Bank Negara: Standard base rate to replace, Base rate

|

|

Aug 12 2021, 01:53 AM, updated 5y ago Aug 12 2021, 01:53 AM, updated 5y ago

Show posts by this member only | Post

#1

|

Junior Member

661 posts Joined: Jul 2008 From: BananaLand |

|

|

|

|

|

|

Aug 12 2021, 02:19 AM Aug 12 2021, 02:19 AM

Show posts by this member only | Post

#2

|

Senior Member

1,045 posts Joined: Jan 2010 From: land beyond heaven and hell!! |

Tldr for non banking peasant? Is it good or is it bad? danabu liked this post

|

|

|

Aug 12 2021, 02:28 AM Aug 12 2021, 02:28 AM

Show posts by this member only | Post

#3

|

Junior Member

661 posts Joined: Jul 2008 From: BananaLand |

QUOTE(~min~ @ Aug 12 2021, 02:19 AM)  Someone replied. Sorry, ayam not financial knowledgeable as well. SliparJepun, jishu, and 2 others liked this post

|

|

|

Aug 12 2021, 02:52 AM Aug 12 2021, 02:52 AM

Show posts by this member only | IPv6 | Post

#4

|

Junior Member

91 posts Joined: Jan 2003 |

Scared of negative equity calls by banks?

How about interbank rate, not affected? |

|

|

Aug 12 2021, 02:57 AM Aug 12 2021, 02:57 AM

Show posts by this member only | IPv6 | Post

#5

|

Junior Member

91 posts Joined: Jan 2003 |

Wow, interbank rate less than 2% since Corona.

And market still soft like old man kukujiao. Even bank got money, also no market participants. |

|

|

Aug 12 2021, 05:45 AM Aug 12 2021, 05:45 AM

Show posts by this member only | Post

#6

|

Junior Member

532 posts Joined: Mar 2008 From: 🍍bikini bottom🍍 |

Any effect to borrowers?

Apart from the name change |

|

|

|

|

|

Aug 12 2021, 06:30 AM Aug 12 2021, 06:30 AM

Show posts by this member only | IPv6 | Post

#7

|

Senior Member

562 posts Joined: Feb 2009 From: klang valley |

QUOTE(Angelic Layer @ Aug 12 2021, 02:57 AM) Wow, interbank rate less than 2% since Corona. Not no market participants, banks are more strict in giving out loan.And market still soft like old man kukujiao. Even bank got money, also no market participants. Stirmling and ericangtzeann liked this post

|

|

|

Aug 12 2021, 06:37 AM Aug 12 2021, 06:37 AM

Show posts by this member only | IPv6 | Post

#8

|

Junior Member

91 posts Joined: Jan 2003 |

|

|

|

Aug 12 2021, 06:46 AM Aug 12 2021, 06:46 AM

Show posts by this member only | IPv6 | Post

#9

|

Senior Member

562 posts Joined: Feb 2009 From: klang valley |

|

|

|

Aug 12 2021, 06:55 AM Aug 12 2021, 06:55 AM

Show posts by this member only | IPv6 | Post

#10

|

Junior Member

91 posts Joined: Jan 2003 |

|

|

|

Aug 12 2021, 06:55 AM Aug 12 2021, 06:55 AM

|

Senior Member

1,716 posts Joined: May 2006 From: JDT |

bananajoe and langstrasse liked this post

|

|

|

Aug 12 2021, 07:03 AM Aug 12 2021, 07:03 AM

Show posts by this member only | IPv6 | Post

#12

|

Junior Member

386 posts Joined: Sep 2020 |

Not for fixed rate loan. BNM is also pandai ma hehe (i think la coz I'm also not financially knowledgable also)

