QUOTE(dixonleong @ Apr 7 2022, 10:58 PM)

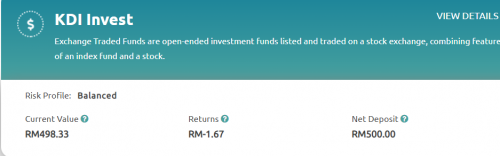

Need to give it few years to see growth. KDI invest choices so far solid. Below RM3k no fees charged so how also you gained.This post has been edited by Davidtcf: Apr 7 2022, 11:42 PM

Investment Kenanga Digital Investing (KDI), KDI Invest, KDI Save

|

|

Apr 7 2022, 11:42 PM Apr 7 2022, 11:42 PM

Show posts by this member only | IPv6 | Post

#861

|

Senior Member

3,520 posts Joined: Jan 2003 |

QUOTE(dixonleong @ Apr 7 2022, 10:58 PM) Need to give it few years to see growth. KDI invest choices so far solid. Below RM3k no fees charged so how also you gained.This post has been edited by Davidtcf: Apr 7 2022, 11:42 PM Daprind liked this post

|

|

|

|

|

|

Apr 8 2022, 10:59 AM Apr 8 2022, 10:59 AM

|

Senior Member

7,565 posts Joined: May 2012 |

|

|

|

Apr 8 2022, 11:26 AM Apr 8 2022, 11:26 AM

|

Senior Member

3,520 posts Joined: Jan 2003 |

|

|

|

Apr 8 2022, 11:42 AM Apr 8 2022, 11:42 AM

|

Senior Member

2,547 posts Joined: Sep 2011 |

missed the 11am cut-off and since today is Friday, just to confirm that it will be better to transfer on Monday before 11am right?

|

|

|

Apr 8 2022, 11:48 AM Apr 8 2022, 11:48 AM

|

Junior Member

144 posts Joined: Jun 2014 From: Kuala Lumpur |

QUOTE(Davidtcf @ Apr 7 2022, 11:42 PM) Need to give it few years to see growth. KDI invest choices so far solid. Below RM3k no fees charged so how also you gained. Decided to put 1K in KDI Invest. Don't mind to leave it there for couple of years. Hope to see +++ coming... Davidtcf and lovelyuser liked this post

|

|

|

Apr 8 2022, 11:51 AM Apr 8 2022, 11:51 AM

|

Junior Member

144 posts Joined: Jun 2014 From: Kuala Lumpur |

QUOTE(lowyat101 @ Apr 8 2022, 11:42 AM) missed the 11am cut-off and since today is Friday, just to confirm that it will be better to transfer on Monday before 11am right? Yes you are right. Even if you put it now, it will only consider Monday as processing time and reflects at 4PM that very same day. Just remember to deposit by Monday before 11AM. lowyat101 liked this post

|

|

|

|

|

|

Apr 8 2022, 03:44 PM Apr 8 2022, 03:44 PM

|

Senior Member

6,427 posts Joined: Jan 2003 From: Autobiography!!! |

QUOTE(dixonleong @ Apr 7 2022, 10:33 PM) noob question, deposit for invest just reflected today, straightaway negative returns. Most likely it is 0.2% FX conversion just wait for statement next month only can confirm on the calculation Are this due to the fees kicking in? Normally the returns (up/down) reflects daily or only at beginning of the month in form of statement? I'm asking so can time further deposit timely (less volatile weeks), as currently majority large US indexed ETF (SPY, VOO, QQQ) has been red down quite a bit these few days  QUOTE(lowyat101 @ Apr 8 2022, 11:42 AM) missed the 11am cut-off and since today is Friday, just to confirm that it will be better to transfer on Monday before 11am right? Yes better do it on working day before 11am |

|

|

Apr 8 2022, 04:08 PM Apr 8 2022, 04:08 PM

|

Junior Member

993 posts Joined: Jun 2013 |

QUOTE(Daprind @ Apr 8 2022, 11:48 AM) Decided to put 1K in KDI Invest. Don't mind to leave it there for couple of years. Hope to see +++ coming... Good expectation and mindset for investment, have a long term horizon. But imagine this, assume yearly 10%, 5 years compounded total return 61.05%Your investment of 1k will grow to 1.61k, will that additional RM 610 makes any big difference to your life? If yes, go on. If not, then you should consider set aside a fix amount and invest periodically (weekly best, else monthly), with that you will get a more meaningful amount for your future self. Daprind liked this post

