Outline ·

[ Standard ] ·

Linear+

Anyone know about foreign FD?

|

dwRK

|

Oct 24 2023, 10:00 PM Oct 24 2023, 10:00 PM

|

|

QUOTE(TOS @ Oct 24 2023, 09:37 PM) Here's my argument with the actual cash flow from my CIMB SG accounts. Warning: this is not for the faint-hearted.  [attachmentid=11483147] thank... will take a look tomorrow when i have my pc back with spreadsheets... waifu takes over at night for her k drama... lol been thinking... they do give you 3.5% as shown in their promo... but because of the offset/delayed payments, its not really compounding at 3.5%... i guess that is your problem with the promo... creative accounting by cimb sg...  |

|

|

|

|

|

dwRK

|

Oct 25 2023, 12:49 AM Oct 25 2023, 12:49 AM

|

|

QUOTE(TOS @ Oct 24 2023, 10:06 PM) Exactly bro (I mean uncle...). The 20-day delay is the single biggest factor causing the deviation from the advertised 3.5% rate. Delays in interest on interest accounts for the rest of the error. Like expanding Taylor series... you have zero order, first order, second order,...  not just that... they sum up X number of days enjoy Y% n Z%... so is not daily rest  |

|

|

|

|

|

dwRK

|

Oct 25 2023, 12:32 PM Oct 25 2023, 12:32 PM

|

|

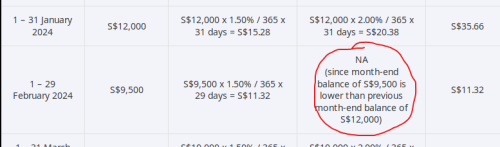

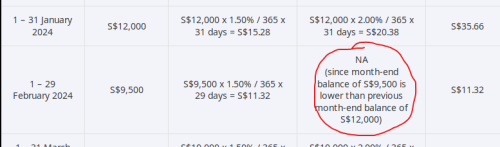

QUOTE(TOS @ Oct 24 2023, 10:06 PM) Exactly bro (I mean uncle...). The 20-day delay is the single biggest factor causing the deviation from the advertised 3.5% rate. Delays in interest on interest accounts for the rest of the error. Like expanding Taylor series... you have zero order, first order, second order,...  your data confuses old ppl... and hard to validate...  so i rolled my own... for <25k account, is 3.2% effective rate... 3.33% if they didn't forfeit bonus... so not as bad as you think, but anyways, main issues are initial 1st 20-day offset, flat rate calc not daily rest, and zero bonus if less than previous month... did not do next tiers... next 2 tiers shift in our favors... so up to 75K will be higher than 3.2%... final tier reduces this... but template is here if you wanna try...   cimb_sg.zip

cimb_sg.zip ( 34.3k )

Number of downloads: 6This post has been edited by dwRK: Oct 25 2023, 12:39 PM |

|

|

|

|

|

dwRK

|

Oct 25 2023, 12:55 PM Oct 25 2023, 12:55 PM

|

|

QUOTE(Hansel @ Oct 25 2023, 12:41 PM) No bro,... bonus amt references amt in Savings Acct at end-September, 2023. Does not benchmark against previous mth unlike the Maybank Singapore program a few years ago. So, if you've "been lucky" and your amt at end-September was $0, you will ALWAYS be receiving bonus interest till the end of program, being March 2024. this one here is what i was referring to...  so, if maintain account, you'll get the final bonus in April, this makes the effective interest 3.33% max for <25k account throughout campaign period... anyways... |

|

|

|

|

|

dwRK

|

Oct 25 2023, 12:56 PM Oct 25 2023, 12:56 PM

|

|

QUOTE(Hansel @ Oct 25 2023, 12:44 PM) You know, guys,... I feel really pathetic,... fighting and debating over a 3.50% or 2.70% interest rate today, when I used to be earning more than 6% in my REITs earlier. Think I better spend more time speculating in forex or IPOs to make more capital gains-lar,.... just a technical discussion with bro TOS... i don't even have skin in the game...  |

