QUOTE(TaiGoh @ Jan 31 2021, 08:19 PM)

Hi guys,

Currently holding a SmartProtect Essential with SmartMedic Xtra plan with Great Eastern since 2012. Thinking to spend some time to review the insurance plan that I bought because normally I just follow what insurance agent suggested.

Currently is 32 years old, working low risk job, non-smoker. Want to ask a few questions hope sifus here can clear my doubts:

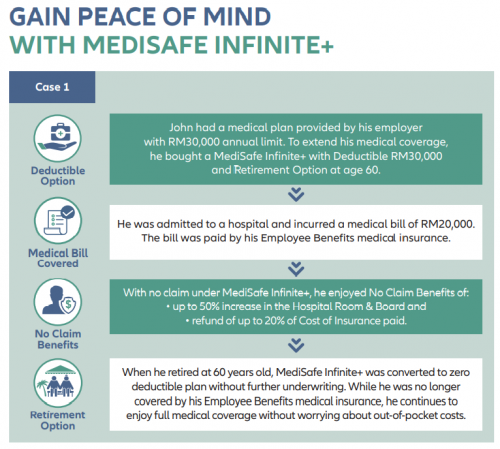

1. If my company provide a company medical card with 80k annual limit, is that okay to sign up for deductible plan with deductible 80k for example? I assume I can change plan in the future to non-deductible plan without issue right (For example when I retired)?

2. Just wondering is there a way we can 'DIY' to compare the plans offered by different companies, or we straight talk to agent and ask for quotation then compare?

3. Personally prefer Prudential or AIA over Great Eastern. Just wondering is that still worth to switch since I already holding a policy with Great Eastern? I assume the benefits, premium, and claiming process should be almost the same across these three companies right?

4. What is the recommended R&B, I assume RM150 will be too low and RM200 onwards should be acceptable right?

Thanks a lot!

You said u were having Smart Medic Xtra (SMX) series in 2012? 2012 we were still using Smart Medic (SM) only which 10% co-insurance. SMX was launched in year 2015-2016. Better check via E-connect. If u r holding SMX actually this plan not too bad. This plan without any co-insurance. Currently holding a SmartProtect Essential with SmartMedic Xtra plan with Great Eastern since 2012. Thinking to spend some time to review the insurance plan that I bought because normally I just follow what insurance agent suggested.

Currently is 32 years old, working low risk job, non-smoker. Want to ask a few questions hope sifus here can clear my doubts:

1. If my company provide a company medical card with 80k annual limit, is that okay to sign up for deductible plan with deductible 80k for example? I assume I can change plan in the future to non-deductible plan without issue right (For example when I retired)?

2. Just wondering is there a way we can 'DIY' to compare the plans offered by different companies, or we straight talk to agent and ask for quotation then compare?

3. Personally prefer Prudential or AIA over Great Eastern. Just wondering is that still worth to switch since I already holding a policy with Great Eastern? I assume the benefits, premium, and claiming process should be almost the same across these three companies right?

4. What is the recommended R&B, I assume RM150 will be too low and RM200 onwards should be acceptable right?

Thanks a lot!

Q1: If u downgrade the existing plan to a 60K or 90K, or 100K deductable amount then obviously ur premium can be as low as RM100/m. When u reach 60yo then u want a deductible plan, you need to undergo the underwriting process based on the current health. As age grow especially 60yo, be frank lots of exclusion and loading.

Q3: not worth bcoz u need to start paying commission to company A or P agent again. bcoz ur current policies has passed 9 years and 100% allocation. No more commission payout. another risk is the waiting period recalculated.

Cant comment on the preference of companies or agents. Can google and check which companies has higher assets and market position.

Feb 2 2021, 09:55 PM

Feb 2 2021, 09:55 PM

Quote

Quote

0.1620sec

0.1620sec

0.75

0.75

7 queries

7 queries

GZIP Disabled

GZIP Disabled