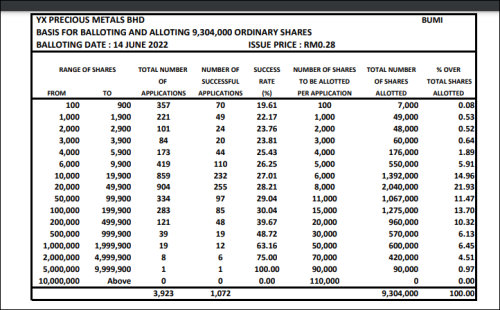

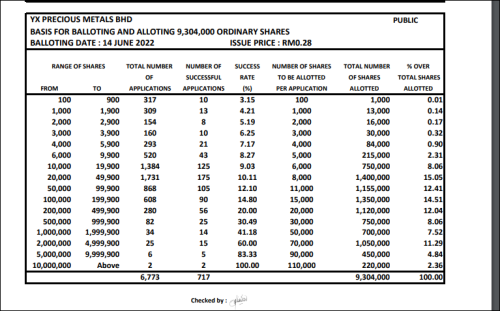

18,608,000 IPO Shares made available for application by the Malaysian public;

11,162,000 IPO Shares made available for application by YXPM’s eligible directors and employees, directors and employees of Tomei Consolidated Berhad (“Tomei”) and its subsidiaries as well as any other persons who have contributed to YXPM’s success;

18,608,000 IPO Shares made available for application by all entitled shareholders of Tomei;

16,751,200 IPO Shares made available by way of private placement to selected investors; and

46,518,800 IPO Shares made available by way of private placement to selected Bumiputera investors approved by Ministry of International Trade and Industry, Malaysia.

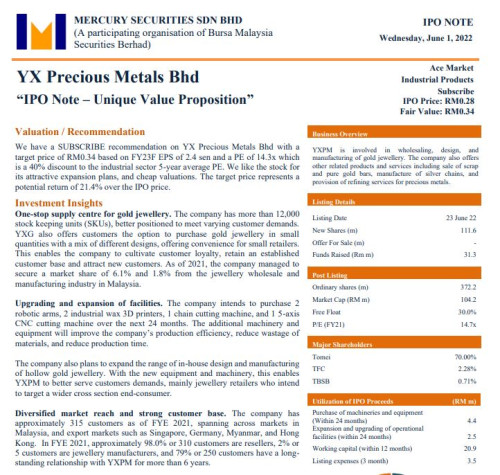

YXPM is an investment holding company. Through its proposed subsidiaries, YXPM is principally involved in wholesale, design and manufacturing of gold jewellery and other related products and services.

Tomei proposes ACE Market listing for its precious metals biz via SPV

https://www.theedgemarkets.com/article/tome...-metals-biz-spv

QUOTE

Jeweller Tomei Consolidated Bhd has proposed to list four wholly-owned subsidiaries under a special purpose vehicle YX Precious Metals Bhd (YXPM) on the ACE Market of Bursa Malaysia.

The four subsidiaries are Yi Xing Goldsmith Sdn Bhd, Gemas Precious Metals Industries Sdn Bhd, Emas Assayer Sdn Bhd and GPM Refinery Sdn Bhd.

The four companies are involved in the precious metals business, in particular the wholesale, design and manufacturing, assaying services and refining services.

They have a combined audited net assets of RM52.1 million as at Dec 31, 2020, Tomei said.

Tomei plans to use proceeds from the IPO for the purchase of new machinery and equipment, for operational expansions, and to supplement YXPM’s working capital.

The four subsidiaries are Yi Xing Goldsmith Sdn Bhd, Gemas Precious Metals Industries Sdn Bhd, Emas Assayer Sdn Bhd and GPM Refinery Sdn Bhd.

The four companies are involved in the precious metals business, in particular the wholesale, design and manufacturing, assaying services and refining services.

They have a combined audited net assets of RM52.1 million as at Dec 31, 2020, Tomei said.

Tomei plans to use proceeds from the IPO for the purchase of new machinery and equipment, for operational expansions, and to supplement YXPM’s working capital.

This post has been edited by nexona88: Jun 17 2022, 06:21 PM

Sep 26 2021, 06:52 PM, updated 4y ago

Sep 26 2021, 06:52 PM, updated 4y ago

Quote

Quote

0.0345sec

0.0345sec

1.04

1.04

5 queries

5 queries

GZIP Disabled

GZIP Disabled