Outline ·

[ Standard ] ·

Linear+

Investment Versa

|

Sitting Duck

|

Sep 14 2023, 12:34 PM Sep 14 2023, 12:34 PM

|

|

Hi Sifu,

Just want some info before I cash in money into Versa.

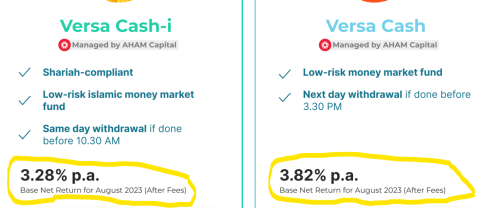

1. 4.3% promo rate is first RM30,000. Would I enjoy this promo rate of 4.3% if I transfer in RM30,000 to versa cash and another RM30,000 versa cash-i? Would the total RM60,000 enjoy 4.3% promo rate?

2. I understand that 4.3% promo rate is net promo rate. Did anyone experience getting lesser than 4.3% in the past few months? In other words is the 4.3% promo rate guarantee or would the rate fluctuates?

Thank you sifu.

|

|

|

|

|

|

Sitting Duck

|

Sep 14 2023, 02:35 PM Sep 14 2023, 02:35 PM

|

|

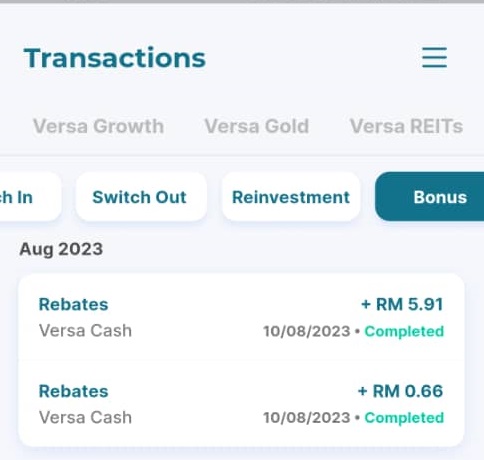

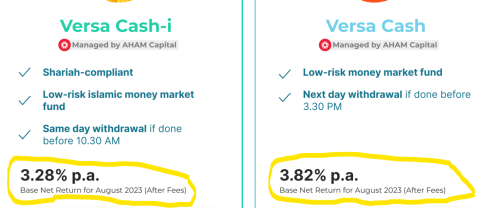

QUOTE(songokujames @ Sep 14 2023, 01:48 PM) 1. Can I save with Versa Cash and Versa Cash-i at the same time, and earn the promotional net return rate of 4.3% p.a. for both funds respectively? Yes, all users can save with Versa Cash and Versa Cash-i at the same time to enjoy the promotional net return rate of 4.3% p.a. on the first RM30,000 in each fund respectively. Subsequent amounts above RM30,000 will be entitled for base net return rate. 2. You earn the base net return from Versa Cash/Cash-i on a daily basis, and the rebates from this campaign will be credited to your account the following month. Example: Your rebates from promotional net return for the month of July will be credited in your Versa Cash/Versa Cash-i account in August. Mean you get base net return from Versa Cash/Cash-i on a daily basis, if the base net return is not up to 4.3%, you will get the rebate next month to tally to 4.3% promo rate. Base net return is vary every month.  Thanks for the explanation. Seems like it's quite tedious to calculate the return. Did anyone tried to keep track of the return to see the return is really 4.3%? When would the 4.3% promo end btw? Couldn't find any info about it in the promo page. Thanks. |

