3 months playing KDI save, trying to make some sense out of its numbers...

1)Everytime you withdraw/WD some money, a portion is removed from your accumulated interest/returns,

sent to your capital/Nett deposit

the bigger the WD the bigger cut it will send to Nett Deposit

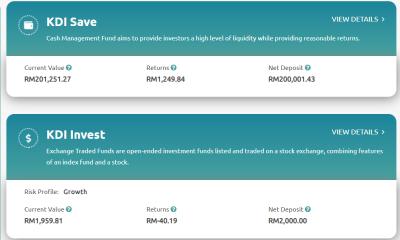

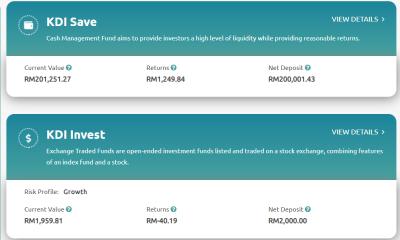

after making 11 withdrawals, my returns dropped down to RM 1249.84 today.

if not it should be RM5877.79.

2)Why KDI must remove some money from your accumulated interest?

Below 200k no reason really, as all returns should earn 3%, i dont know.

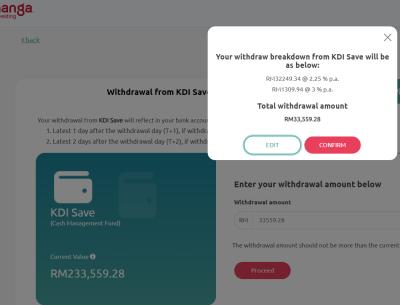

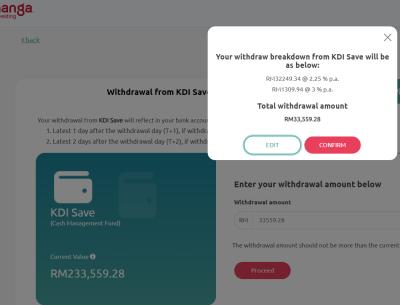

Above 200k, i think because it wants to reduce the returns portion that earn 2.25%.

After many WDs, finally it comes to remaining returns left all earning 3%

even if you are at RM200k and above.

see my simulation WD for 2 accounts

3)Someone asked above RM200k would my interest still earn 3%?

The answer seem YES ,looking from my simulation WD attached.

But not all your accumulated interest, only a portion of them.

How KDI decided that out of my total returns of RM5877.79

only RM1249.84 would be entitled for 3% is a mystery.

(Every time i WD, i make sure i dont touch the portion that earn 3%.)

My wife's smaller account with accumulated returns of RM3187.48

has RM1309.94 portion entitled for the 3%.

I could be totally wrong in my interpretation,

feel free to share your views.

Need more data, i can share them.

Attached thumbnail(s)

May 12 2022, 03:33 PM

May 12 2022, 03:33 PM

Quote

Quote

0.0402sec

0.0402sec

0.37

0.37

6 queries

6 queries

GZIP Disabled

GZIP Disabled