Outline ·

[ Standard ] ·

Linear+

What does CCRIS collateral means?, Am I eligible for 90% loan again?

|

TSpakjat

|

Jun 9 2021, 09:25 PM, updated 5y ago Jun 9 2021, 09:25 PM, updated 5y ago

|

New Member

|

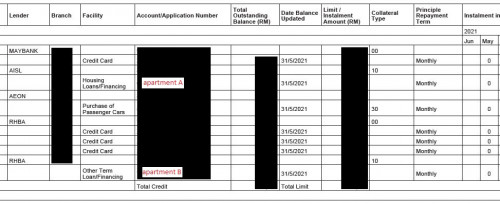

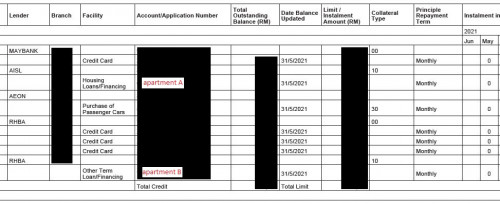

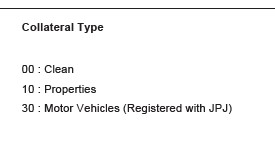

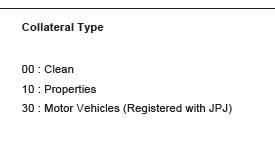

Years ago I refinanced my apartment B. So there is a housing loan & cash out loan for apartment B Recently I payoff only the apartment B housing loan. Now in the CCRIS the cash out loan for apartment B was written as "other term loan". But in the collateral column it is written with code "10" which shown as "properties" From what is shown in my CCRIS now, am I considered to have 1 or 2 housing loan in BNM eyes? Am I eligible to get a 90% housing loan again?   Attached image(s) Attached image(s) |

|

|

|

|

|

mini orchard

|

Jun 9 2021, 09:52 PM Jun 9 2021, 09:52 PM

|

|

At the end of the day, your total loan matters.

Even if you qualified for 90%, but if your debt is high against your income, bank will only grant below 90.

Banks will not separate eligibility criteria but to assess your overall risk level.

This post has been edited by mini orchard: Jun 9 2021, 09:55 PM

|

|

|

|

|

|

TSpakjat

|

Jun 9 2021, 10:18 PM Jun 9 2021, 10:18 PM

|

New Member

|

QUOTE(mini orchard @ Jun 9 2021, 09:52 PM) At the end of the day, your total loan matters. Even if you qualified for 90%, but if your debt is high against your income, bank will only grant below 90. Banks will not separate eligibility criteria but to assess your overall risk level. but if one already have 2 active housing loan, no matter how low his DSR is, bank can only give max 70% loan right? so in my case, am I seen to be having 1 or 2 housing loan at this moment? |

|

|

|

|

|

mini orchard

|

Jun 9 2021, 10:39 PM Jun 9 2021, 10:39 PM

|

|

QUOTE(pakjat @ Jun 9 2021, 10:18 PM) but if one already have 2 active housing loan, no matter how low his DSR is, bank can only give max 70% loan right? so in my case, am I seen to be having 1 or 2 housing loan at this moment? The criteria is whichever gives the bank a lower risk level. So if your dsr is low, then is 70%. If your dsr is high, it may below 70. I would guess your outstanding cash out loan is link to you Apartment B as collateral, hence is considered a housing loan. |

|

|

|

|

|

TSpakjat

|

Jun 9 2021, 11:26 PM Jun 9 2021, 11:26 PM

|

New Member

|

QUOTE(mini orchard @ Jun 9 2021, 10:39 PM) The criteria is whichever gives the bank a lower risk level. So if your dsr is low, then is 70%. If your dsr is high, it may below 70. I would guess your outstanding cash out loan is link to you Apartment B as collateral, hence is considered a housing loan. that means i need to payoff the cash out loan first and only then 90% loan will be possible. |

|

|

|

|

|

Michaelbyz23

|

Jun 10 2021, 10:00 AM Jun 10 2021, 10:00 AM

|

|

https://www.imoney.my/articles/buy-or-sell-...perty%20onwards. 3. Up to 90% of financing limit beyond second property, which are priced above RM600,000 Buyers can now get a loan for up to 90% of the purchase price for properties priced above RM600,000. Previously, property buyers were limited to 70% financing for their third property onwards. This makes a huge difference in the upfront cash you need to fork out.

|

|

|

|

|

|

TSpakjat

|

Jun 10 2021, 01:49 PM Jun 10 2021, 01:49 PM

|

New Member

|

QUOTE(Michaelbyz23 @ Jun 10 2021, 10:00 AM) https://www.imoney.my/articles/buy-or-sell-...perty%20onwards. 3. Up to 90% of financing limit beyond second property, which are priced above RM600,000 Buyers can now get a loan for up to 90% of the purchase price for properties priced above RM600,000. Previously, property buyers were limited to 70% financing for their third property onwards. This makes a huge difference in the upfront cash you need to fork out. definitely great advantage for above 600k buyer |

|

|

|

|

Jun 9 2021, 09:25 PM, updated 5y ago

Jun 9 2021, 09:25 PM, updated 5y ago

Quote

Quote

0.0196sec

0.0196sec

0.42

0.42

6 queries

6 queries

GZIP Disabled

GZIP Disabled