I use KDI save personally cause I like the same day withdrawal and money is growing daily. Versa-i also same day withdrawal not the versa. But never like that they need to top-up so much for just to make it 4.3%.

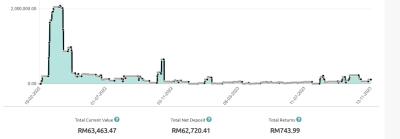

KDI save 4% up to RM50k

Versa-i 4.3% up to RM30k only 3.28% without rebates

https://versa.com.my/versa-cash/Let's not forget you need to wait for next month until they credit you the rebate/tipup with versa. You don't get that with KDI save as money is growing daily.

No management fees with KDI save while you are paying management fees with both versa.

Depends on what you want. You want straight to the point or do you want some twist and turns? Does the extra 0.3% matter to you? How long do you want to depend on rebates/topup (I believed KDI save is also also being top-up by kenanga cause their base rate is 3.5% for money above RM50k. Next tier is 3%.

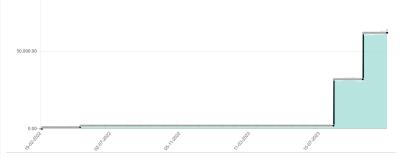

https://digitalinvesting.com.my/kdi-save/Some people will just screw it. Make use of whatever promo while promo still available. Some people always go for highest return. Some people use both to maximise the interest quota (<RM50k in kdi save, <RM30k in both versa and versa-i) cause does not want to get lesser returns.

Personally I never used bank account anymore for storing my money. Been years. The last bank account I used was Maybank egia-i at 4.5% and ocbc 360.

Thanks for this post. Forgot that I had opened one in the past last time. Old already

Oct 4 2023, 05:37 PM

Oct 4 2023, 05:37 PM

Quote

Quote

0.0231sec

0.0231sec

0.52

0.52

6 queries

6 queries

GZIP Disabled

GZIP Disabled