QUOTE(Qanxia @ Jun 12 2021, 04:08 PM)

anyone facing this issue? I deposit RM500 and receive 0.34 units in notification. But in actual in transaction only show 0.29 units.

QUOTE(tsutsugami86 @ Jun 12 2021, 11:44 PM)

The 0.34 is the distribution you received, it should be RM 0.34 not in units.

The distribution(RM 0.34) reinvested then you get 0.29 units.

Hey there. I'm seeing similar issue:The distribution(RM 0.34) reinvested then you get 0.29 units.

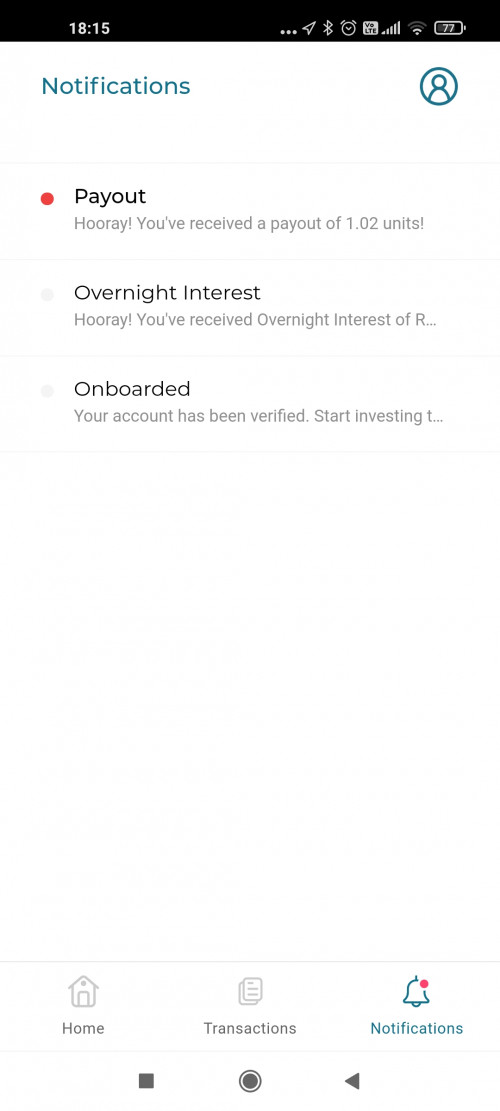

12 June notification says I got 1.02 units, but

10 June transaction says .87 units acquired

What's more, I just did some calculations on my earning since it's been exactly a month I entered:

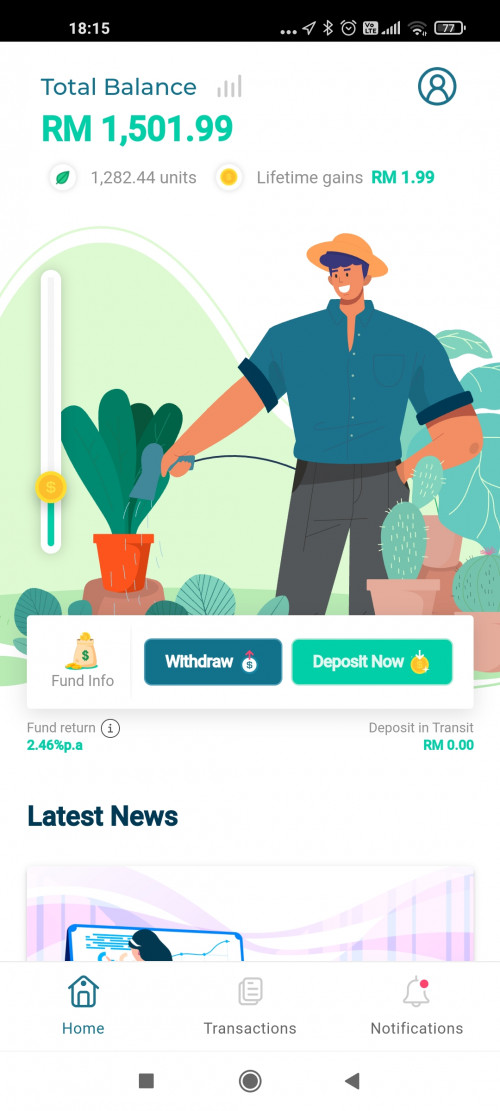

RM 1.99 gain with RM 1500 means 1.592% interest p.a.

This is worse than 1 month tenure FD!

FYI, unit nav is 1501.99 ÷ 1282.44 = RM 1.17119709 each

I earned 0.87+0.98=1.85 units, so that means I got RM 2.16671462

This translates to 1.7333717% interest p.a. slightly better, but FD has periodical promotions that offer higher.

So is Versa not that great after all?

Jun 14 2021, 06:27 PM

Jun 14 2021, 06:27 PM

Quote

Quote 0.0672sec

0.0672sec

0.54

0.54

7 queries

7 queries

GZIP Disabled

GZIP Disabled