QUOTE(Ramjade @ Dec 8 2025, 01:29 PM)

Agent should told customer cannot use insurance until 2y old. Guess he or she conveniently forgot to mentioned that.

But how come the insurance company "instruct" him to claim?Insurance Talk V7!, Your one stop Insurance Discussion

|

|

Yesterday, 01:31 PM Yesterday, 01:31 PM

Show posts by this member only | IPv6 | Post

#7661

|

All Stars

14,891 posts Joined: Mar 2015 |

|

|

|

|

|

|

Yesterday, 01:33 PM Yesterday, 01:33 PM

Show posts by this member only | IPv6 | Post

#7662

|

All Stars

24,354 posts Joined: Feb 2011 |

QUOTE(MUM @ Dec 8 2025, 01:31 PM) My guess is they want to cancel his insurance. See if he commited fraud. Cause lots of people commited fraud by not declaring any illness before hand. Insurance companies never have your best interest at heart.Cause if he commited fraud, then no need to cover him anymore. Covering him means future losses for insurance company whenever he gets admitted and the bill goes up be due to high blood pressure side effects. This post has been edited by Ramjade: Yesterday, 01:38 PM |

|

|

Yesterday, 01:52 PM Yesterday, 01:52 PM

Show posts by this member only | IPv6 | Post

#7663

|

All Stars

14,891 posts Joined: Mar 2015 |

QUOTE(Ramjade @ Dec 8 2025, 01:33 PM) My guess is they want to cancel his insurance. See if he commited fraud. Cause lots of people commited fraud by not declaring any illness before hand. Insurance companies never have your best interest at heart. The insurance company can also investigate for "fraud" when he submit the claim for cancer treatment without the claim for hypertension treatment.Cause if he commited fraud, then no need to cover him anymore. Covering him means future losses for insurance company whenever he gets admitted and the bill goes up be due to high blood pressure side effects. Has he submitted any claims for that cancer treatment? ...now not on laptop, ..cannot see clearer |

|

|

Yesterday, 01:58 PM Yesterday, 01:58 PM

Show posts by this member only | IPv6 | Post

#7664

|

All Stars

24,354 posts Joined: Feb 2011 |

QUOTE(MUM @ Dec 8 2025, 01:52 PM) The insurance company can also investigate for "fraud" when he submit the claim for cancer treatment without the claim for hypertension treatment. Cancer was after the high blood pressure event. He used his insurance for his high blood pressure before the 2y up. As long as the high pressure thingy not resolve, insurance will refuse to cover anything after that.Has he submitted any claims for that cancer treatment? ...now not on laptop, ..cannot see clearer |

|

|

Yesterday, 02:21 PM Yesterday, 02:21 PM

|

All Stars

14,891 posts Joined: Mar 2015 |

QUOTE(Ramjade @ Dec 8 2025, 01:58 PM) Cancer was after the high blood pressure event. He used his insurance for his high blood pressure before the 2y up. As long as the high pressure thingy not resolve, insurance will refuse to cover anything after that. Then it is his fault for not doing what had been "instructed" to do.....he had been "instructed" to submit his claim for Hypertension.If he had done as instructed, I believes the Cancer claim will be looked into by the insurance claim. |

|

|

Yesterday, 02:21 PM Yesterday, 02:21 PM

|

Senior Member

803 posts Joined: Nov 2012 |

My current premium was 300 and received a letter from Allianz Life to increase by 10% for the next 5 years. I cant afford this premium increase and looking for alternatives. Should the alternative be me trying to work the existing coverage like reduction or removal to fit within the budget?

|

|

|

|

|

|

Yesterday, 02:29 PM Yesterday, 02:29 PM

|

All Stars

14,891 posts Joined: Mar 2015 |

QUOTE(OptimusStar @ Dec 8 2025, 02:21 PM) My current premium was 300 and received a letter from Allianz Life to increase by 10% for the next 5 years. I cant afford this premium increase and looking for alternatives. Should the alternative be me trying to work the existing coverage like reduction or removal to fit within the budget? Just a kay poh and unqualified comment.Amount of medical coverage to be covered are always the more the better as medical inflation will make the amount covered to be enough now may become so little in the next 40 yrs. Generally, I prefer medical coverage till at least 85 yrs old. But, .... all that would depends in what amount of budget I can afford to allocate (especially after retirement, no active income) for those good to hv "wants" This post has been edited by MUM: Yesterday, 02:30 PM |