|

|

|

|

|

dwRK

|

Oct 25 2023, 04:20 PM Oct 25 2023, 04:20 PM

|

|

QUOTE(TOS @ Oct 25 2023, 12:49 PM) Yup, in the second Excel I posted yesterday I got an IRR of 3.11% for about 2 months of interests with money kept in account and rolling. A tiny correction is the compounding period is 365 days used by CIMB SG, not 365.25. I think their convention is ACT/365 if I recalled correctly. And as what Hansel says, it's based on September month-end balance. So from what we see, it's indeed not 3.5% but the drop in 40ish basis points does not explain the low 2.7% p.a. IRR I am getting. I am suspecting that the drop from 3.1/3.2% to 2.7% is probably also because we treat it as a saving account and hence money moving in and out reduces the IRR. What do you think? didnt look at your other 2 tables to bro Hansel... i use 365.25 because it matches closer to cimb example when setting it up.. i did see they use 365 in their example but didnt follow... i didn't recheck for 365 after... yes bal amount generating interest or not will affect irr... you can see it in my table... my spreadsheet can easily account for money movements.... but the final step putting the intetest into the final calc is manual... lazy to set up macro or new column to do the final step... |

|

|

|

|

|

dwRK

|

Oct 25 2023, 04:32 PM Oct 25 2023, 04:32 PM

|

|

QUOTE(TOS @ Oct 25 2023, 01:04 PM) This is for new customers... You need to check the table for existing customers. There is a slight difference in the way they define the month-end balance criterion. yeah... i just went with new customer plan... i was curious how to set up the offset data for the spreadsheet ... and how might it influence the irr... i have no interest in either cimb plans  anyways my table should be easy to use for either plan... once you get the hang of it...  |

|

|

|

|

|

dwRK

|

Oct 25 2023, 06:01 PM Oct 25 2023, 06:01 PM

|

|

QUOTE(TOS @ Oct 25 2023, 05:02 PM) Actually, it's not too difficult. The trick here is to game the system as they only check the balance on the last day of each month. So, on the last day, or 1 day before it to be safer, you move the funds out to some other accounts, then the next day (first day of new month), you move the money back in again. You lose one day of interest each month, but you gain the flexibility of having a very low end-of-month balance for comparison in subsequent months, which helps in managing liquidity. rhb mca giving 3.7... no fake 3.5... no jumping through hoops... etc etc  |

|

|

|

|

|

dwRK

|

Oct 26 2023, 06:22 AM Oct 26 2023, 06:22 AM

|

|

QUOTE(Medufsaid @ Oct 25 2023, 08:28 PM) but the SGD in rhb mca is not part of singapore eco system right? I can't FAST in and out from my CIMB sg acct. investors or savers need to be made aware of this i dont know what systems Malaysia n Singapore conduct cross border payment... i know swift wire can do sgd, etc... am sure got other systems in use rhb mca best for ppl to just park fx money imho... if you have many transactions and want it cheap... you go with local banks and live with what ever interests they give you ... |

|

|

|

|

|

dwRK

|

Nov 1 2023, 05:53 PM Nov 1 2023, 05:53 PM

|

|

QUOTE(Toku @ Nov 1 2023, 11:27 AM) That is called internalization? internalization is when broker settles matching orders in-house first if available... if no matching they route to the exchange... QUOTE(TOS @ Nov 1 2023, 12:02 PM) its not front running lah aiyoo... bank didn't jump in ahead of bro Hansel's order... bank is also not taking a position against him, but obviously bank is the counterparty... |

|

|

|

|

|

dwRK

|

Nov 3 2023, 09:43 AM Nov 3 2023, 09:43 AM

|

|

QUOTE(TOS @ Nov 1 2023, 05:55 PM) How do you know they don't?  just as you have no proof they do...  but against the law is one... rogue employee notwithstanding... unless is a systemic and systematic program to front run clients... paltry sum ah from bro Hansel not worth the risk... |

