QUOTE(80ckaijin @ Mar 1 2022, 10:00 PM)

They don't reply after office hour. Wait for office hour. They will reply you. They replied my email in one day during office hour timing.Investment Kenanga Digital Investing (KDI), KDI Invest, KDI Save

Investment Kenanga Digital Investing (KDI), KDI Invest, KDI Save

|

|

Mar 1 2022, 11:40 PM Mar 1 2022, 11:40 PM

Return to original view | IPv6 | Post

#21

|

All Stars

24,346 posts Joined: Feb 2011 |

|

|

|

|

|

|

Mar 3 2022, 07:29 PM Mar 3 2022, 07:29 PM

Return to original view | Post

#22

|

All Stars

24,346 posts Joined: Feb 2011 |

QUOTE(tanesh1997 @ Mar 3 2022, 07:24 PM) Guys, do you think KDI Invest is much better than SA? Need your opinion as SA returns have been disappointing.. For me I don't even bother with either of them. You can DIY buy Qqq or Voo. Better returns than either one and cheaper over long term. Medufsaid liked this post

|

|

|

Mar 5 2022, 10:43 PM Mar 5 2022, 10:43 PM

Return to original view | IPv6 | Post

#23

|

All Stars

24,346 posts Joined: Feb 2011 |

QUOTE(Davidtcf @ Mar 5 2022, 10:39 PM) Agree. XLK is a much better option. KWEB not sure when can go up is like keep sea of red no matter how well general stock market is performing. You cant blame them. It happen before Beijing crackdown. How were to know crackdown haven't stop?Really dumb for Stashaway to switch from XLK to KWEB. If they experiment see not working should quickly switch back to XLK or some better ETF la. Keep die die say China tech etf is good. All over the news we can see what’s happening. Davidtcf liked this post

|

|

|

Mar 9 2022, 08:53 AM Mar 9 2022, 08:53 AM

Return to original view | Post

#24

|

All Stars

24,346 posts Joined: Feb 2011 |

|

|

|

Mar 9 2022, 10:45 AM Mar 9 2022, 10:45 AM

Return to original view | IPv6 | Post

#25

|

All Stars

24,346 posts Joined: Feb 2011 |

|

|

|

Mar 9 2022, 12:56 PM Mar 9 2022, 12:56 PM

Return to original view | Post

#26

|

All Stars

24,346 posts Joined: Feb 2011 |

Hoshiyuu liked this post

|

|

|

|

|

|

Mar 19 2022, 08:02 PM Mar 19 2022, 08:02 PM

Return to original view | IPv6 | Post

#27

|

All Stars

24,346 posts Joined: Feb 2011 |

QUOTE(BooYa @ Mar 19 2022, 07:56 PM) Market is green. Nothing to do with AI. Medufsaid liked this post

|

|

|

Mar 30 2022, 12:33 AM Mar 30 2022, 12:33 AM

Return to original view | Post

#28

|

All Stars

24,346 posts Joined: Feb 2011 |

QUOTE(guy3288 @ Mar 29 2022, 09:48 PM) i dont know, is it important to know the real reason?? Bro use the old trick of wife, children account. That way you can keep up to say rm800k in there provided you have 2 children.not important as long as we don't lose out, capital same, interest earning same also. kenanga system silly doing that can cause some to think kenanga cheat cut their interest.. another thing silly is kenanga profile only allow 1 bank account causing me trouble now how to WD to multiple banks in 1 day. i updated the bank account, received email instantly said bank acc updated- so i WD RM100 to bank A i updated it again put bank B acc, again email came said acc updated - so i made another WD to bank B this is misleading, actually it is not updated because end of the day i received all RM100 x4 in bank D, the last update! However the system is clever when i tested key in 1 wrong number, it knows and wont accept that bank acc. But no use, what i need is instant updating and WD money paid to that account when WD order sent like in Phillip eUT. I could WD to multiple different bank accounts within minutes in eUT. Anybody can suggest how to do WD to multiple different bank accounts in 1 day? I think 4 account is more that enough for you? This post has been edited by Ramjade: Mar 30 2022, 12:34 AM |