|

|

Yesterday, 02:44 PM Yesterday, 02:44 PM

Show posts by this member only | IPv6 | Post

#7668

|

All Stars

24,354 posts Joined: Feb 2011 |

QUOTE(MUM @ Dec 8 2025, 02:21 PM) Then it is his fault for not doing what had been "instructed" to do.....he had been "instructed" to submit his claim for Hypertension. Have he been instructed? My quick read like he was not asked to submit that claims.If he had done as instructed, I believes the Cancer claim will be looked into by the insurance claim. QUOTE(OptimusStar @ Dec 8 2025, 02:21 PM) My current premium was 300 and received a letter from Allianz Life to increase by 10% for the next 5 years. I cant afford this premium increase and looking for alternatives. Should the alternative be me trying to work the existing coverage like reduction or removal to fit within the budget? You got only 3 choices.1. Reduce your coverage amount (room and board is tied to amount covered) 2. Don't pay, accept your reduce in duration of coverage. 3. Abandon allianz and buy standalone insurance. You can get cheap and good quality insurance with etiqa via online. But only if you are healthy. This post has been edited by Ramjade: Yesterday, 03:38 PM |

|

|

Yesterday, 02:49 PM Yesterday, 02:49 PM

|

Senior Member

3,633 posts Joined: Apr 2019 |

QUOTE(MUM @ Dec 8 2025, 02:29 PM) Just a kay poh and unqualified comment. the other thing is... take a look at the forecasted medical card fee for age above 70... usually it is in a schedule/table of the proposal...Amount of medical coverage to be covered are always the more the better as medical inflation will make the amount covered to be enough now may become so little in the next 40 yrs. Generally, I prefer medical coverage till at least 85 yrs old. But, .... all that would depends in what amount of budget I can afford to allocate (especially after retirement, no active income) for those good to hv "wants" I am not sure if by the time one reach that age, would one still want to continue paying... its like 20 to 30K rm pa of fees... |

|

|

Yesterday, 02:51 PM Yesterday, 02:51 PM

Show posts by this member only | IPv6 | Post

#7670

|

All Stars

14,891 posts Joined: Mar 2015 |

QUOTE(Ramjade @ Dec 8 2025, 02:44 PM) He had been instructed to submit the claim for Hypertension. (1st case)I guess, ....When he refused to follow that instructions for the 1st illness, ...I guess any subsequent claims for other illness will not be looked into. |

|

|

Yesterday, 02:58 PM Yesterday, 02:58 PM

Show posts by this member only | IPv6 | Post

#7671

|

All Stars

14,891 posts Joined: Mar 2015 |

QUOTE(Wedchar2912 @ Dec 8 2025, 02:49 PM) the other thing is... take a look at the forecasted medical card fee for age above 70... usually it is in a schedule/table of the proposal... I had a feeling, i estimated and prepared for an annual increase of at least 7% to the actual current premium paid. ( for ease of my own calculation, ...I budgeted a 10% yearly increase)I am not sure if by the time one reach that age, would one still want to continue paying... its like 20 to 30K rm pa of fees... In another thread, ... How to deal with medical insurance repricing? https://forum.lowyat.net/topic/5432101 Post 1 did hv some images of COI increased over a 9 yrs period Wedchar2912 liked this post

|

|

|

Yesterday, 03:11 PM Yesterday, 03:11 PM

Show posts by this member only | IPv6 | Post

#7672

|

Senior Member

3,633 posts Joined: Apr 2019 |

QUOTE(MUM @ Dec 8 2025, 02:58 PM) I had a feeling, i estimated and prepared for an annual increase of at least 7% to the actual current premium paid. ( for ease of my own calculation, ...I budgeted a 10% yearly increase) You are prudent... And the rest of us may need to use the same medical inflation rate of 10% like you.In another thread, ... How to deal with medical insurance repricing? https://forum.lowyat.net/topic/5432101 Post 1 did hv some images of COI increased over a 9 yrs period Like mine now is only around 2.4K pa (medical card portion). Using 10%, that's 24K pa after 25 years.... Looks about right... MUM liked this post