This post has been edited by clockpulses: Aug 12 2021, 07:06 AM |

|

|

Aug 12 2021, 07:06 AM Aug 12 2021, 07:06 AM

Show posts by this member only | IPv6 | Post

#13

|

Junior Member

342 posts Joined: Jan 2013 |

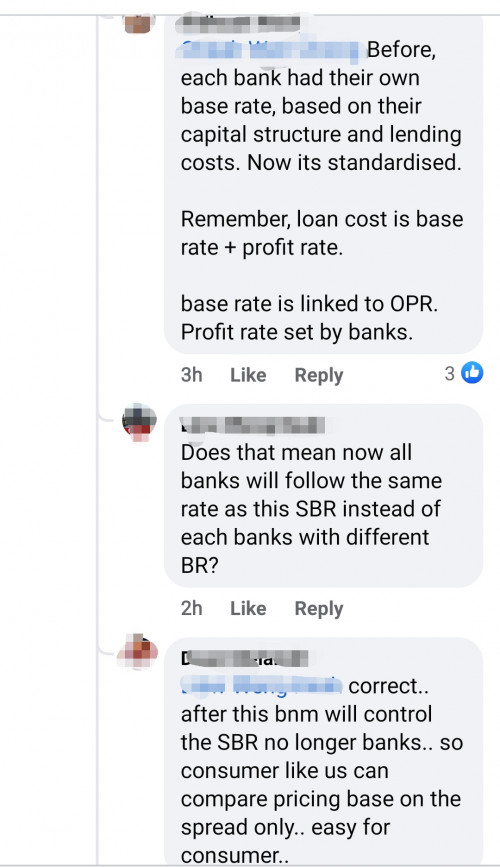

QUOTE(Angelic Layer @ Aug 12 2021, 06:55 AM) Based on historical setting of BR, the banks dont deviate from OPR changes anyway. If OPR down 0.25, BR also drop 0.25. This move is purely for consumer ease of comparison between banks. Banks can still set their spread as they wish |

|

|

|

|

|

Aug 12 2021, 07:57 AM Aug 12 2021, 07:57 AM

Show posts by this member only | IPv6 | Post

#14

|

Junior Member

178 posts Joined: Jun 2013 |

only for new loan takers ..

|

|

|

Aug 12 2021, 07:59 AM Aug 12 2021, 07:59 AM

Show posts by this member only | IPv6 | Post

#15

|

Senior Member

1,617 posts Joined: Apr 2010 |

correct me if i'm wrong.

this is good for new borrowers. coz all banks standard base rate, so bank wanna earn, need to approve more loan -> which leads to property bull run and we'll see property prices rise again |

|

|

Aug 12 2021, 08:01 AM Aug 12 2021, 08:01 AM

|

Junior Member

123 posts Joined: Jan 2019 |

Thats just a name change right? BR is always fixed by bnm

|

|

|

Aug 12 2021, 08:02 AM Aug 12 2021, 08:02 AM

|

Junior Member

103 posts Joined: Oct 2019 |

so now, the only difference is profit rate between banks?

that should make it easier to choose |

|

|

Aug 12 2021, 08:02 AM Aug 12 2021, 08:02 AM

Show posts by this member only | IPv6 | Post

#18

|

Senior Member

1,374 posts Joined: Feb 2016 From: Milky Way |

Isn’t this like u-turn back to previous BLR (base lending rate)?

Even with BR, in the end every bank still charge roughly similar interest rate due to competition. |

|

|

Aug 12 2021, 08:05 AM Aug 12 2021, 08:05 AM

Show posts by this member only | IPv6 | Post

#19

|

Senior Member

4,830 posts Joined: Jan 2012 |

Good for consumers cos bloody sotong bank increase their base rate 2x before when they were no increase in the OPR

I send complaint to BNM via telelink but nothing can be done cos banks were free to set their own base rate |

|

|

Aug 12 2021, 08:23 AM Aug 12 2021, 08:23 AM

Show posts by this member only | IPv6 | Post

#20

|

Junior Member

19 posts Joined: Jan 2009 |

Just like US easy to control inflation and deflation

|

|

|

Aug 12 2021, 08:30 AM Aug 12 2021, 08:30 AM

|

Senior Member

904 posts Joined: Jan 2003 From: Central Region Status: Safe Trader |

good let the gov control bank not bank control gov

|

|

|

Aug 12 2021, 08:36 AM Aug 12 2021, 08:36 AM

Show posts by this member only | IPv6 | Post

#22

|

Junior Member

293 posts Joined: Sep 2012 |

QUOTE(Angelic Layer @ Aug 12 2021, 02:57 AM) Wow, interbank rate less than 2% since Corona. Oh man, how 🤔 u know old man soft?And market still soft like old man kukujiao. Even bank got money, also no market participants. From your experience? Propsense liked this post

|

|

|

Aug 12 2021, 08:38 AM Aug 12 2021, 08:38 AM

|

Senior Member

1,923 posts Joined: Feb 2016 |

|

|

|

Aug 12 2021, 08:39 AM Aug 12 2021, 08:39 AM

|

Senior Member

1,923 posts Joined: Feb 2016 |

|

|

|

Aug 12 2021, 08:42 AM Aug 12 2021, 08:42 AM

Show posts by this member only | IPv6 | Post

#25

|

Junior Member

44 posts Joined: Feb 2021 |

so its good for consumers like us ?

|

|

|

Aug 12 2021, 10:28 AM Aug 12 2021, 10:28 AM

|

Junior Member

661 posts Joined: Jul 2008 From: BananaLand |

mohon financial ktard masuk n explain

|

|

|

Aug 12 2021, 10:31 AM Aug 12 2021, 10:31 AM

|

Junior Member

81 posts Joined: Feb 2019 |

To summarize, can I say all banks will now offer the exact same interest rate for those mentioned individual loans?

