QUOTE(Samasama90 @ Jul 4 2022, 02:51 PM)

Ic. No wonder can not find past performance.

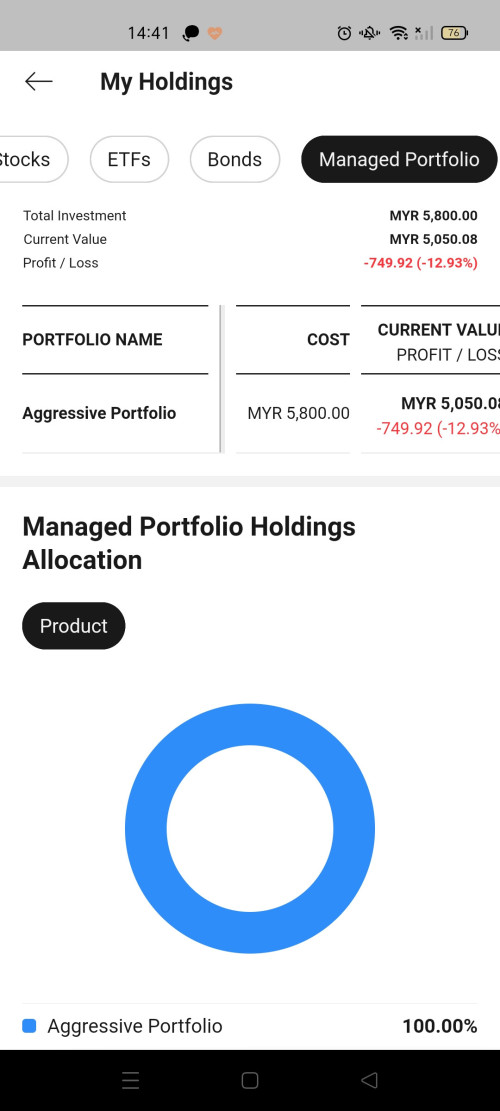

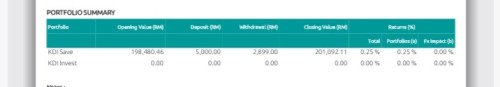

I do diverse some money into Fundsupermart manage portfolio, but so far -ve return. No idea want to continue that manage portfolio or jump ship to this KDI fund. So far invest what also -ve return.

You have to understand that the fund or etf hold stocks. When majority of the stocks goes down, the etc or the fund goes down. There's no way around it I do diverse some money into Fundsupermart manage portfolio, but so far -ve return. No idea want to continue that manage portfolio or jump ship to this KDI fund. So far invest what also -ve return.

The only way around it is if they have a robot which can predict the future and sell before it drops and buy when it's near or at the bottom. But if such robot were to exist, you won't get access to it as the creators will keep it for themselves as it's basically a free gold mine for them.

Btw FSM managed portfolio have reputation of being super lousy for a long time already like 5 years+.

Jul 4 2022, 03:40 PM

Jul 4 2022, 03:40 PM

Quote

Quote

0.0908sec

0.0908sec

0.29

0.29

7 queries

7 queries

GZIP Disabled

GZIP Disabled