Outline ·

[ Standard ] ·

Linear+

Dividend Stock

|

donhay

|

Apr 9 2021, 11:33 AM Apr 9 2021, 11:33 AM

|

|

QUOTE(Darrenhans @ Apr 7 2021, 09:41 AM) currently holding KIPREIT, Taliworks, and UOADEV QUOTE(min ck @ Apr 7 2021, 01:02 PM) Matrix, Zhulian, Tenaga, Al-Aqar REITS, Hup Seng, Malakof (most recent div not that attractive), Taliworks, Gasmsia, Litrak, Petgas (if excluding special dividend, DY not that high) Is Taliworks good for you ? good div? What yours average price now?  Thanks |

|

|

|

|

|

min ck

|

Apr 9 2021, 11:05 PM Apr 9 2021, 11:05 PM

|

Getting Started

|

QUOTE(donhay @ Apr 9 2021, 11:33 AM) Is Taliworks good for you ? good div? What yours average price now?  Thanks Current avg price is 82.8 cents, so DY should be 6.6/82.8 * 100 = 7.97% (6.6 cents is the total div for the most recent financial year) Anyone who managed to grab when it was 40-50 cents per share should be enjoying around 12%-15% DY..  |

|

|

|

|

|

Tctf

|

Apr 10 2021, 01:32 AM Apr 10 2021, 01:32 AM

|

Getting Started

|

Matrix every QR sure got dividend never miss (DY6.0%)

CMMT (REIT), price still low, will come back after covid19 (DY4.4%)

Inno with 80% dividend policy, price is still low (DY6.1%)

Blue chip = Tenaga, Topglove, UoADev, Genm

Do some self studies, u will get your answer

|

|

|

|

|

|

tehoice

|

Apr 14 2021, 10:42 AM Apr 14 2021, 10:42 AM

|

|

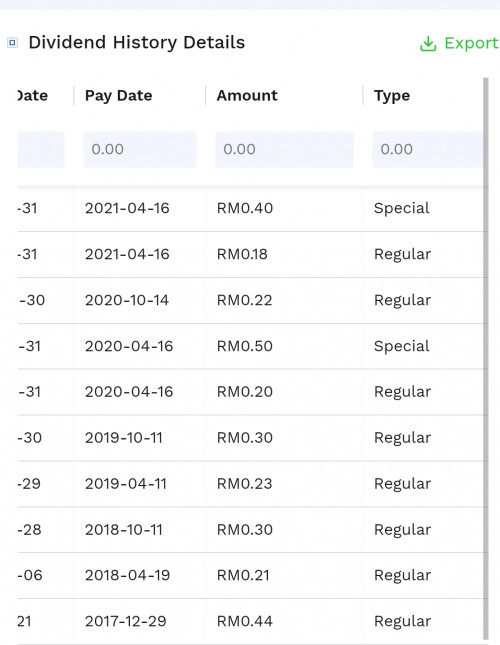

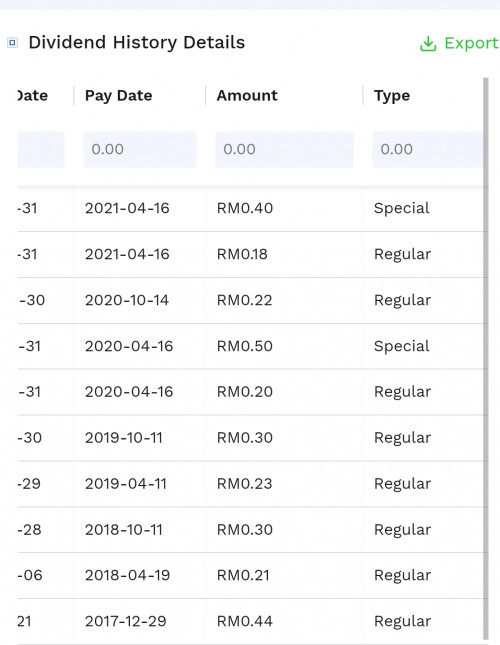

United Plantations

|

|

|

|

|

|

Ramjade

|

Apr 14 2021, 11:01 AM Apr 14 2021, 11:01 AM

|

|

Arkk, lemonade, amd, Taiwan semi conductor.

Seeling options and generating my own dividend. Min 10%p.a

|

|

|

|

|

|

westernkl

|

Apr 15 2021, 11:50 PM Apr 15 2021, 11:50 PM

|

|

QUOTE(CSW1990 @ Apr 5 2021, 11:18 PM) currently hold tenaga, digi, jaycorp Jaycorp DY macam not bad. Worth to invest? |

|

|

|

|

|

CSW1990

|

Apr 16 2021, 08:08 AM Apr 16 2021, 08:08 AM

|

|

QUOTE(westernkl @ Apr 15 2021, 11:50 PM) Jaycorp DY macam not bad. Worth to invest? should be worth to keep if buy at low, still have growth potential. |

|

|

|

|

|

victorfoo P

|

Apr 16 2021, 11:27 AM Apr 16 2021, 11:27 AM

|

New Member

|

i think everyone love dividends, just that need to be aware of price trend and growth of dividend yield. as reference ya, https://dividends.my/3-years-dividend-growing/ |