|

|

|

Apr 8 2022, 04:14 PM Apr 8 2022, 04:14 PM

|

Senior Member

1,210 posts Joined: Nov 2011 |

QUOTE(Daprind @ Apr 8 2022, 11:48 AM) Decided to put 1K in KDI Invest. Don't mind to leave it there for couple of years. Hope to see +++ coming... QUOTE(lovelyuser @ Apr 8 2022, 04:08 PM) Good expectation and mindset for investment, have a long term horizon. But imagine this, assume yearly 10%, 5 years compounded total return 61.05% It's also worth nothing that $VT, the backbone of the aggressive KDI Invest portfolio has an expense ratio of 0.07% on top of 0.2% FX charges. It's one thing to start out small and test the waters, but I won't recommend anyone to pay 0.7% annual fees to buy a 0.07% expense ratio ETF if investing for long term anyway.Your investment of 1k will grow to 1.61k, will that additional RM 610 makes any big difference to your life? If yes, go on. If not, then you should consider set aside a fix amount and invest periodically (weekly best, else monthly), with that you will get a more meaningful amount for your future self. Daprind liked this post

|

|

|

Apr 8 2022, 04:16 PM Apr 8 2022, 04:16 PM

|

Probation

36 posts Joined: Jul 2020 |

QUOTE(Hoshiyuu @ Apr 8 2022, 04:14 PM) It's also worth nothing that $VT, the backbone of the aggressive KDI Invest portfolio has an expense ratio of 0.07% on top of 0.2% FX charges. It's one thing to start out small and test the waters, but I won't recommend anyone to pay 0.7% annual fees to buy a 0.07% expense ratio ETF if investing for long term anyway. Why said so might enlighten me? |

|

|

Apr 8 2022, 04:19 PM Apr 8 2022, 04:19 PM

|

Senior Member

6,427 posts Joined: Jan 2003 From: Autobiography!!! |

|

|

|

Apr 8 2022, 04:25 PM Apr 8 2022, 04:25 PM

|

Probation

36 posts Joined: Jul 2020 |

QUOTE(xander83 @ Apr 8 2022, 04:19 PM) Ok, thanks for the input. I just want to venture into ETF buying. still thinking to choose through KDI Invest which majority is US big ETF like VT,SPY,VOO or through DIY IBKR which I can buy Ireland domiciled ETF similar to US one. |

|

|

Apr 8 2022, 04:28 PM Apr 8 2022, 04:28 PM

Show posts by this member only | IPv6 | Post

#873

|

All Stars

65,295 posts Joined: Jan 2003 |

QUOTE(lowyat101 @ Apr 8 2022, 11:42 AM) missed the 11am cut-off and since today is Friday, just to confirm that it will be better to transfer on Monday before 11am right? strategically, before 11am Fridaypractically, put before 11am next monday if you really have no intention to use the $$ now, sure, do the deposit now also can. no harm anyway. however, since there is no benefits for doing so, keeping the $$ in your bank now is more practical in case of emergency/adhoc use during the weekend |

|

|

|

|

|

Apr 8 2022, 04:31 PM Apr 8 2022, 04:31 PM

|

Senior Member

1,210 posts Joined: Nov 2011 |

QUOTE(CQT @ Apr 8 2022, 04:16 PM) Ah, what I mean is, KDI Invest don't really offer anything attractive or unique to a person with international brokerage access. But it remains a good alternative to those who aren't willing to DIY.Currently, KDI Invest's aggressive portfolio consist of ~65% $VT (Vanguard Total World Index) and the rest a mix of BNDX (Aggregate bond), CASH, and a sprinkle of miscellaneous ETF like QQQ and SPY. Functionally, it's literally just a mix of VT (Total World Equities), BNDX (World Aggregate Bond), and CASH. Such a simple portfolio can further be simplified by dropping BNDX (young people usually opt to not add Bond to portfolios until latter in investing life, or use EPF/ASNB/SSPN as pseudo bonds). Thus, its a 1-fund portfolio consist of VT. Most brokerage charge very little commissions (free or 0.35 US cents) on US etfs, and the ongoing charges for holding VT is only 0.07%. So to grossly simplify it, if VT returns 7% a year - you get 6.93% of the return. You get only 6.3% of the return if investing through KDI. (~10% less). This will greatly affect your compounding - and hurts a lot when market is sideways for a very long time. Furthermore, VT's non-US alternative, VWRA, only pay 15% withholding tax instead of VT's 30% - that's another 0.5% different in annual returns. So it doesn't actually take too much capital to quickly outperform KDI Invest or any roboadvisor investing in basically the same thing, but earn more simply you are paying less fees. TL:DR: fees bad, KDI Invest no offer anything unique This post has been edited by Hoshiyuu: Apr 8 2022, 04:32 PM |

|

|

Apr 8 2022, 04:39 PM Apr 8 2022, 04:39 PM

|

Senior Member

6,427 posts Joined: Jan 2003 From: Autobiography!!! |

QUOTE(CQT @ Apr 8 2022, 04:25 PM) Ok, thanks for the input. I just want to venture into ETF buying. still thinking to choose through KDI Invest which majority is US big ETF like VT,SPY,VOO or through DIY IBKR which I can buy Ireland domiciled ETF similar to US one. Just put in rm2800 in KDi in order to get fee free for nowTHe rest of it just diy buying Irish domiciled and hold long term Btw KDI not that attractive at the moment as most of the portfolio are very simple to replicate for almost next to nothing Daprind liked this post

