Hi, Manu Secure & Manu Wealth a good insurance cum saving plan ?

Any pro can describe more?

Thanks

Insurance Talk V7!, Your one stop Insurance Discussion

Insurance Talk V7!, Your one stop Insurance Discussion

|

|

Mar 23 2021, 03:15 PM Mar 23 2021, 03:15 PM

Return to original view | Post

#1

|

Junior Member

157 posts Joined: Aug 2012 |

Hi, Manu Secure & Manu Wealth a good insurance cum saving plan ?

Any pro can describe more? Thanks |

|

|

|

|

|

Mar 23 2021, 03:57 PM Mar 23 2021, 03:57 PM

Return to original view | Post

#2

|

Junior Member

157 posts Joined: Aug 2012 |

high return saving plan bro

|

|

|

Mar 23 2021, 04:20 PM Mar 23 2021, 04:20 PM

Return to original view | Post

#3

|

Junior Member

157 posts Joined: Aug 2012 |

QUOTE(lifebalance @ Mar 23 2021, 04:16 PM) All insurance products are illustrated @ Low 2% and High 5% But this manu secure & manu wealth looks attractiveBear in mind that you're required to stay throughout the entire term of the saving plan (Ranges from 15 - 35 years) if you want to see at least 2 - 5% return otherwise you'll be getting less than that after deducting all the cost. If you're looking for liquidity then putting your money in insurance saving plan is not ideal.  |

|

|

Mar 23 2021, 05:52 PM Mar 23 2021, 05:52 PM

Return to original view | Post

#4

|

Junior Member

157 posts Joined: Aug 2012 |

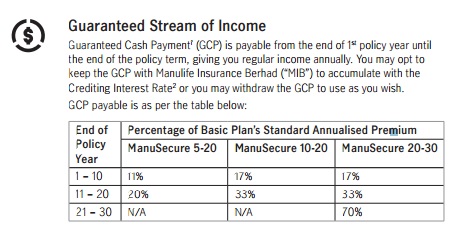

QUOTE(lifebalance @ Mar 23 2021, 04:51 PM) Do take note that this is payable based on the annualized premium, mean how ya?Here’s a quick example: If you purchased ManuSecure 5-20, you will receive payments equal to 11% of your basic plan’s standard annualised premium for the first ten policy years. With an annual premium of RM10,000, this GCP payment will amount to RM1,100 per year. This then increases to 20% – which amounts to RM2,000 a year – for the remaining ten years of the policy. Looks like you got it right Sure, feel free to ask example yearly RM10k for 5 years...then end of 20 years can get back how much? |

|

|

Mar 23 2021, 05:57 PM Mar 23 2021, 05:57 PM

Return to original view | Post

#5

|

Junior Member

157 posts Joined: Aug 2012 |

QUOTE(lifebalance @ Mar 23 2021, 04:51 PM) Do take note that this is payable based on the annualized premium, mean RM10,000 for 5 years then get back total RM31,000 interest?Here’s a quick example: If you purchased ManuSecure 5-20, you will receive payments equal to 11% of your basic plan’s standard annualised premium for the first ten policy years. With an annual premium of RM10,000, this GCP payment will amount to RM1,100 per year. This then increases to 20% – which amounts to RM2,000 a year – for the remaining ten years of the policy. Looks like you got it right Sure, feel free to ask |

|

|

Mar 24 2021, 10:49 AM Mar 24 2021, 10:49 AM

Return to original view | IPv6 | Post

#6

|

Junior Member

157 posts Joined: Aug 2012 |

Wonder how much medical + CI cost now?

How much Annual limit is good enough? |

|

|

|

|

|

Mar 24 2021, 11:16 AM Mar 24 2021, 11:16 AM

Return to original view | IPv6 | Post

#7

|

Junior Member

157 posts Joined: Aug 2012 |

QUOTE(lifebalance @ Mar 24 2021, 10:58 AM) Depends on the person's age, gender, occupation, smoker status and the benefits you're applying for. Start from 1mil? Roughly how much ya monthlyHow much annual limit is good enough ? It's a personal preference, insurance companies offers from RM25,000 Annually up to RM3,000,000 Annually. If you can secure somewhere at least RM500,000 Annually, that would be the average to cover most of the hospitalization cost. Most companies offer newer plans starting from RM1,000,000 Annually nowadays. |

|

|

Apr 16 2021, 09:27 AM Apr 16 2021, 09:27 AM

Return to original view | Post

#8

|

Junior Member

157 posts Joined: Aug 2012 |

|

|

|

Apr 16 2021, 09:38 AM Apr 16 2021, 09:38 AM

Return to original view | Post

#9

|

Junior Member

157 posts Joined: Aug 2012 |

QUOTE(lifebalance @ Apr 16 2021, 09:34 AM) This is the latest promo on the additional annual limit. This additional benefit will cease immediately if there are changes in the Room & Board or Co-Insurance Option after policy is issued ----> is that mean they will change in future to ammend back to the original annual limit?Quite okay if it's your first policy or coming from an old medical card with lower annual limit. Any better insurance can compare with this? |

| Change to: |  0.0264sec 0.0264sec

0.17 0.17

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 26th November 2025 - 01:18 PM |