I need your advice and clarification on how my medical policy works. Note the policy is from Great Eastern.

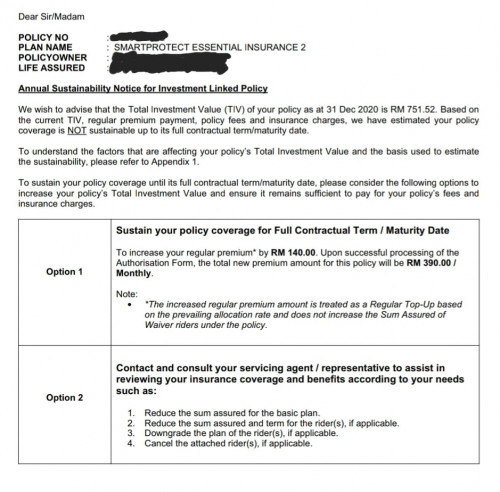

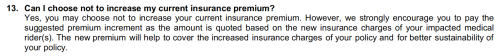

I receive this letter couple of months back asking me top up because my current monthly payment is unable to "sustain" my insurance plan.

My insurance agent explain to me that topping up is not required especially for my age demographic (late 20s), and my policy can still cover me to maybe age 70+(?)

I have a few questions :

1) What is the difference between increasing and not increasing the premium amount.

2) If i increase the premium amount, does it mean that the policy can maintain longer and vice versa ?

3) Scenario : Lets say i don't increase the premium amount, and the policy can "sustain" until I'm 70, what happens later if i reach to 71 age, does my policy suddenly lapse ? how will i be notified and how much should i increase the premium then ? (Touch Wood) Lets say if i'm hospitalised at age 71, does it mean that my insurance is effectively lapse and I'm not insured? What happen to all the premiums i payed previously, does it not cover any of my hospital bill ?

4) Scenario : Lets say i do increase the premium and policy can sustain longer, but what if (touch wood) I don't reach the supposedly extended period. What happens to the extra premiums I paid ? All wasted ?

Really sorry if I'm asking very noob-ish questions.

Appreciate your time in explaining this to me and much thanks in advance.

Aug 10 2021, 07:23 PM

Aug 10 2021, 07:23 PM

Quote

Quote

0.0654sec

0.0654sec

0.72

0.72

7 queries

7 queries

GZIP Disabled

GZIP Disabled