|

|

|

|

|

Sitting Duck

|

Sep 14 2023, 05:53 PM Sep 14 2023, 05:53 PM

|

|

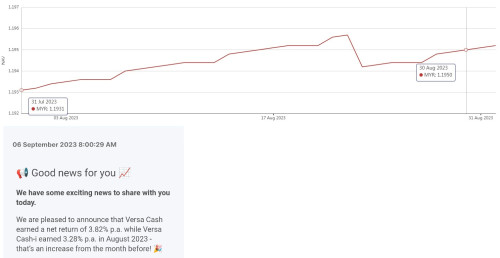

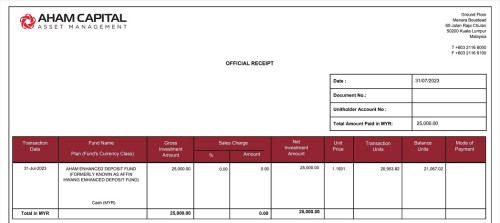

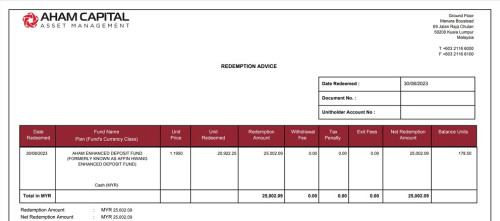

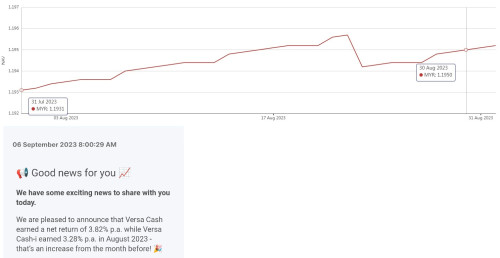

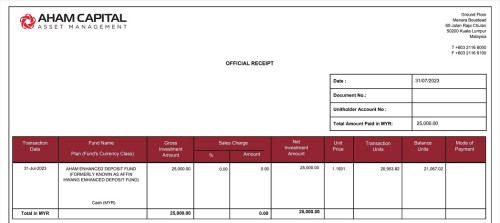

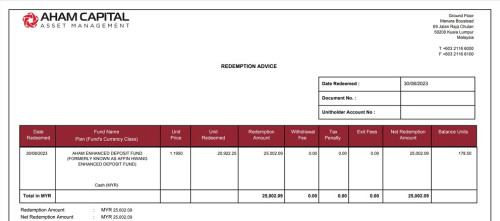

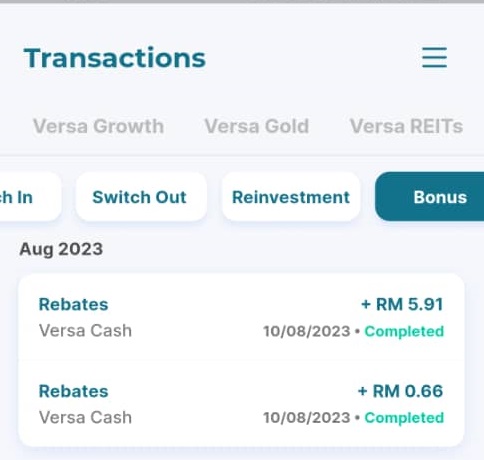

QUOTE(1mr3tard3d @ Sep 14 2023, 03:16 PM) depends on how your calculate it would be straightforward if you use their NAVs» Click to show Spoiler - click again to hide... « NAV 30/08/23 = RM 1.1950 + Distribution RM 0.0016 = RM 1.1966 NAV 31/07/23 = RM 1.1931 return for 30 days ~ 3.57% p.a., without rebate so i have no idea how did they get net return of 3.82% p.a. in August  if you want the tedious way, » Click to show Spoiler - click again to hide... «    Balance as at 30/08/23 = 178.50 x RM 1.1950 = RM 213.31 + RM 25,002.09 = RM 25,215.40 Balance as at 31/07/23 = 21,067.02 x RM 1.1931 = 25,135.06 Return = RM 25,215.40 - RM 25,135.06 - RM 6.57 (rebate for July) = RM 73.77 ~ 3.57% p.a. still pending for the August rebate Thank you. Very detailed but tedious.  Based on feedback, it seems like it will definately be 4.3% return with rebate. I guess I'll just try it out and calculate it for the first few months to confirm it's indeed 4.3%. I saw the Rize thread that it seems like the returns are not as per publised. So hopefully Versa is the same case as Rize. This post has been edited by Sitting Duck: Sep 14 2023, 05:54 PM |

|

|

|

|

|

Sitting Duck

|

Sep 15 2023, 04:38 PM Sep 15 2023, 04:38 PM

|

|

QUOTE(xander2k8 @ Sep 15 2023, 03:51 PM) It is regulated in the 1st place 🤦♀️ by SC itself hence the risks is low but I wouldn’t put in more than 30k because of the rebates Suspect they waited for BNM news before calculating those rebates and it looks like the promo or rebates might be lesser next month eh? i thought it's net 4.3% promo rate regardless OPR up or down? I'm confused. |

|

|

|

|

|

Sitting Duck

|

Apr 22 2024, 11:15 AM Apr 22 2024, 11:15 AM

|

|

Edited: Please ignore. Managed to find the "cash out" option.

This post has been edited by Sitting Duck: Apr 22 2024, 11:57 AM

|

|

|

|

|

Sep 14 2023, 12:34 PM

Sep 14 2023, 12:34 PM

Quote

Quote

0.0594sec

0.0594sec

0.48

0.48

7 queries

7 queries

GZIP Disabled

GZIP Disabled