QUOTE(Ramjade @ Oct 16 2022, 10:23 AM)

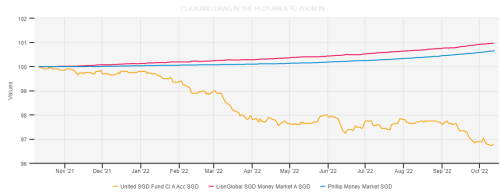

You mean United SGD Fund Cl A? It has dropped 3% for the past 1 year vs. other mmf funds.

This post has been edited by harmonics3: Oct 17 2022, 01:18 PM

Anyone know about foreign FD?

|

|

Oct 17 2022, 01:16 PM Oct 17 2022, 01:16 PM

Return to original view | IPv6 | Post

#1

|

Junior Member

637 posts Joined: Jul 2012 |

|

|

|

|

|

|

Oct 18 2022, 09:18 AM Oct 18 2022, 09:18 AM

Return to original view | Post

#2

|

Junior Member

637 posts Joined: Jul 2012 |

QUOTE(Hansel @ Oct 17 2022, 02:19 PM) QUOTE(TOS @ Oct 17 2022, 02:22 PM) That's exactly what I was illustrating for KDI Save and Versa's case... ya... learning the hard way as I am still vested in this United SGD Cl A fund, used to have better return than Lion Global and Philips MMFs but also much more volatile"Short-term" bonds can also be marked down when rates rise significantly. Good that you showed this chart.  TOS liked this post

|

|

|

Nov 7 2022, 12:21 PM Nov 7 2022, 12:21 PM

Return to original view | IPv6 | Post

#3

|

Junior Member

637 posts Joined: Jul 2012 |

QUOTE(Hansel @ Nov 7 2022, 11:22 AM) Then you will need a Term Deposit that is calculated daily, paid monthly and has a reasonable interest rate to go with, 'reasonable' being at least 2.5% in today's environment. Can be withdrawn anytime,... no need to wait till the beginning of the following mth.. That will be good, in Malaysia we have KDI save @ 2.5% p.a. (until year end) with same day deposit/withdrawal (cutoff time at 11am during weekdays). Anything similar in Singapore (especially >2.5% p.a.)? Hansel liked this post

|

|

|

Jul 20 2023, 11:16 AM Jul 20 2023, 11:16 AM

Return to original view | Post

#4

|

Junior Member

637 posts Joined: Jul 2012 |

|

| Change to: |  0.0393sec 0.0393sec

0.51 0.51

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 6th December 2025 - 04:22 PM |