So I go Maybank, Public Bank, HSBC, RHB etc for house loan all will offer the same interest rate? This post has been edited by Mixo Mania: Aug 12 2021, 10:32 AM |

|

|

Aug 12 2021, 10:35 AM Aug 12 2021, 10:35 AM

|

Senior Member

5,641 posts Joined: Apr 2011 From: Kuala Lumpur |

QUOTE(Mixo Mania @ Aug 12 2021, 10:31 AM) To summarize, can I say all banks will now offer the exact same interest rate for those mentioned individual loans? No it's not. It will be Standard Base Rate (which is OPR in a nutshell) + spread (different for each bank, this is how much they are earning from you)So I go Maybank, Public Bank, HSBC, RHB etc for house loan all will offer the same interest rate? |

|

|

Aug 12 2021, 10:42 AM Aug 12 2021, 10:42 AM

Show posts by this member only | IPv6 | Post

#29

|

Junior Member

303 posts Joined: Aug 2005 |

|

|

|

Aug 12 2021, 10:43 AM Aug 12 2021, 10:43 AM

|

Senior Member

5,641 posts Joined: Apr 2011 From: Kuala Lumpur |

QUOTE(bananajoe @ Aug 12 2021, 10:28 AM) Before this the Base Rate for every bank is different. No one knows how they calculate their Base Rate. Previous: Base Rate (OPR+ own bank's rate) + Spread = Interest Rate charged So we can have Sotong bank charging BR 2.5% + 0.75% = 3.25% to customer A And we can also have Sotong bank charging 2.5% + 0.5% = 3.0% because he has better risk Maybank maybe will charge BR 2.1% + 0.9% = 3.0% Current: Standard Base Rate = OPR. Every bank will be the same. No more separate Base Rate for each bank. So for customers they will only need to compare the spread for different banks. Sotong bank: 1.75% OPR + 1.25% spread Maybank: 1.75% OPR + 1.3% spread |

|

|

Aug 12 2021, 10:59 AM Aug 12 2021, 10:59 AM

|

Junior Member

661 posts Joined: Jul 2008 From: BananaLand |

QUOTE(victorian @ Aug 12 2021, 10:43 AM) Before this the Base Rate for every bank is different. No one knows how they calculate their Base Rate. Thanks!Previous: Base Rate (OPR+ own bank's rate) + Spread = Interest Rate charged So we can have Sotong bank charging BR 2.5% + 0.75% = 3.25% to customer A And we can also have Sotong bank charging 2.5% + 0.5% = 3.0% because he has better risk Maybank maybe will charge BR 2.1% + 0.9% = 3.0% Current: Standard Base Rate = OPR. Every bank will be the same. No more separate Base Rate for each bank. So for customers they will only need to compare the spread for different banks. Sotong bank: 1.75% OPR + 1.25% spread Maybank: 1.75% OPR + 1.3% spread |

|

|

Aug 12 2021, 11:09 AM Aug 12 2021, 11:09 AM

|

Senior Member

926 posts Joined: Aug 2013 |

QUOTE(victorian @ Aug 12 2021, 10:43 AM) Before this the Base Rate for every bank is different. No one knows how they calculate their Base Rate. This! Previous: Base Rate (OPR+ own bank's rate) + Spread = Interest Rate charged So we can have Sotong bank charging BR 2.5% + 0.75% = 3.25% to customer A And we can also have Sotong bank charging 2.5% + 0.5% = 3.0% because he has better risk Maybank maybe will charge BR 2.1% + 0.9% = 3.0% Current: Standard Base Rate = OPR. Every bank will be the same. No more separate Base Rate for each bank. So for customers they will only need to compare the spread for different banks. Sotong bank: 1.75% OPR + 1.25% spread Maybank: 1.75% OPR + 1.3% spread As such there will be better transparency across the banking sector. Bad news for banks as pricing will be more transparent. Good news for customers as you will be able to easily compare interest rates across all banks. No need to figure out the exact base rate for each bank anymore, all bank will have the same base rate after this. Only the spread will be different. Good job bnm |

|

|

Aug 12 2021, 11:11 AM Aug 12 2021, 11:11 AM

Show posts by this member only | IPv6 | Post

#33

|

Junior Member

695 posts Joined: Nov 2010 |

|

| Change to: |  0.0210sec 0.0210sec

1.10 1.10

5 queries 5 queries

GZIP Disabled GZIP Disabled

Time is now: 20th December 2025 - 11:16 PM |

All Rights Reserved © 2002- 2025 Vijandren Ramadass (~unite against racism~)

Powered by Invision Power Board © 2025 IPS, Inc.

Quote

Quote