Outline ·

[ Standard ] ·

Linear+

Anyone know about foreign FD?

|

Lawyer1

|

Jan 27 2009, 10:00 AM Jan 27 2009, 10:00 AM

|

|

QUOTE(cherroy @ Jan 27 2009, 09:46 AM) Currently those foreign currency FD/call account etc by commercial banks generally can accept bank in but cannot withdraw back as foreign currency note, as far as I know. Because Banks don't prepare those note or having those note in place all the time, that's why they don't allow customers to withdraw as note. People,........... Sgp banks will allow withdrawal in foreign currency notes !!!!!!!!! |

|

|

|

|

|

Saigo

|

Jan 27 2009, 12:08 PM Jan 27 2009, 12:08 PM

|

|

QUOTE(cherroy @ Jan 26 2009, 04:06 PM) Holding physical note in massive amount is always not advisable, as the risk of being stolen is greater the risk of the currency appreciating. Also you get none interest from it by holding physical note. You still can withdraw the NZD, using NZD remittance to withdraw in NZ bank if your intention is to study there or stay there for long haul. But just for few days travelling purposes, then it might not be that suitable. Actually I'm planning to deposit the notes into a safe deposit box, so the risk of being stolen should be nearly non-existent.. unless I happen to be robbed on the way to the bank *touch wood. I'm not going to be travelling for a few days, but 1 whole month there. Would it still be viable then to do as you said? |

|

|

|

|

|

cherroy

|

Jan 27 2009, 06:21 PM Jan 27 2009, 06:21 PM

|

20k VIP Club

|

QUOTE(Saigo @ Jan 27 2009, 12:08 PM) Actually I'm planning to deposit the notes into a safe deposit box, so the risk of being stolen should be nearly non-existent.. unless I happen to be robbed on the way to the bank *touch wood. I'm not going to be travelling for a few days, but 1 whole month there. Would it still be viable then to do as you said? It is viable you take those money as remittance, or TT the money to there (provided you got account there). If just for travelling purposes, then not much money needed, so it might not suitable as well. As this is more suit to someone need some significant of money like study abroad which might need few ten K or so, needing the money for business, or got account at there for saving or whatever purposes etc apart from one the of main purposes of this kind of FD for diversification one's asset into other currencies form. |

|

|

|

|

|

Saigo

|

Jan 30 2009, 06:38 PM Jan 30 2009, 06:38 PM

|

|

One of the significant problems is I don't have an account in NZ, plus if I'm not mistaken, you need to actually be residing in NZ to have an NZ bank account..

Thanks for the advice anyhow.

This post has been edited by Saigo: Feb 11 2009, 12:22 AM

|

|

|

|

|

|

Saigo

|

Feb 11 2009, 12:23 AM Feb 11 2009, 12:23 AM

|

|

OK guys, circumstances have sorta changed and I find myself contemplating the usage of foreign FD again.

Here's a quick brief on my current situation: I find myself quite suddenly going to Australia to complete my final year there (long story), and I found that the AUD has been fluctuating for the past few months.

I don't know if I understood completely what you guys have said in previous posts, but assuming that I found a desirable target exchange rate, say, 2.3, so I should go to the bank and 'lock in' at this particular interest rate, regardless of whether it increases or decreases? Will the bank charge any additional fees on top of this?

Thing is I'm not too entirely sure what duration I should set it as. Any ideas? My course is due to commence in July in Australia.

|

|

|

|

|

|

SUSOptiplex330

|

Feb 11 2009, 07:24 AM Feb 11 2009, 07:24 AM

|

|

I think you can do it this way:

1. When you wanted to, convert your RM into AUD and make an AUD Fixed Deposit account for 3 months (that will mature in mid-May, then renew it monthly before final withdrawal in July)

2. When July comes, you tell the bank to convert the AUD in the fixed deposit into a bank draft in your name.

3. You bring the bank draft to Australia. Open a Australian bank account and deposit your bank draft into it.

Are you or your parent a HSBC Premier customer? If yes, there is another alternative.

|

|

|

|

|

|

Saigo

|

Feb 12 2009, 09:59 AM Feb 12 2009, 09:59 AM

|

|

That's actually a good idea. Nope, none of my family members use HSBC.

Although I've recently looked into HSBC and found out that they have an account called the Foreign Currency Current Account.. actually I think other banks do as well. It's like a savings account I reckon, but I think there are additional fees for when you withdraw or deposit. :/

Now I'm not too sure which I should go for - a foreign current account or fixed deposit.

|

|

|

|

|

|

howszat

|

Feb 14 2009, 07:27 PM Feb 14 2009, 07:27 PM

|

|

|

|

|

|

|

|

shadowz

|

Feb 15 2009, 06:19 PM Feb 15 2009, 06:19 PM

|

|

Yes the AUS has been fluctuating. I have yet to see it drop below 2.3 tho. The thing that gets me is that if wait too long and the RM depreciates, then the AUS will naturally increase against RM. Erk. Risk of course~

