Hi Everyone,

As per title, I have a little regret after purchasing a subsale unit of RM350k , 988sqft, 3R2B low dense condo/flat.

Initially was planned for own stay and low monthly commitments, but now I found out it's a bit far from the city, 15km+/- to klcc

More infos on my purchase :

-Signed SPA on August 2021

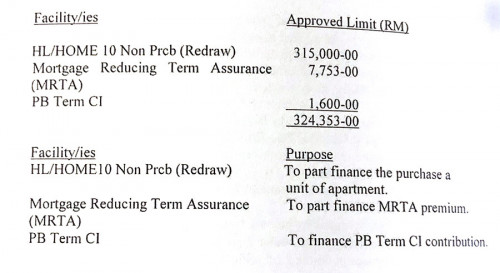

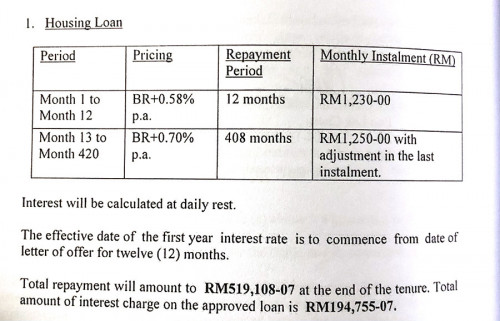

-Loan 35 years

-allocated 60k budget to renovate whole unit ( havent done )

highly appreciate if I could hear your opinion/advice on how I should handling the situation. Should I keep or let go at some loss?

This post has been edited by Chern1991: Nov 2 2021, 02:44 PM

Regret in Purchasing

Nov 2 2021, 02:02 PM, updated 5y ago

Nov 2 2021, 02:02 PM, updated 5y ago

Quote

Quote

0.0209sec

0.0209sec

0.52

0.52

5 queries

5 queries

GZIP Disabled

GZIP Disabled