QUOTE(y3ivan @ Oct 30 2021, 07:02 PM)

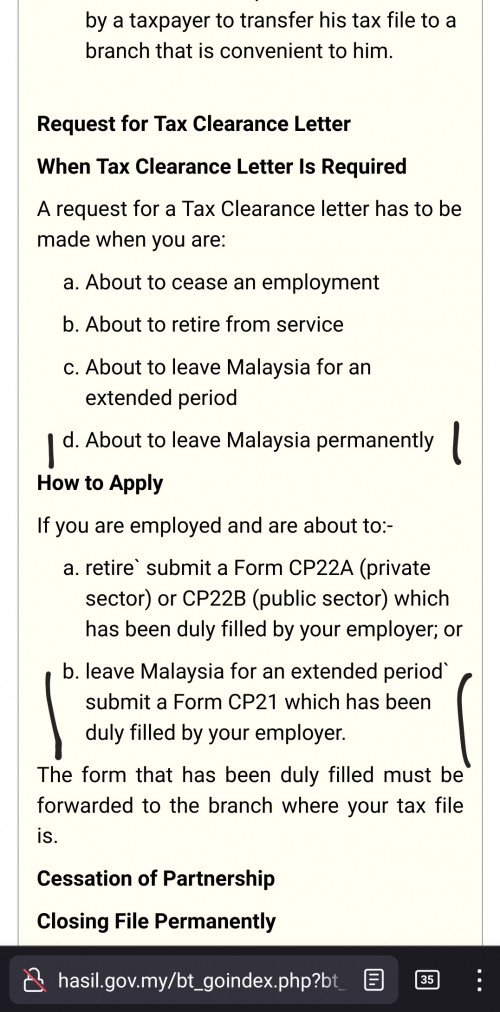

It's actually closing your tax file. But people call it tax clearance. But your current employer will need to give you a specific borang (can't remember already, I did this many years back)

I know what to do because I did this before. Your employer is supposed to do this because that is requirement from lhdn. But most employers if small company don't care about this step.

Closing your tax file means you don't have to submit income tax any longer for employment income but if you have side income still subject to income tax.

Quick question, if i still have rental income, should i still go for tax clearance?

QUOTE(lawrencesha @ Oct 30 2021, 07:17 PM)

Well, I'm a Malaysian now working in SG. I did not do a tax clearance nor close the tax account but I still submit my income tax return yearly (with zero income la).

My uncle left Malaysia, did not close his income tax account nor did he continue his filing. Years later when he return to KL for a visit, he was stopped by Kastam saying his passport is blacklisted. Apparently, LHDN assumes he is still working in Malaysia, and slap him with a RM20K tax bill. Pay or else he is not leaving Malaysia. Appeal will take months. He suck thumb and pay.

Nice sounds like i can skip the tax clearance and still able to go SG as long as i do the income tax return promptly. Initially I was worried that I'll be blocked by the Kastam when leaving for SG without tax clearance letter.

thanks for the input guys!!! appreciate it.

Oct 30 2021, 06:33 PM, updated 5y ago

Oct 30 2021, 06:33 PM, updated 5y ago

Quote

Quote

0.0209sec

0.0209sec

0.57

0.57

5 queries

5 queries

GZIP Disabled

GZIP Disabled