hi guys, need your advise. no choice i have to ask here dy..

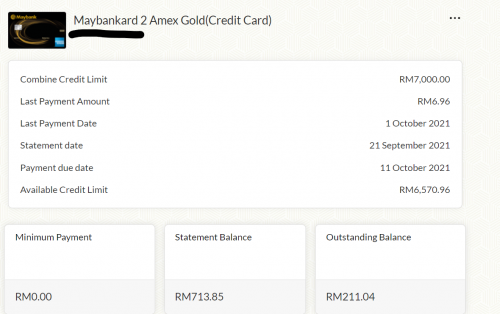

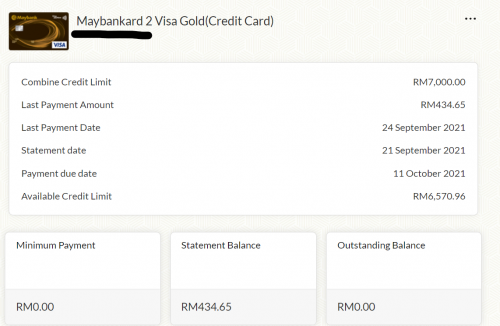

i got rejected for maybank credit card limit increase for the 3rd time !!!!! i do not understand and i wonder anyone have any tips for me or not. 2nd time rejected because system said need wait for cool down period after 1st application, fine..... but 1st and 3rd time they reject because of my salary or what? i dont und. my payment history is good ! i spend roughly 20k+ per month on both VI and Amex premier. sometime even more! and i always ensure my payment is in full. except for last month cos i was in UK for a month, so i totally forgotten to pay, but when i paid, its always in full !

recently this low credit limit is restricting my lifestyle. few months ago I made a huge purchase (rm300k+) using the 0% payment plan, paid using 3 cards, cimb, citibank, maybank. only this kedekut maybank credit limit is lowest, less than 100k...

so what is the logic of rejecting my credit card limit increase application?

salary? my monthly salary is >30k .... ctos score is good ! payment always in full, just occasionally late cos forgotten... and i didnt apply a sky high limit.. i only request for rm100k credit limit also cannot?

i also tried increasing UOB (from citi) and their system is lousy... i havent even get my replacement zenith card yet... i submit via their app, waited 1 mth no response, called the helpline, said approval for walk-in faster, i walk in branch, branch ask me submit online email... what a messed up bank... submitted online, still no response ! i dont put much hope dy, memang plan to cancel UOB anyway. I love maybank card, always put my main purchases here but why they treat me so bad....

sigh... end of rant..

anyone has any idea?

dont ask me apply for another card.. 3 cards already i also cant manage, always forget make payment, then the SST, then multiple logins to handle, apps on phone, etc. i hope to stick with these 3 cards only, and mostly on maybank.

Try applying credit limit increase via maybank manually. Not via m2u. See got improvement or not. But i admit cc limit increase with maybank is quite painful.

But if you got past history of forgetting, you kinda be careful this can put you in a bad spot.

Jun 23 2021, 01:28 PM, updated 5y ago

Jun 23 2021, 01:28 PM, updated 5y ago

Quote

Quote

0.0357sec

0.0357sec

0.87

0.87

5 queries

5 queries

GZIP Disabled

GZIP Disabled