QUOTE(gashout @ Dec 3 2023, 04:27 PM)

i get what everyone says.

end of the day, if we want to judge how well a fund does, it's about over the years, not over 3 months, because in 3 months, it can be up or down. so it's pure luck.

people want to see over the years, average return is xx% and so far, it's been disappointing.

if you thought i was telling you KDI Invest is good long term investment , you are wrongend of the day, if we want to judge how well a fund does, it's about over the years, not over 3 months, because in 3 months, it can be up or down. so it's pure luck.

people want to see over the years, average return is xx% and so far, it's been disappointing.

i believe you must have read Post 2495

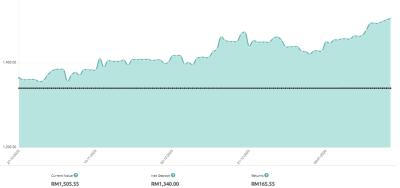

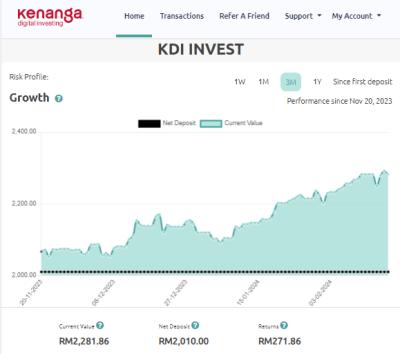

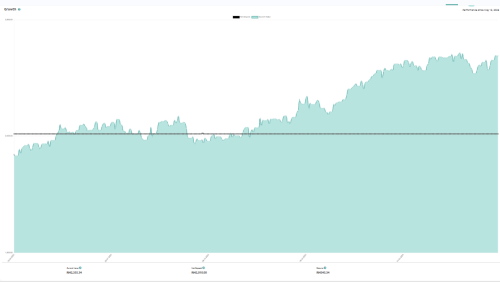

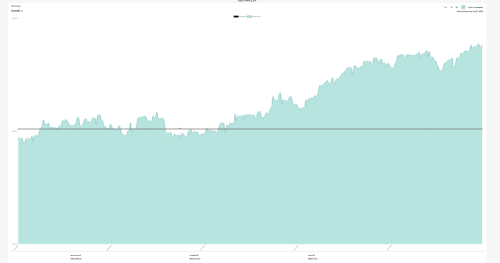

where i showed my KDI invest Yo yo up and down cyclically.

Prices yo yo up and down is nothing surprising

So there are times your invest will make money.

Must it only be due to MYR depreciation (rebutted) or luck?

it happened from time to time as i had shown above.

no conjectures no speculation

just cold hard facts in real life scenarios.

And the 3.7% return in 3.5 months why must convert to pa become 12.7%?

Because we need a standardised way to compare

apple and apple comparison-

not apple and oranges like what slapface guy tried to do.

Eg your 3 years investment gave you 10%.

would you be happy and say wow i got 10%!

No! you must convert it to annualised rate then you see oh 3.3%pa only , not great at all.

Dec 3 2023, 06:41 PM

Dec 3 2023, 06:41 PM

Quote

Quote

0.0952sec

0.0952sec

0.37

0.37

7 queries

7 queries

GZIP Disabled

GZIP Disabled