QUOTE(watabakiu @ May 22 2024, 11:01 PM)

So how is hibah related to insurance? The way I see it is that I buy a hibah insurance, nominate a person that will receive it in the event that I die. The way I am making money is the difference between the premium paid, and the compensation received. Say premium is 1k/year, compensation is 10k. died-ed on second year, so the nominee will get 8k. Correct?

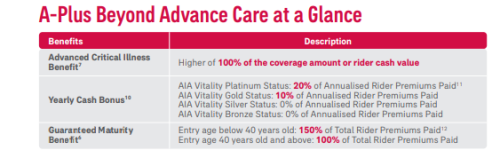

How Hibah is related to insurance? - Takaful is one of the way to leverage on to leave behind "hibah" to your loved ones. It cannot be challenged by any person or institution, making it a good instrument to guarantee your loved ones receive whatever amount you buy.

Why would someone use Takaful to hibah?

- because you can leave behind money that you haven't earned yet. You pay a fraction, but when death happens, takaful company will pay your family much higher lump sum than what you paid. e.g, you pay 1k/year, sum cover is 10k, so when you die, your nominee will get 10k as per agreed.

I wouldn't say any insurance is making money... cos when a person died, the family loss all the income possibility the person could earn if they still around.

So insurance is minimizing loss... not making money.

May 23 2024, 04:44 PM

May 23 2024, 04:44 PM

Quote

Quote

0.0303sec

0.0303sec

1.03

1.03

7 queries

7 queries

GZIP Disabled

GZIP Disabled