QUOTE(kuganes_g @ Apr 6 2025, 04:32 AM)

Hi peoples, i'd like to get some suggestions on my situation.

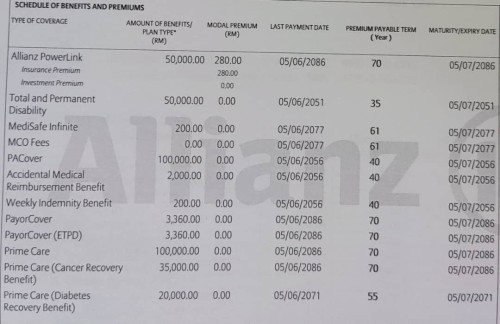

I'm currently 39, non-smoker, no prior claim, clean payment.

Have 200k debt (house & car), parents to care, intending to remain single.

Backstory

With that said, met with the new agent, and here's the options discussed.

1. maintain the same plan, don't accept repricing = 20 years

2. maintain the same plan, accept repricing (rm560 at year 5) = 24 years. Optional top up rm420. So rm980 in total to reach age 80

3. replace MediSafe Infinite - Plan 200 to HealthAssured, but sign new AssuredLink policy = rm380 while maintaining the rest as-is rm280. So rm660 in total to reach age 80

4. go look for other insurer

Honestly speaking i'm now feeling reluctant towards ILP.

But based on my limited online search, the offerings are more enticing than standalone.

So here i am, seeking your opinions on:

1. what are the recommended range i should be aiming for medical, pa, ci & life?

2. is what i have sign up worth to hold on now?

3. if yes, how better to navigate this repricing situation?

4. if not, what suggestions can you direct me to?

I sincerely thank you for your time reading, and i appreciate any response hereon!

if you are in good health, no brainer to sign up for new planI'm currently 39, non-smoker, no prior claim, clean payment.

Have 200k debt (house & car), parents to care, intending to remain single.

Backstory

» Click to show Spoiler - click again to hide... «

With that said, met with the new agent, and here's the options discussed.

1. maintain the same plan, don't accept repricing = 20 years

2. maintain the same plan, accept repricing (rm560 at year 5) = 24 years. Optional top up rm420. So rm980 in total to reach age 80

3. replace MediSafe Infinite - Plan 200 to HealthAssured, but sign new AssuredLink policy = rm380 while maintaining the rest as-is rm280. So rm660 in total to reach age 80

4. go look for other insurer

Honestly speaking i'm now feeling reluctant towards ILP.

But based on my limited online search, the offerings are more enticing than standalone.

So here i am, seeking your opinions on:

1. what are the recommended range i should be aiming for medical, pa, ci & life?

2. is what i have sign up worth to hold on now?

3. if yes, how better to navigate this repricing situation?

4. if not, what suggestions can you direct me to?

I sincerely thank you for your time reading, and i appreciate any response hereon!

Apr 9 2025, 10:46 AM

Apr 9 2025, 10:46 AM

Quote

Quote 0.0237sec

0.0237sec

0.64

0.64

7 queries

7 queries

GZIP Disabled

GZIP Disabled