QUOTE(potatolala @ Mar 1 2021, 02:34 AM)

This is my understanding of the strategy.

Assume that you have $10k and btc @ 100k

You start with buying $10k btc @ 100k

With every 10% btc drop, you sell.

Now you have $9k and btc @ 90k.

Then you re-enter again. Buy $9k btc @ 90k (Here I not sure if I need to immediately buy or wait for awhile)

You keep repeating steps.

For this strategy to work, the btc needs to shoot the moon.

The lower you capital is, the longer the btc needs to shoot. Maybe need to shoot to Mars/Jupiter only can breakeven

Correct me if I am wrong.

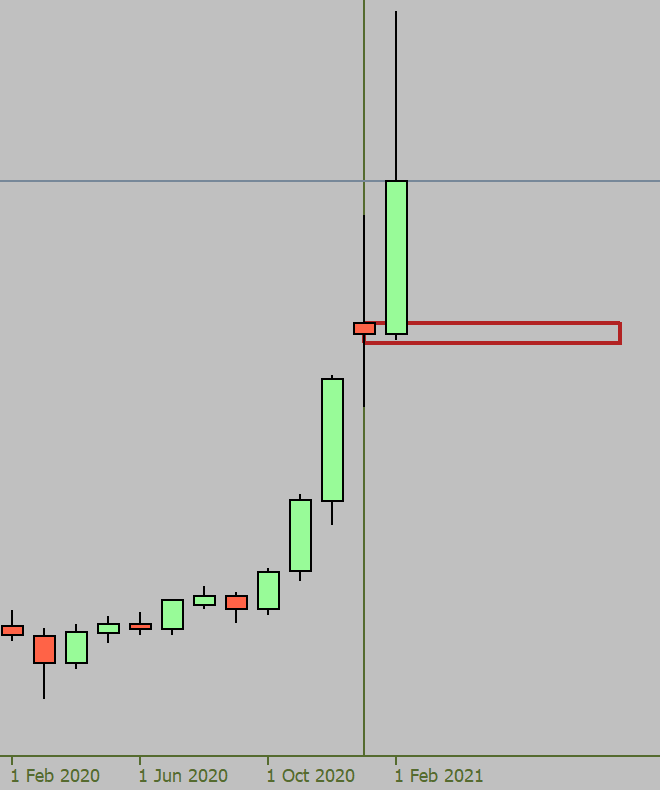

Yes, you're mostly right. Let's follow your example:

a)Risk 10% of $10k buy btc @100k; fails

b)Risk 10% of $9k buy btc @90k; fails

c)Risk 10% of $8.1k buy btc @80k;fails

d)Risk 10% of $7.29k buy btc @70k; fails

e)Risk 10% of $6.56k buy btc @60k; fails

f)Risk 10% of $5.9k buy btc @50k; fails

g)Risk 10% of $5.31k buy btc @40k; fails

h)Risk 10% of $4.78k buy btc @30k; successfully capture bull run to btc @200k

Your original $4.78k worth of btc is now $31.87k, minus $5.2k losses = $26.65k nett profit

Let's say you split $10k to just buy the dip method normally @100k, 90k & 80k, averaged price to 90k, your gains when btc @200k is $22.2k nett profit. So there are some gains from my method, IF price dips a whole lot. If price doesn't dip much, then the usual cost averaging hodlr method would produce more gains.

This post has been edited by Supreme1394: Mar 1 2021, 03:26 AM

Feb 26 2021, 12:56 PM

Feb 26 2021, 12:56 PM

Quote

Quote

0.0297sec

0.0297sec

0.35

0.35

7 queries

7 queries

GZIP Disabled

GZIP Disabled