QUOTE(timeekit @ Aug 10 2021, 07:23 PM)

Hi All,

I need your advice and clarification on how my medical policy works. Note the policy is from Great Eastern.

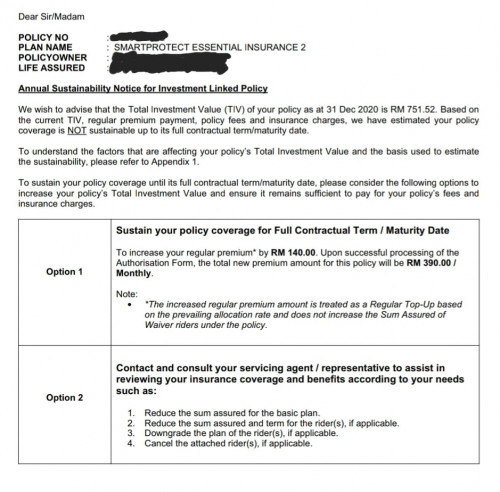

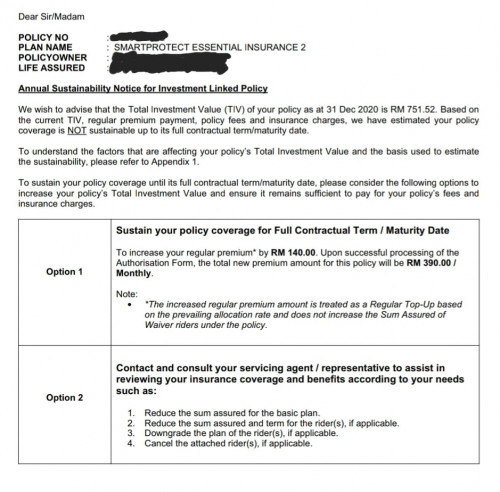

I receive this letter couple of months back asking me top up because my current monthly payment is unable to "sustain" my insurance plan.

My insurance agent explain to me that topping up is not required especially for my age demographic (late 20s), and my policy can still cover me to maybe age 70+(?)

I have a few questions :

1) What is the difference between increasing and not increasing the premium amount.

2) If i increase the premium amount, does it mean that the policy can maintain longer and vice versa ?

3) Scenario : Lets say i

don't increase the premium amount, and the policy can "sustain" until I'm 70, what happens later if i reach to 71 age, does my policy suddenly lapse ? how will i be notified and how much should i increase the premium then ? (Touch Wood) Lets say if i'm hospitalised at age 71, does it mean that my insurance is effectively lapse and I'm not insured? What happen to all the premiums i payed previously, does it not cover any of my hospital bill ?

4) Scenario : Lets say i

do increase the premium and policy can sustain longer, but what if (touch wood) I don't reach the supposedly extended period. What happens to the extra premiums I paid ? All wasted ?

Really sorry if I'm asking very noob-ish questions.

Appreciate your time in explaining this to me and much thanks in advance.

1) we need to understand why is this happening in the first place. BNM has this mandatory sustainability stress test announced

HERE. Check it out

the bad news is this practice is also retrospectively applied to existing investment-linked plans. Since you are buying from GE, it is my territory.

An increase in premium

IS NOT EQUAL to an increase in insurance charge. It is merely a piece of advice to ask you to allocate more funds in order to let GE deduct the insurance charge per month. (it is called unit-linked or unit deduction rider for a reason).

Now, you have the options to

remain as it is or

increase premium or

reduce your benefits to allow the policy to sustain till its end of term. new plans signed after 1 July 2019 would not have the privilege to remain with the existing premium and are subject to

mandatory review of premium.

2) Yes. but still very much depends on the performance of the fund(s) selected. check your investment portfolio under the policy

3)

no need to wait till 71 years of age, GE will notify u via SMS, email, and snail-mail (remember to register all your info in eConnect) when you have a potential lapse date, u may check your annual statement. my advice to u, switch your portfolio to fixed income or balanced fund temporarily to safeguard your investments (switching is FOC)

Once, it is insufficient to sustain, you can do a

"single premium top-up" or a permanent increase in premium4) all money paid in premium will be first distributed to

(i) unallocated premium and (ii) allocated premium channels. the first channel is for agency-related expenses etc and the rest will go to the allocated premium channel. and all the received money will be used to acquire units in your selected fund, then GE will gradually deduct the cost of insurance expenses monthly from your fund account (aka total investment value). so to answer your question, your money is still in the investment account under your name, it won't be forfeited whatsoever.

In conclusion,if you are currently broke, stay as it is.

if you are ok with the increment in premium, reply to GE and adjust. it is much more beneficial in the long run.

Aug 9 2021, 06:59 PM

Aug 9 2021, 06:59 PM

Quote

Quote

0.0276sec

0.0276sec

0.54

0.54

7 queries

7 queries

GZIP Disabled

GZIP Disabled