For those who are thinking of investing in foreign currency FD and don't mind doing so in the domestic banks, I think RHB MCA account is really a good option.

Pros

1. Possibly the best rate in the market, it's even better than Wise for sure.

2. All balances receive very competitive interest, calculated daily, credited monthly. (no lock-up period, but rate is lower than FD).

3. Insured by PIDM up to RM250k.

Cons

1. Only useful for keeping foreign currencies in your own RHB account

2. Outward TT will incur fees, inward TT is free though. So conversion from different currencies between different bank accounts across countries, Wise would be better.

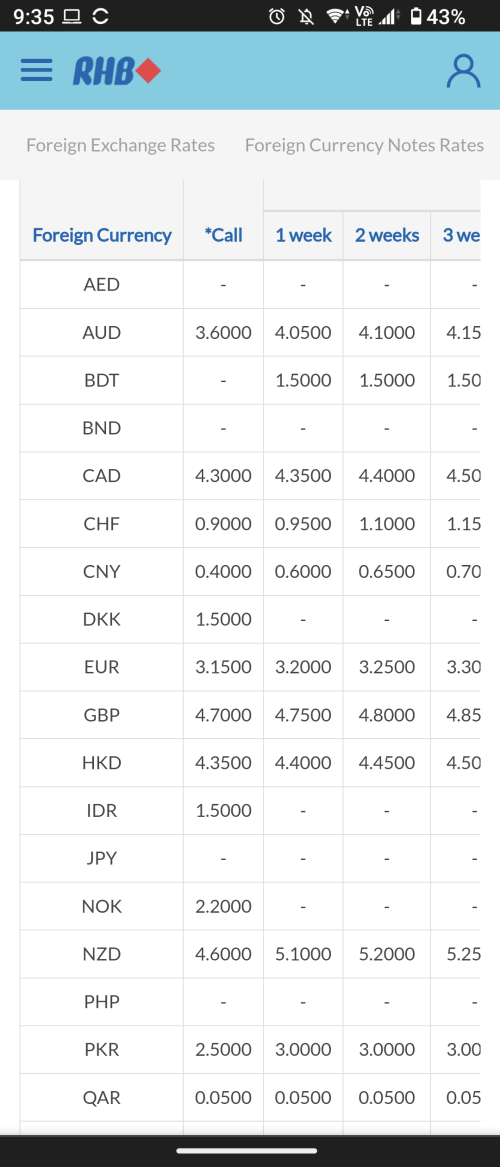

3. Limited to 24 currencies, Wise have more currencies.

4. Each conversion must involve Ringgit. IE say to convert between USD and EUR, U need to convert USD to MYR first, then MYR to EUR, so you lose on the double spread. Wise is better for direct conversion between any pair of currencies not involving ringgit.

Every month, on salary date, I just put some money into the high yielding currencies of AUD, CAD, GBP, NZD, SGD and USD.

Call rate as of today: AUD (3.25%), CAD (4%), GBP (4.1%), NZD (4.5%), SGD (3.4%), USD (4.95%).

