Hi, this is my current ILP plan. (Pic Attached)

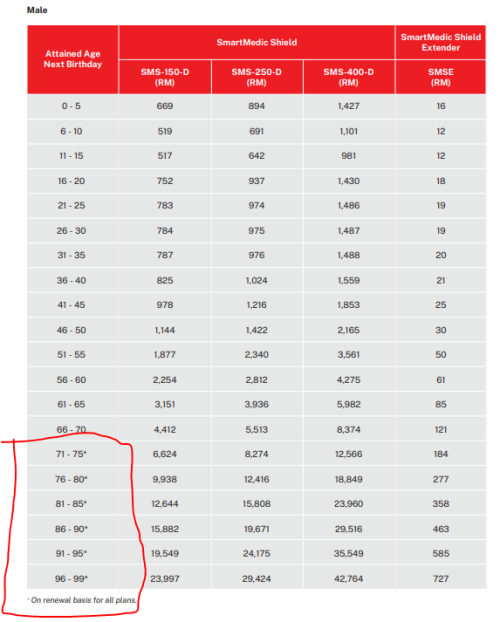

I'm thinking of increasing my Annual Limit on the Medical Card & adding Riders.

I'm speaking from a GE agent which i think i can give a better suggestion:-

1. If I wish to increase my Death/TPD or CI coverage, would it cost less to upgrade my current Rider or to buy a standalone Term Life Online Policy (until 80yrs coverage)?

2 different policies as term and ILP. More precise you need to do a cost of insurance comparison only can tell which one cheaper to go for instead of simply answer you. 2. Can I upgrade my current plan to the Smart Medic Million + Extender & upgrade my Riders, Without Underwriting again ?

You can upgrade it but MUST underwrite again. 3. Would it be better to collect my surrender value & change to Allianz Medisafe Infinite+, as it provides better additional benefits (20% NCB Discount & Traditional Medicine/2nd Opinion) OR should I just continue with Great Eastern because I've already paid the Agent's fee ?

You should continue with GE as u said paid for the commission and this SMX rider still a good medical plan, you just add in Smart Extender (SE), to make ur annual limit from RM144K to RM1.2mil annually. (get more advise from ur agent). By adding this SE, any admission still have SMX to go for.

4. A relative of mine has an AIA Excelife Whole Life Policy.

Is it possible to Withdraw the Cash Value & still maintain coverage by paying the premium annually ?

FYI, whole life has cash bonus not cash value (traditional plan). Yes, whole life can withdraw all the cash bonus and just pay the premium.

Cash value only for ILP plan. ILP only allow to withdraw certain amount of Cash Value but not all. All research so far says No, however, an Insurance Agent, said Yes. I'm wondering if he's confused Whole Life with ILP ?

Apologies for so many questions.

She/ he definitely confused. Thanks in advance, been researching Insurance for the past 3 days. I'm confident I can explain insurance policies better than 50% of Agents

<a href='https://pictr.com/images/2021/10/31/BVwdQ6.md.png' target='_blank'>https://pictr.com/images/2021/10/31/BVwdQ6.md.png

<a href='https://pictr.com/images/2021/10/31/BVwdQ6.md.png' target='_blank'>https://pictr.com/images/2021/10/31/BVwdQ6.md.png </a>

<a href='https://pictr.com/images/2021/10/31/BVwuDq.md.png' target='_blank'>https://pictr.com/images/2021/10/31/BVwuDq.md.png </a>

Oct 8 2021, 10:42 AM

Oct 8 2021, 10:42 AM

Quote

Quote

0.0361sec

0.0361sec

0.33

0.33

7 queries

7 queries

GZIP Disabled

GZIP Disabled