disabled