|

|

|

|

|

|

cherroy

|

Feb 15 2009, 06:37 PM Feb 15 2009, 06:37 PM

|

20k VIP Club

|

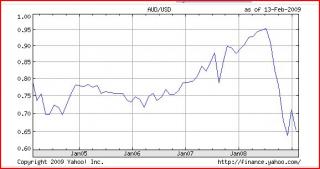

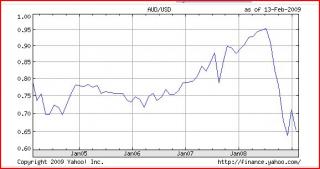

QUOTE(howszat @ Feb 14 2009, 07:27 PM) ZAR has lost almost half its value since 5 years ago against USD. So it is pretty high risk currency compared to AUD and NZD. While AUD just back to its 5 years ago level. South Africa inflation rate is pretty high, which is not good for the currency, that's why it needs to offer high interest rate. Don't mean which is good or not good. Just a comparison of risk involved. In foreign currency FD, currency strength is one of the very important factor to be considered besides interest rate factor. Chart quoted from Yahoo finance. Attached thumbnail(s)

|

|

|

|

|

|

SUSOptiplex330

|

Feb 15 2009, 07:35 PM Feb 15 2009, 07:35 PM

|

|

QUOTE(howszat @ Feb 14 2009, 07:27 PM) RHB must be joking. 1 month GBP FD rate at 0.9% when other banks give 2.+%. And Hi cherroy. Where do you get those currency charts? This post has been edited by Optiplex330: Feb 15 2009, 07:37 PM |

|

|

|

|

|

Ern3st

|

Feb 15 2009, 09:18 PM Feb 15 2009, 09:18 PM

|

Getting Started

|

TS - I not here to suggest anything but just give you the calculation

Illustration:

Just take New Zealand Dollar as example = 10% (< easier to calculate*)

*By depositing your money into a foreign bank, you required to bear the risk of exchange rate"

which is exchange rate is also taken in calculation of your earning.**

1st example situation ( 1year ):

Malaysian (RM) deposit rm100 in New Zealand bank which is getting 10% of interest.

If RM value increase 10% = rm110

Rm110 x 10% interest = rm11

[So you're earn RM121 (110+11) which is mean if RM value increase you r not earn only 10%]

2nd example situation ( 1year)

Malaysian (RM) deposit rm100 in New Zealand bank which is getting 10%of interest

If RM value drop 10% = RM 90

Rm 90 x 10% = RM 9

[So you're earn RM 99 ( 90+9 ) which is mean you only lost 1%]

Conclusion:

If you're invest ,you may earn 21% return or lost 1%.

So is there worth for you to invest? Just consider your self.

|

|

|

|

|

|

cherroy

|

Feb 15 2009, 09:18 PM Feb 15 2009, 09:18 PM

|

20k VIP Club

|

QUOTE(Optiplex330 @ Feb 15 2009, 07:35 PM) RHB must be joking. 1 month GBP FD rate at 0.9% when other banks give 2.+%. And Hi cherroy. Where do you get those currency charts? Now BOE has slashed rate to 1.0% already last week or so. So no possible for others to give 2% anymore. Already said mah, quoted from Yahoo finance.  |

|

|

|

|

|

Lawyer1

|

Feb 16 2009, 10:56 AM Feb 16 2009, 10:56 AM

|

|

QUOTE(cherroy @ Feb 15 2009, 09:18 PM) Now BOE has slashed rate to 1.0% already last week or so. So no possible for others to give 2% anymore. Already said mah, quoted from Yahoo finance.  The RBA might be slashing again,..... hmm,... I think the once mighty Aus FD is gone. |

|

|

|

|

|

SUSOptiplex330

|

Feb 16 2009, 11:49 AM Feb 16 2009, 11:49 AM

|

|

QUOTE(cherroy @ Feb 15 2009, 09:18 PM) Now BOE has slashed rate to 1.0% already last week or so. So no possible for others to give 2% anymore. Already said mah, quoted from Yahoo finance.  I just checked. 6 month GBP FD is 1.9% now. Still far better than RHB's 0.9% |

|

|

|

|

|

Colaboy

|

Feb 17 2009, 03:58 AM Feb 17 2009, 03:58 AM

|

|

AUD FD is still giving 5.5% right?

|

|

|

|

|

|

weichong

|

Feb 17 2009, 07:47 AM Feb 17 2009, 07:47 AM

|

Getting Started

|

QUOTE(Colaboy @ Feb 17 2009, 03:58 AM) AUD FD is still giving 5.5% right? aud 3.35% for 1 year fd |

|

|

|

|

|

shakiraa

|

Feb 24 2009, 12:08 AM Feb 24 2009, 12:08 AM

|

|

which currency is worth investing now? thanks.

|

|

|

|

|

|

Suk

|

Jun 8 2009, 09:40 AM Jun 8 2009, 09:40 AM

|

|

QUOTE(shakiraa @ Feb 24 2009, 12:08 AM) which currency is worth investing now? thanks. Yes, Which currency good to buy now ? £ is 5.7 now. Lowest was 5.3 Highest Few year ago, £7.1 So, I am planning to buy now. |

|

|

|

|

|

cherroy

|

Jun 8 2009, 11:06 AM Jun 8 2009, 11:06 AM

|

20k VIP Club

|

QUOTE(Suk @ Jun 8 2009, 09:40 AM) Yes, Which currency good to buy now ? £ is 5.7 now. Lowest was 5.3 Highest Few year ago, £7.1 So, I am planning to buy now. GBP fundamental is the weakest among all the major currencies, that's why it fall so much. |

|

|

|

|

Jan 27 2009, 10:00 AM

Jan 27 2009, 10:00 AM

Quote

Quote

0.0176sec

0.0176sec

0.22

0.22

6 queries

6 queries

GZIP Disabled

GZIP Disabled