|

|

|

|

|

dwRK

|

Nov 3 2023, 11:51 AM Nov 3 2023, 11:51 AM

|

|

QUOTE(TOS @ Nov 3 2023, 10:01 AM) https://www.nytimes.com/2016/07/21/business...ent-orders.htmlhttps://www.nytimes.com/2009/03/05/business...specialist.htmlhttps://www.ft.com/content/9a09df46-4f18-11...c5-db83e98a590aSome examples above are from brokerage firms and corporate banking side, can't find a private bank example. But in theory it's not impossible, especially for banks with multiple banking segments in one umbrella like JP Morgan (which has private banking, corporate banking, investment banking etc). This one comes close: https://www.euromoney.com/article/b12kkwwzh...t-the-beginning Front-running is very common actually, even in Malaysia. bro... check the dates oh... every 'crime' is legal... until it becomes illegal... every law that is passed is because of some shit hit the fan... but just like polis advice me last time... can speed dun get caught...  but front running still rampant on crypto exchanges... got bots doing it... amusing to watch but frustrating to trade... hahaha... |

|

|

|

|

|

dwRK

|

Nov 4 2023, 12:43 PM Nov 4 2023, 12:43 PM

|

|

QUOTE(Hansel @ Nov 3 2023, 12:22 PM) I know of all the above, bros,... But if I'm still winning,.. I guessed I'm better than their rows and rows of analysts and 'manipulators' sitting in the office. bro TOS still young... lots of energy to sweat the small stuff...  internalization lah... fake 3% lah... bank front running lah... hahahahaha... edit... forgot to add... pidm/bnm cannot protect mca lah... hahahahaha... but still good lah... share what he learn... This post has been edited by dwRK: Nov 4 2023, 12:47 PM |

|

|

|

|

|

dwRK

|

Nov 8 2023, 11:03 AM Nov 8 2023, 11:03 AM

|

|

QUOTE(Hansel @ Nov 5 2023, 02:49 PM) ...have a good weekend, bro DWRK and other bros too. hope you had a great weekend too...  mine was mixed... 2 laptop semi-kaput... but had a breakthrough developing my bot trading system... also came up with some novel programming logic for it... very happy with these  |

|

|

|

|

|

dwRK

|

Feb 29 2024, 09:07 AM Feb 29 2024, 09:07 AM

|

|

QUOTE(Ramjade @ Feb 29 2024, 08:40 AM) Please don't link that thief link here. He takes info from here and didn't give credit and make it like his own research. yup... every new idea and lubang we post here he make video next day... get all the clicks... |

|

|

|

|

|

dwRK

|

Feb 29 2024, 02:21 PM Feb 29 2024, 02:21 PM

|

|

QUOTE(frankliew @ Feb 29 2024, 09:34 AM) USDT Binance first 500USD 30%, after that 20% fuyo ? 0-500 7%... then 22%... |

|

|

|

|

|

dwRK

|

Apr 4 2024, 10:28 AM Apr 4 2024, 10:28 AM

|

|

guys... when you "invest" in currency... eventually need to also sell... therefore must look at round-trip, buy/sell spread for best comparison... on usd, rhb spread is 0.64%... alliance is 3.54% !!! des why long ago i kept "promoting" rhb when not many ppl here knows about it...  anyways back to alliance... they give you 5.65%pa... if put for 1 year you actually only get 2.11% net... but because alliance fd is higher than rhb... if you put long enough, returns from alliance will eventually exceeds rhb... my guesstimate maybe in 15-20 yrs  anyways... imho that is far too long, and too uncertain... |

|

|

|

|

Oct 24 2023, 10:00 PM

Oct 24 2023, 10:00 PM

Quote

Quote

0.0432sec

0.0432sec

0.25

0.25

7 queries

7 queries

GZIP Disabled

GZIP Disabled