|

|

|

Apr 8 2022, 04:40 PM Apr 8 2022, 04:40 PM

|

Senior Member

1,210 posts Joined: Nov 2011 |

QUOTE(CQT @ Apr 8 2022, 04:25 PM) Ok, thanks for the input. I just want to venture into ETF buying. still thinking to choose through KDI Invest which majority is US big ETF like VT,SPY,VOO or through DIY IBKR which I can buy Ireland domiciled ETF similar to US one. It'll depend on your capital, your investment interval, and how much you plan to deposit each time. It goes something like this:1. 0 lump sum capital, plan to put in 200 or so a month build investing habit: Stashaway, KDI Invest is fine. 2. 500-1000 a month, prefer monthly DCA to better capture up and downs of the market - IBKR and buy $VT, accept paying 15% more WHT for cheaper trading fees. Move to Ireland domiciled &VWRA in the future when withholding tax drag is bigger than trade commission cost. 3. ~2500-3000++ a month, or willing to invest quarterly (save up to 3000-5000+ then one shot invest every 3-4 months): $VWRA on IBKR. Fees for reference: Wise forex MYR -> USD is about 0.5% forex charge IBKR forex: 2USD fixed, spot rate. IBKR US stocks : 0.35USD IBKR Ireland domiciled USD denominated stocks: 1.70USD $VT Expense Ratio: 0.07% annually $VWRA Expense Ratio: 0.22% annually imforumer, lovelyuser, and 1 other liked this post

|

|

|

Apr 8 2022, 05:00 PM Apr 8 2022, 05:00 PM

|

Probation

36 posts Joined: Jul 2020 |

QUOTE(Hoshiyuu @ Apr 8 2022, 04:40 PM) It'll depend on your capital, your investment interval, and how much you plan to deposit each time. It goes something like this: Ok thanks for all the input guys much appreciate it 1. 0 lump sum capital, plan to put in 200 or so a month build investing habit: Stashaway, KDI Invest is fine. 2. 500-1000 a month, prefer monthly DCA to better capture up and downs of the market - IBKR and buy $VT, accept paying 15% more WHT for cheaper trading fees. Move to Ireland domiciled &VWRA in the future when withholding tax drag is bigger than trade commission cost. 3. ~2500-3000++ a month, or willing to invest quarterly (save up to 3000-5000+ then one shot invest every 3-4 months): $VWRA on IBKR. Fees for reference: Wise forex MYR -> USD is about 0.5% forex charge IBKR forex: 2USD fixed, spot rate. IBKR US stocks : 0.35USD IBKR Ireland domiciled USD denominated stocks: 1.70USD $VT Expense Ratio: 0.07% annually $VWRA Expense Ratio: 0.22% annually |

|

|

Apr 8 2022, 06:12 PM Apr 8 2022, 06:12 PM

|

Senior Member

2,547 posts Joined: Sep 2011 |

» Click to show Spoiler - click again to hide... « wow... nice info. but i don't really know most of the abbreviations any website that that i shall start looking into if i prefer to "DIY" way? thanks |

|

|

Apr 8 2022, 06:17 PM Apr 8 2022, 06:17 PM

|

Senior Member

3,520 posts Joined: Jan 2003 |

QUOTE(Hoshiyuu @ Apr 8 2022, 04:14 PM) It's also worth nothing that $VT, the backbone of the aggressive KDI Invest portfolio has an expense ratio of 0.07% on top of 0.2% FX charges. It's one thing to start out small and test the waters, but I won't recommend anyone to pay 0.7% annual fees to buy a 0.07% expense ratio ETF if investing for long term anyway. Below RM3k no fees just need to pay for FX rate. If invest past 3k better go DIY buy via IBKR. That’s my take anyway.Anyhow robo like these will always have their customers. They too lazy to DIY |

|

|

Apr 8 2022, 06:18 PM Apr 8 2022, 06:18 PM

|

Senior Member

3,520 posts Joined: Jan 2003 |

QUOTE(lowyat101 @ Apr 8 2022, 06:12 PM) » Click to show Spoiler - click again to hide... « wow... nice info. but i don't really know most of the abbreviations any website that that i shall start looking into if i prefer to "DIY" way? thanks https://forum.lowyat.net/topic/4843925/+5430#entry104084700 Easiest ETF is keep buy VWRA as it covers whole world. This post has been edited by Davidtcf: Apr 8 2022, 06:22 PM |

| Change to: |  0.0202sec 0.0202sec

0.22 0.22

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 8th December 2025 - 01:08 AM |