|

|

Mar 30 2022, 05:07 AM Mar 30 2022, 05:07 AM

Return to original view | IPv6 | Post

#29

|

All Stars

24,346 posts Joined: Feb 2011 |

QUOTE(guy3288 @ Mar 30 2022, 01:38 AM) thanks for trying to help, perhaps i must make myself clearer to get better suggestion.. Can try to give them suggestion. Whether they want to implement it up to them.I want to withdraw RM 1.8M out fr my KDI Save to 4 diff bank accs all in 1 day. RM800k B islam, 400k PBB, 300k MBB , 300k HLB all on 4.4.22 i tested with RM100 yesterday , tak jadi! deposit masuk use 6 bank accounts also all accepted. Withdraw out to 4 banks, why KDI can't make it easier?. maybe, but it says WD no limit, luckily........... |

|

|

Apr 17 2022, 08:25 PM Apr 17 2022, 08:25 PM

Return to original view | IPv6 | Post

#30

|

All Stars

24,346 posts Joined: Feb 2011 |

|

|

|

Apr 24 2022, 09:40 AM Apr 24 2022, 09:40 AM

Return to original view | IPv6 | Post

#31

|

All Stars

24,346 posts Joined: Feb 2011 |

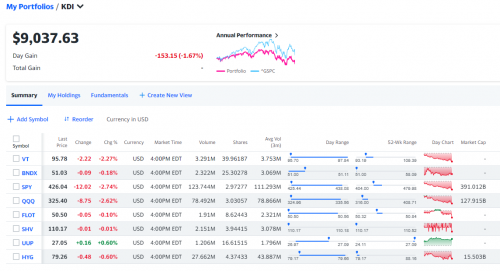

QUOTE(Medufsaid @ Apr 23 2022, 07:44 PM) Merubin I "started" this yahoo finance simulation with $9358now it's $9k You need to understand simc wits holding ETFs and in the past one week, AU's market is down hence your return will also be negative. waiting to see if anyone will share their real results That's just how it works. |

|

|

May 2 2022, 09:56 PM May 2 2022, 09:56 PM

Return to original view | IPv6 | Post

#32

|

All Stars

24,346 posts Joined: Feb 2011 |

QUOTE(guy3288 @ May 2 2022, 09:49 PM) Why need to ask if I am buying? Of course I am buying. I love red market and the redder it is, the better. Because I can buy more stuff at a cheap price.Never fear a red market. This post has been edited by Ramjade: May 2 2022, 10:27 PM lovelyuser and Hoshiyuu liked this post

|

|

|

May 3 2022, 07:37 AM May 3 2022, 07:37 AM

Return to original view | IPv6 | Post

#33

|

All Stars

24,346 posts Joined: Feb 2011 |

QUOTE(Hoshiyuu @ May 3 2022, 01:24 AM) I know right? I'm at least 25 years away from my horizon, I was worrying I would spend the first decade buying into the unrelenting US bull and have sequence of return slap me in the face when i want to retire early. Precisely. But I believed we have another or two leg down some more unless fed chooses the easy way and kick the can down the road instead of doing what is right.Never stopped buying every month. Invested all my windfalls, no regrets. If you have no use for money in the near future, and things are on discount buy. Never fear when your portfolio is going down or a red market. Is just opportunity to pick up things on the cheap Wealth is made in a red market not in a green market. Red market is a transfer of wealth from weak hands/paper hands to those with diamond hands. QUOTE(guy3288 @ May 3 2022, 01:44 AM) I am poor guy. Wrong person to ask.This post has been edited by Ramjade: May 3 2022, 07:48 AM |

|

|

|

|

|

May 5 2022, 04:59 PM May 5 2022, 04:59 PM

Return to original view | IPv6 | Post

#34

|

All Stars

24,346 posts Joined: Feb 2011 |

QUOTE(ericlaiys @ May 5 2022, 04:37 PM) Market went up already after fed announcement. lovelyuser liked this post