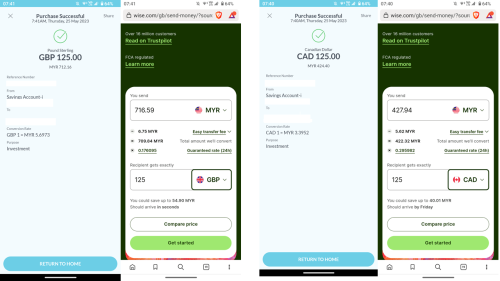

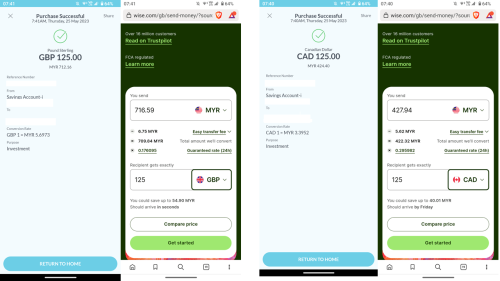

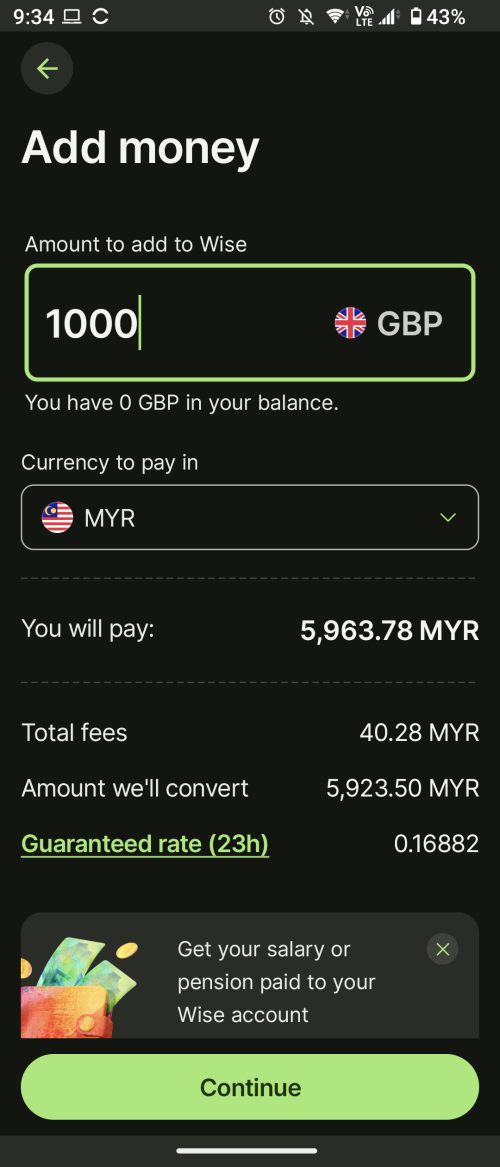

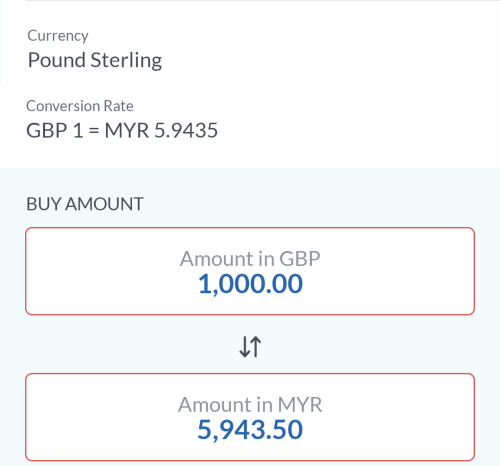

Comparison of rates between RHB and Wise as at 25 May 2023 morning, of conversion from Ringgit into the respective currencies. Rate from Wise website is taken at the same time I did conversion from Ringgit.

USD125: RHB (RM576.13), Wise (RM580)

AUD125: RHB (RM377.66), Wise (RM380.21)

GBP125: RHB (RM712.16), Wise (RM716.59)

CAD125: RHB (RM424.40), Wise (RM427.94)

NZD125: RHB (RM352.58), Wise (RM355.36)

SGD125: RHB (RM427.59), Wise (RM431.47)

I don't put into FD in RHB MCA account as it required 2000unit foreign currency for initial deposit, and interest will only be credited after tenure is completed. Plus, there's only small difference in interest rate between call account and FD account for most currencies.

https://www.rhbgroup.com/personal/deposits/...view/index.html

This post has been edited by Mr Gray: May 26 2023, 07:13 PM

This post has been edited by Mr Gray: May 26 2023, 07:13 PM

Feb 4 2023, 11:37 AM

Feb 4 2023, 11:37 AM

Quote

Quote

[/url]

[/url]

0.0697sec

0.0697sec

1.24

1.24

7 queries

7 queries

GZIP Disabled

GZIP Disabled