Outline ·

[ Standard ] ·

Linear+

Insurance Talk V7!, Your one stop Insurance Discussion

|

watabakiu

|

Oct 2 2021, 11:22 PM Oct 2 2021, 11:22 PM

|

|

Wanting to get a PruBSN with an agent, but is been over a month & still not ready. is this normal?

agent say got manpower issue, & now still in underwriting stage.

& let say I decide to just cancel now, will i get my deposit back?

|

|

|

|

|

|

watabakiu

|

Oct 2 2021, 11:47 PM Oct 2 2021, 11:47 PM

|

|

QUOTE(watabakiu @ Oct 2 2021, 11:22 PM) Wanting to get a PruBSN with an agent, but is been over a month & still not ready. is this normal? agent say got manpower issue, & now still in underwriting stage. & let say I decide to just cancel now, will i get my deposit back? QUOTE(Leo the Lion @ Oct 2 2021, 11:28 PM) Mine took 2-3months in underwriting stage  PruBSN also? |

|

|

|

|

|

watabakiu

|

Apr 15 2022, 02:03 PM Apr 15 2022, 02:03 PM

|

|

Just thinking out loud, would mental illnesses be covered by insurance? Like visiting shrinks, talking² while the doctor scribble on notes

|

|

|

|

|

|

watabakiu

|

Dec 20 2022, 09:34 AM Dec 20 2022, 09:34 AM

|

|

How do one go about changing smoker --> non-smoker status? & will it have any effect on the premium, going forward?

|

|

|

|

|

|

watabakiu

|

May 23 2023, 11:53 AM May 23 2023, 11:53 AM

|

|

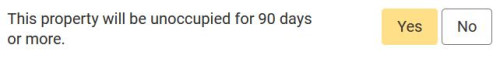

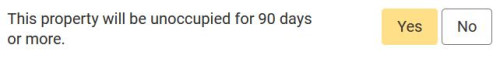

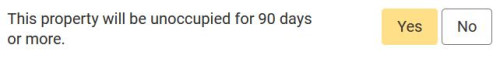

I plan to renew my fire insurance, and there's this part for me to declare :  Does this affect the pricing ? It is Etiqa Insurance |

|

|

|

|

|

watabakiu

|

May 23 2023, 12:11 PM May 23 2023, 12:11 PM

|

|

QUOTE(lifebalance @ May 23 2023, 12:09 PM) This is a risk disclosure. Any impact on the price, or getting the renewal approved ? |

|

|

|

|

|

watabakiu

|

May 26 2023, 08:34 PM May 26 2023, 08:34 PM

|

|

QUOTE(watabakiu @ May 23 2023, 11:53 AM) I plan to renew my fire insurance, and there's this part for me to declare :  Does this affect the pricing ? It is Etiqa Insurance QUOTE(JIUHWEI @ May 24 2023, 01:02 PM) Usually, insurance companies don't really want to insure buildings/properties left vacant for that long of a period. This is correct. Renewed my insurance through phone, and enquire about it to the CS. She said that they won't insure house that are left vacant more than 90days. Asked whether can leave the house vacant still, but impact premium? No, she said. >90days = not insured. |

|

|

|

|

|

watabakiu

|

May 22 2024, 06:41 PM May 22 2024, 06:41 PM

|

|

What is this Hibah all about, and is it really at all necessary? In my circle of friends, they said agents approached them to get this hibah thing, to the extend they have promoted this waaaaaaaay more than the usual coverage e.g. health, life, CI....

|

|

|

|

|

|

watabakiu

|

May 22 2024, 11:01 PM May 22 2024, 11:01 PM

|

|

QUOTE(lifebalance @ May 22 2024, 06:43 PM) Hibah is the voluntary transfer of property ownership from one party to another during the life of the transferor, without any consideration. It is a gift in the form of cash or property, and is often used to honor someone. The word hibah comes from the Arabic word Hiba, which means "gift" or "blessing". So how is hibah related to insurance? The way I see it is that I buy a hibah insurance, nominate a person that will receive it in the event that I die. The way I am making money is the difference between the premium paid, and the compensation received. Say premium is 1k/year, compensation is 10k. died-ed on second year, so the nominee will get 8k. Correct? |

|

|

|

|

|

watabakiu

|

May 23 2024, 10:14 PM May 23 2024, 10:14 PM

|

|

QUOTE(jsonting @ May 23 2024, 04:44 PM) How Hibah is related to insurance? - Takaful is one of the way to leverage on to leave behind "hibah" to your loved ones. It cannot be challenged by any person or institution, making it a good instrument to guarantee your loved ones receive whatever amount you buy. Why would someone use Takaful to hibah? - because you can leave behind money that you haven't earned yet. You pay a fraction, but when death happens, takaful company will pay your family much higher lump sum than what you paid. e.g, you pay 1k/year, sum cover is 10k, so when you die, your nominee will get 10k as per agreed. I wouldn't say any insurance is making money... cos when a person died, the family loss all the income possibility the person could earn if they still around. So insurance is minimizing loss... not making money. Thanks for points. on the way takaful hibah is structured, there is a term limit to it, example 30years, yes? can there be a chance the premium paid exceeds the compensation. and in instances the person insured is still alive, would the insurance return the premium, or consider burn? |

|

|

|

|

|

watabakiu

|

Jun 13 2024, 07:54 PM Jun 13 2024, 07:54 PM

|

|

So very sorry to interrupt, but how frequent should one review his / her insurance policy?

|

|

|

|

|

|

watabakiu

|

Jun 14 2024, 09:44 AM Jun 14 2024, 09:44 AM

|

|

Thank you all for the response. What about age? if not mistaken there's this age tier (say, 30-35, 36-40, etc) so wouldn't it make sense to review policy before going into the next age tier. as example, to review policy prior to turning 36 next birthday?

|

|

|

|

|

|

watabakiu

|

Jun 20 2024, 05:28 PM Jun 20 2024, 05:28 PM

|

|

I have a 4-year old policy, and unlike previous years, my Agent is no longer as keen to respond to my policy reviews. Is it normal?

|

|

|

|

|

|

watabakiu

|

Jun 20 2024, 05:44 PM Jun 20 2024, 05:44 PM

|

|

QUOTE(watabakiu @ Jun 20 2024, 05:28 PM) I have a 4-year old policy, and unlike previous years, my Agent is no longer as keen to respond to my policy reviews. Is it normal? QUOTE(tyenfei @ Jun 20 2024, 05:36 PM) None of us here can judge what happened between you & your agent. You may try reach out to him/her. You 2 treat each other kopi/ teh before right?  hahahah is relative 1 leh, CNY got yam seng. mebbe sebab less comission kut? yr1 komisen tinggi, yr4 komisen yillek |

|

|

|

|

|

watabakiu

|

Jun 21 2024, 09:36 PM Jun 21 2024, 09:36 PM

|

|

QUOTE(hksgmy @ Jun 20 2024, 09:43 PM) The worst kind to buy a policy from…. Come to think of it, yeah it sure is! |

|

|

|

|

|

watabakiu

|

Feb 23 2025, 11:20 PM Feb 23 2025, 11:20 PM

|

|

I have stopped smoking cigarettes for over three years now. So if I were to subscribe to new term life insurance, should I still select for 'smoker' or I can now select 'non-smoker'?

|

|

|

|

|

Oct 2 2021, 11:22 PM

Oct 2 2021, 11:22 PM

Quote

Quote

0.0434sec

0.0434sec

0.41

0.41

7 queries

7 queries

GZIP Disabled

GZIP Disabled