|

|

|

Yesterday, 03:37 PM Yesterday, 03:37 PM

Show posts by this member only | IPv6 | Post

#7673

|

All Stars

14,891 posts Joined: Mar 2015 |

Deleted

This post has been edited by MUM: Yesterday, 03:43 PM |

|

|

|

|

|

Yesterday, 03:41 PM Yesterday, 03:41 PM

Show posts by this member only | IPv6 | Post

#7674

|

All Stars

14,891 posts Joined: Mar 2015 |

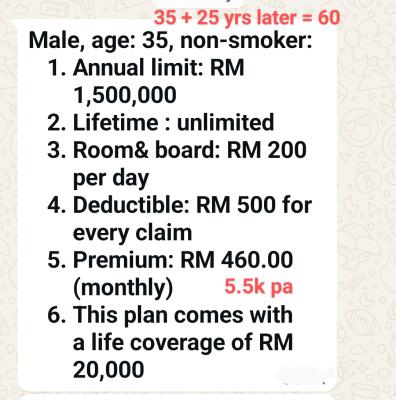

QUOTE(Wedchar2912 @ Dec 8 2025, 03:11 PM) You are prudent... And the rest of us may need to use the same medical inflation rate of 10% like you. From your calculation, 2.4k now@ 10% will be 24k at 25yrs later.Like mine now is only around 2.4K pa (medical card portion). Using 10%, that's 24K pa after 25 years.... Looks about right... Yesterday my Dim Sum kaki shared with me.... 5.5k now will be 55k at 60 yrs old.? That is not even reached 85 yrs old.... By then maybe 100k pa liao? That 1.5 million coverage with current purchasing power will became ?? K of amount of real purchasing power coverage after 45 yrs? (35 + 45 = 80 yrs old) This post has been edited by MUM: Yesterday, 03:43 PM Attached thumbnail(s)

|

|

|

Yesterday, 04:10 PM Yesterday, 04:10 PM

Show posts by this member only | IPv6 | Post

#7675

|

Senior Member

3,633 posts Joined: Apr 2019 |

QUOTE(MUM @ Dec 8 2025, 03:41 PM) From your calculation, 2.4k now@ 10% will be 24k at 25yrs later. Wah. I hope not 55K at 60yo. Like that really must pick a lower coverage to be able to afford for most people. Of course agents will never say this and still say get as much as one can afford Today.... Problem is one may have to cancel the coverage when one is old and needed the coverage most. (insurance firms themselves indicated the high inflation in their forecasting too) Yesterday my Dim Sum kaki shared with me.... 5.5k now will be 55k at 60 yrs old.? That is not even reached 85 yrs old.... By then maybe 100k pa liao? That 1.5 million coverage with current purchasing power will became ?? K of amount of real purchasing power coverage after 45 yrs? (35 + 45 = 80 yrs old) I like to use chicken rice as inflation gauge. Back in 2000, chicken rice was like 3 toppish. Now 9 toppish? So 3 times. So 1.5m coverage is like 500K coverage today. Still decent I think. Even divide by extra 2, that's 250K rm. Whatever it is, just want to share the advice someone once gave me: start working towards a bucket of say 1m rm for medical emergency self-coverage in case insurance firm create shenanigans like earlier story if delayed GL or payment etc. This post has been edited by Wedchar2912: Yesterday, 06:53 PM MUM liked this post

|

|

|

Today, 01:08 PM Today, 01:08 PM

|

Senior Member

1,323 posts Joined: Nov 2008 |

QUOTE(MUM @ Dec 8 2025, 11:36 AM) What do you think should be the next course of action for BOTH policy holder and insurance company to do if "assuming" the agent's (aka the "friend"), has left the industry or changed to another company or no more reachable by phone, etc ? Assuming the agent has left the industry, insurer will notify the insured via writing on the new servicing agent, highly likely to be the upline of the agent. The insured can then call up the new servicing agent to help him with his predicament. Assuming the agent can no longer be contacted, the insured can file a complaint to the insurer, and request to be assigned a new agent. It is easy for the customer to throw their frustrations at the new servicing agent (tu biasa, human nature). But after you're done, kindly proceed to establish a working relationship with the new servicing agent. He or she is there to help you as best they can. The service center will usually identify someone experienced, with a decent track record to take over the case. Again, I would like to clarify on the claims: Insurers are more worried about compliance than paying claims. Every single insurer shares the same concern. |

| Change to: |  0.0209sec 0.0209sec

0.78 0.78

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 9th December 2025 - 02:58 PM |