|

|

|

|

|

jutamind

|

Apr 16 2021, 07:54 PM Apr 16 2021, 07:54 PM

|

|

victorfoo In the stock detail page, you should flip all your charts with latest years on the right hand side. It's weird to see year 2020 on the left QUOTE(victorfoo @ Apr 16 2021, 11:27 AM) i think everyone love dividends, just that need to be aware of price trend and growth of dividend yield. as reference ya, https://dividends.my/3-years-dividend-growing/

|

|

|

|

|

|

fms21

|

Apr 17 2021, 02:48 PM Apr 17 2021, 02:48 PM

|

|

QUOTE(westernkl @ Apr 15 2021, 11:50 PM) Jaycorp DY macam not bad. Worth to invest? now dropped to 1.70 should be ok to buy next week if got bullet.. maybe policy using share price reduction to pay dividend can trap certain counter.. |

|

|

|

|

|

Eurobeater

|

May 2 2021, 08:52 PM May 2 2021, 08:52 PM

|

|

My favourite so far is TNB, Sentral Reit and RCE. These all give around >5% div yield. Esp TNB. Last year, even at my entry price of RM10.88, my yield is 7.3%. Quite nice

|

|

|

|

|

|

prophetjul

|

May 3 2021, 11:00 AM May 3 2021, 11:00 AM

|

|

QUOTE(Eurobeater @ May 2 2021, 08:52 PM) My favourite so far is TNB, Sentral Reit and RCE. These all give around >5% div yield. Esp TNB. Last year, even at my entry price of RM10.88, my yield is 7.3%. Quite nice Tenaga is now sub 10. BUY with both hands!  Seriously, can they keep up with thsi present dividend? i do not think so. This post has been edited by prophetjul: May 3 2021, 11:07 AM |

|

|

|

|

|

CSW1990

|

May 3 2021, 11:52 AM May 3 2021, 11:52 AM

|

|

QUOTE(fms21 @ Apr 17 2021, 02:48 PM) now dropped to 1.70 should be ok to buy next week if got bullet.. maybe policy using share price reduction to pay dividend can trap certain counter.. Below 1.7 should be good buy if plan to keep for dividend. Support around 1.63 |

|

|

|

|

|

Mattrock

|

May 7 2021, 01:31 PM May 7 2021, 01:31 PM

|

|

QUOTE(prophetjul @ May 3 2021, 11:00 AM) Tenaga is now sub 10. BUY with both hands!  Seriously, can they keep up with thsi present dividend? i do not think so. Tenaga stock price has been steadily declining since 2018 from above RM15 to below RM10 now. Could this be why the dividend percentage is increasing? Has the actual dividend amount increased over the years? I am wary of high dividend stocks whose value keeps going down. |

|

|

|

|

|

prophetjul

|

May 7 2021, 04:45 PM May 7 2021, 04:45 PM

|

|

QUOTE(Mattrock @ May 7 2021, 01:31 PM) Tenaga stock price has been steadily declining since 2018 from above RM15 to below RM10 now. Could this be why the dividend percentage is increasing? Has the actual dividend amount increased over the years? I am wary of high dividend stocks whose value keeps going down. I am actually trading it.  |

|

|

|

|

|

DragonReine

|

May 9 2021, 12:55 AM May 9 2021, 12:55 AM

|

|

QUOTE(Mattrock @ May 7 2021, 01:31 PM) Tenaga stock price has been steadily declining since 2018 from above RM15 to below RM10 now. Could this be why the dividend percentage is increasing? Has the actual dividend amount increased over the years? I am wary of high dividend stocks whose value keeps going down.  price drop because of a combination foreign investors dumping shares, local major corporate investors not picking up much of it (some actually reduced their holdings), growing ESG concerns about Tenaga's mostly coal-based power, tax rate eating into profits for 2020, and Covid-19 impacting on profits further Honestly the question is whether you believe electricity consumption will be less these coming years 😅 IMO tenaga is one of those blue chip stocks you hold not for capital gains lol |

|

|

|

|

|

lee28

|

May 18 2021, 12:07 AM May 18 2021, 12:07 AM

|

New Member

|

i would like to ask is PWROOT (7237) a good dividend company? i red some article regarding the dividen paid out is not sustainable. i dont quite understand. https://simplywall.st/stocks/my/food-bevera...-berhad-klsepwrThis post has been edited by lee28: May 18 2021, 12:07 AM |

|

|

|

|

|

phas3r

|

May 18 2021, 01:59 AM May 18 2021, 01:59 AM

|

|

Pchem

edit: nvm i think it's not much

This post has been edited by phas3r: May 18 2021, 03:02 AM

|

|

|

|

|

|

Norsaiful Zaidi

|

May 19 2021, 10:41 AM May 19 2021, 10:41 AM

|

New Member

|

Litrak

Low PE, High EPS, OK Dividend.

|

|

|

|

|

|

Afterburner1.0

|

May 20 2021, 11:17 AM May 20 2021, 11:17 AM

|

|

Atrium Reits & Jaycorp ok to buy and keep?

|

|

|

|

|

Apr 9 2021, 11:33 AM

Apr 9 2021, 11:33 AM

Quote

Quote

0.0257sec

0.0257sec

0.98

0.98

5 queries

5 queries

GZIP Disabled

GZIP Disabled