|

|

|

May 11 2022, 08:16 AM May 11 2022, 08:16 AM

Return to original view | IPv6 | Post

#35

|

All Stars

24,346 posts Joined: Feb 2011 |

|

|

|

May 11 2022, 08:02 PM May 11 2022, 08:02 PM

Return to original view | IPv6 | Post

#36

|

All Stars

24,346 posts Joined: Feb 2011 |

QUOTE(Alocasia @ May 11 2022, 07:32 PM) So the AI harvested this news and decided it is a buy signal? 😂 Unlimwly you are getting above 3% for anything form banks other than loans unless interest rate 2.5% or more.since KDI Safe is so much more flexible, if the bank offers promo rate >3%, can always withdraw and park the fund there. |

|

|

May 19 2022, 02:33 PM May 19 2022, 02:33 PM

Return to original view | IPv6 | Post

#37

|

All Stars

24,346 posts Joined: Feb 2011 |

QUOTE(guy3288 @ May 19 2022, 02:05 PM) there are always 2 sides of the coin to consider.. He's Singaporean. No luck with amanah saham.after many years i found out for myself the steady and consistent return is better. steady and consistent i refer the 4-6% types, not the current 2-3% types. My last batch FDs are still 4.85%pa interest paid monthly, till end next year. So stocks, unit trusts etc are like for fun only in my case ie not earning much after 20 years Had i put them in 4-6% above i would have earned more. yeah sure, we cant just put all in FD, ASX or MMF right? I started off with 20% there now slowly reduced to below 10% as i find them not very productive.for me lah. I would rather rely on my 80% portions - consistent return 4-7.4% 7.4% from corporate bonds properties should be safe right ,yet my best returns , 6-13% nett rental capital appreciation 200% |

|

|

May 19 2022, 10:55 PM May 19 2022, 10:55 PM

Return to original view | IPv6 | Post

#38

|

All Stars

24,346 posts Joined: Feb 2011 |

QUOTE(Alocasia @ May 19 2022, 06:08 PM) I learnt this concept from GenXGenYGenZ back then when I was still a student. He also said that focus on saving your first million and the following steps would be easier. Even with 1M, and 4% p.a averagely back then is already 40k p.a and 3.3k per month. Can you consistently make 3.3k nett from other investment like stocks monthly? And one may need to sell the stock before they can take the profit. If you know what you are doing yes. Can be done. Rm3.3k/month. Been there and down that. But question is how many people can get that 1m? I am still no way near there. Maybe 40-50%mark.QUOTE(sgh @ May 19 2022, 06:36 PM) The key to this strategy is when can you earn your first million ? If salary worker you can do some maths if can hit by the time you retire then yes that strategy works. If cannot hit then the strategy does not work out very well isn't it? Also don't just look at the 3.3k in your e.g also need to factor in the rising cost of living and any other loans you haven't pay finish like house, car, kids education etc. That's the main point. Very difficult to get the first million.guy3288 don't worry. I think by next year. You can get back 4%p.a FD rate at the rate US is increasing their rates, Malaysia have to follow. No choice. |

|

|

Jun 8 2022, 03:02 PM Jun 8 2022, 03:02 PM

Return to original view | IPv6 | Post

#39

|

All Stars

24,346 posts Joined: Feb 2011 |

|

|

|

Jun 28 2022, 11:37 AM Jun 28 2022, 11:37 AM

Return to original view | IPv6 | Post

#40

|

All Stars

24,346 posts Joined: Feb 2011 |

QUOTE(Davidtcf @ Jun 28 2022, 11:33 AM) Unlikely. Cause it's marketing budget. Once they get their target customers, they will stop it. Like credit card benefits. Medufsaid liked this post

|

| Change to: |  0.0846sec 0.0846sec

0.19 0.19

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 7th December 2025 - 04:23 PM |