Sooner or later you guys can have access to stocks and ETFs in US and HK.

https://links.sgx.com/FileOpen/iFAST_FSMOne...t&FileID=653549

Fundsupermart Stock Broker, Lower brokerage fee 0.05%

Fundsupermart Stock Broker, Lower brokerage fee 0.05%

|

|

Mar 28 2021, 08:47 PM Mar 28 2021, 08:47 PM

Return to original view | IPv6 | Post

#1

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

Sooner or later you guys can have access to stocks and ETFs in US and HK. https://links.sgx.com/FileOpen/iFAST_FSMOne...t&FileID=653549 fms21 and WhitE LighteR liked this post

|

|

|

|

|

|

Mar 29 2021, 10:21 AM Mar 29 2021, 10:21 AM

Return to original view | IPv6 | Post

#2

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

Well, I am an iFAST shareholder. But to be fair to you guys, definitely I can guess they will make money out of currency spread. For US market, they may learn from Robinhood and earn some bid-ask spread from "market-making".

I don't think the broker will set up nominee accounts in foreign currency for you guys to keep USD/HKD in cash. Most likely they will convert MYR in-house. I may be wrong, but in any case, don't be happy too early. This post has been edited by TOS: Mar 29 2021, 10:22 AM |

|

|

Jul 16 2021, 06:01 PM Jul 16 2021, 06:01 PM

Return to original view | IPv6 | Post

#3

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

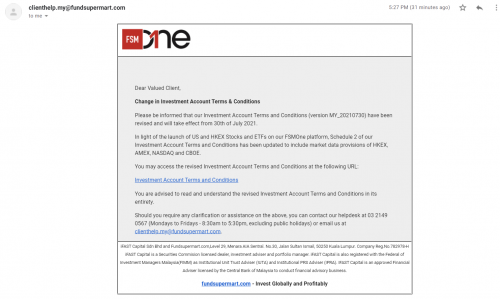

Some good progress: iFAST is preparing to offer US/HK stock trading from Malaysia.  This post has been edited by TOS: Jul 16 2021, 06:02 PM WhitE LighteR liked this post

|

|

|

Aug 4 2021, 11:47 PM Aug 4 2021, 11:47 PM

Return to original view | IPv6 | Post

#4

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

It has arrived.

https://www.fsmone.com.my/funds/research/ar...!?src=funds  However, fees are rather expensive compared to foreign broker, but much cheaper compared to local brokers that offer US/HK investment. https://www.fsmone.com.my/stocks/get-started/stock-fees This post has been edited by TOS: Aug 5 2021, 12:00 AM |

|

|

Oct 11 2021, 07:13 PM Oct 11 2021, 07:13 PM

Return to original view | Post

#5

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

China A shares have arrived at FSM SG. Not available on FSM MY yet however.

https://secure.fundsupermart.com/fsm/articl...e-on-fsmone-com |

|

|

Oct 15 2021, 07:58 PM Oct 15 2021, 07:58 PM

Return to original view | Post

#6

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

QUOTE(mois @ Oct 15 2021, 07:54 PM) For investor, it is very convenient can use FSM to buy US stocks. Like one app to rule them all. Can instantly change RM to USD at reasonable rate as well. For trader maybe not suitable due to usd8/trade Are you sure the forex rates are reasonable? Have you confirmed with fintech service providers like Instrem, Wise, Sunway Money, Bigpay etc. and/or money changer?This post has been edited by TOS: Oct 15 2021, 07:58 PM |

|

|

|

|

|

Oct 24 2021, 12:16 AM Oct 24 2021, 12:16 AM

Return to original view | Post

#7

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

Soon, you can buy SGX shares from FSM Malaysia. You can then access S-REITs from FSM Malaysia! https://links.sgx.com/FileOpen/iFAST_Result...t&FileID=687862  QUOTE Moving forward, the Malaysia operation is looking to introduce Singapore stockbroking services to its investors. WhitE LighteR liked this post

|

|

|

Oct 26 2021, 06:21 PM Oct 26 2021, 06:21 PM

Return to original view | Post

#8

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

QUOTE(tehoice @ Oct 26 2021, 11:59 AM) There is a reason I am an iFAST shareholder WhitE LighteR liked this post

|

|

|

Oct 26 2021, 07:28 PM Oct 26 2021, 07:28 PM

Return to original view | Post

#9

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

QUOTE(Ramjade @ Oct 26 2021, 07:21 PM) Watch out. With moomoo and tiger, it's only a matter of time before iFast also burns cash to compete with them. I am rooting for Moomoo as they are backed by tencent. I foresee that day to come. In HK, moomoo ads appear everywhere, on public buses, in almost all MTR stations. You should beware of regulatory risk too. Anyway, I didn't know you have stakes in Futu. You write options on Futu stocks listed in NASDAQ? This post has been edited by TOS: Oct 26 2021, 07:28 PM |

|

|

Oct 26 2021, 09:25 PM Oct 26 2021, 09:25 PM

Return to original view | Post

#10

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

QUOTE(Ramjade @ Oct 26 2021, 09:21 PM) I don't have stakes in futu but I have tencent HK version. No way ifast can compete if they don't burn money or else guarantee to lose market share. iFAST has other businesses like B2B segment. Time will tell who wins. I heard it's a good platform. This is coming from sg investors who don't bother about sg stocks at all (same boat as them who love to buy when market is red). They are mainly using IBKR and TD. They said they are impress with moomoo. I only have tiger and so far so so. I didn't open Moomoo yet so can't comment if it's better than tiger. Anyway, I think you have heard of "embrace, extend, extinguish", the triple-E strategy. |

| Change to: |  0.0230sec 0.0230sec

2.32 2.32

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 23rd December 2025 - 09:38 PM |