4 Stocks The WallStreetBets Reddit Community Is Short Squeezing

GameStop (NYSE: GME);

AMC (NYSE: AMC);

Nokia (NYSE: NOK);

Top Glove (SGX: BVA)

The entire world’s eyes are on Redditors, GameStop and Robinhood.

What happens next is anyone’s guess.

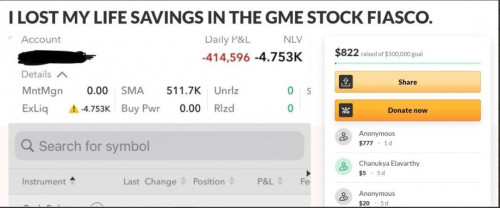

Followers of our regular 4 Stocks This Week column will likely have at least seen some of what’s been happening with the short squeeze led by the WallStreetBets Redditors. This has led to wild fluctuations in stock prices, as well as caused widespread confusion and havoc on financial market participants.

TLDR version of what’s happened (which is really insufficient to give you a full picture):

WallStreetBets (also known as /r/wallstreetbets or WSB) is a subreddit where participants discuss stock trades. According to online sources, it started way back in 2012, but has evolved into a “working-class VS elites” battle royale in recent weeks.

In the recent week, havoc has ensued as an army of Redditors led by WallStreetBets poured money into a number of stocks – including more not mentioned in this article – to cause a short squeeze.

A short squeeze, as defined by Investopedia, is when stocks or other financial assets jump in prices. This forces the short-sellers who have bet on prices going down to incur big losses AND forced to buy the very stocks they were shorting to avoid incurring even bigger losses.

The reasons Redditors did this may range from YOLO-ing, to FOMO-ing, to joining a movement to “F***” hedge funds and wall street”.

Hedge fund Melvin Capital, rumoured to have been holding a short position of up to 140% on GameStop has been forced to close its short position and its backers had to infuse US$3 billion into the fund. Some news sources put short sellers losses on GameStop at nearly US$20 billion this month.

Elon Musk is in the fray as well – supporting the Reddit movement with a one-word tweet “Gamestonk!!”. Of course, Elon Musk’s Tesla (NYSE: TSLA) has previously been a short sell target for many funds.

On the other hand, billionaire investor Leon Cooperman gave an interview where, among many other statements, was quoted as saying “This fair share is a bullshit concept. It’s just a way of attacking wealthy people, and I think it’s inappropriate”. Such a quote, even if delivered with a mostly reasonable content, will always be taken in the worst possible way.

Trading platforms such as Robinhood, and others, which branded themselves as “for the man on the street” as allegedly bent against pressure from wealth hedge fund owners Citadel to restrict the buying of target stocks in the name of protecting investors. Some point to this as the definition of market manipulation. The allegation is that Robinhood derives a large amount of revenue from these hedge funds. This has been refuted by Robinhood CEO.

The US Congress will be holding hearings on GameStop trading, with many proponents calling for a hearing on “Robinhood’s market manipulation”

What happens next is anyone’s guess. But everyone’s eyes are on this. Before we get carried away (and write an actual news piece!), here are the 4 stocks backed by the Reddit Army:

Read Also: Selling Stocks You Don’t Even Own – Should Short Selling Be Made Illegal?

GameStop (NYSE: GME)

Perhaps the most popular stock among all for this saga, GameStop (NYSE: GME) is what really led the “high street VS Wall Street” movement.

Whether it’s relevant or not, GameStop is actually a gaming retailer with 5,509 stores across the US, Canada, Europe, and Australia.

The company sells video games, gaming consoles and computers, television sets, mobile phones, and other gadgets and accessories. COVID-19 delivered a setback as consumers stayed away from its outlets.

In its latest results, it delivered a revenue of US$6.5 billion in sales for FY2019, 22% down from the US$8.3 billion it achieved the year before. It lost US$464.4 million in FY2019, which was actually an improvement against FY2018, when it lost US$794.8 million.

Notwithstanding this, you can see its price was hovering at around the US$4 to US$20 range in the last 6 months. It was only in the current 2-week period when it share price skyrocketed 1630% to US$325 a share. You can also see the wild swing in between when it lost close to 40% of its value and then quickly gained it back the next day.

AMC Entertainment (NYSE: AMC)

AMC’s (NYSE AMC) share price follows a very similar trajectory to GameStop’s share price. Its share price was hovering between US$4 and US$2 in the past 6 months before the current week. It then soared over 900% to close to $20.

For those who have heard of AMC but don’t know what it does – here’s why it was such a target for short-sellers. AMC operates over 1,000 theatres and has over 11,000 screens in 15 countries. It is a movie theatre chain.

It is precisely the kind of business that COVID-19 has decimated. This was what attracted short-sellers.

In the first half of its FY2020, revenue fell over 65% to US$960.0 million. At just the halfway point in FY2020, it also incurred a total loss of US$2.7 million, compared to a loss of US$150,000 in the whole of FY2019.

Nokia (NYSE: NOK)

Nokia (NYSE: NOK) is listed on the New York Stock Exchange (NYSE), on the Euronext Paris, and in its native Helsinki.

While it has also become a meme stock, it is unlike the earlier two stocks – in that it isn’t a stock that got battered because of COVID-19. In fact, the only way Nokia (and perhaps another meme stock Blackberry as well) is attracting attention from the Reddit army is because their stocks are getting pummelled.

This legacy telecommunications stock is getting another lease of life as its share price has recovered 41% from November 2020 lows. Notwithstanding this, the stock is still down from 6 months ago.

Uniquely, this shows that any stock getting hammered lower can become a target of Reddit rescuers, which will likely deter short sellers from in more ways.

https://www.reuters.com/companies/TPGCbi.KL

Top Glove Corporation Berhad

7113

Top Glove (SGX: BVA)

Top Glove (SGX: BVA) has a secondary listed on Singapore’s SGX. It is also a stock we’ve covered extensively in the past as a COVID-19 play. In the past few months, vaccination developments and other company-specific news has dragged the company’s share price down.

As you can see in the 6-month chart, prices are sharply lower. However, the 5-days chart shows why Top Glove made it into this list. On 29 January, shares in Top Glove spiked sharply, by 10% to $2.22.

Also, in case you’re wondering how WallStreetBets got wind of Top Glove in this part of the world, they didn’t. What’s happened is that Redditors are coming alive globally, and the movement has inspired Malaysians, with their own BursaBets, to invest heavily into Top Glove – a stock that has been battered in recent times.

Do Not Blindly Invest

While it is admirable for small retail investors to band together to take on the world’s largest hedge funds, we must remember that we still owe our future selves a retirement plan. Putting some money into

YOLO or FOMO

or to stick it to the rich can be fun and romanticised – but it does not replace prudent financial investment for the long-term. We also have to consider the possibility the reality that we are being duped into a pump and dumb scheme.

Perhaps the best way to stick it to the rich is to always buy from small local companies, even if they are more expensive. If we want to and have the stomach to do it with thousands of dollars, why not support a real small business owned by someone you know in your community.

This post has been edited by plouffle0789: Feb 3 2021, 01:00 PM

4 Stocks Reddit Community Is Short Squeezing, 2021 february!!

Feb 3 2021, 01:00 PM, updated 5y ago

Feb 3 2021, 01:00 PM, updated 5y ago

Quote

Quote

0.0183sec

0.0183sec

0.65

0.65

5 queries

5 queries

GZIP Disabled

GZIP Disabled