QUOTE(yklooi @ Aug 2 2021, 09:18 PM)

thanks for the explanation,...

in your example,...

Eg.

I bought a policy for my children.

I am the policy owner and the 1st party and will pay the yearly premium.

My children are the 3rd party.

The insurance co is the 2nd party who will pay a claim for any injury or medical claim.

The money goes to the policy owner and not the 3rd party.

(same situation i am having too...)

so in this case, can i pass this policy to my children when they are working while i am not?......some thing like mentioned "absolute assignment"?

Dear YK looi,in your example,...

Eg.

I bought a policy for my children.

I am the policy owner and the 1st party and will pay the yearly premium.

My children are the 3rd party.

The insurance co is the 2nd party who will pay a claim for any injury or medical claim.

The money goes to the policy owner and not the 3rd party.

(same situation i am having too...)

so in this case, can i pass this policy to my children when they are working while i am not?......some thing like mentioned "absolute assignment"?

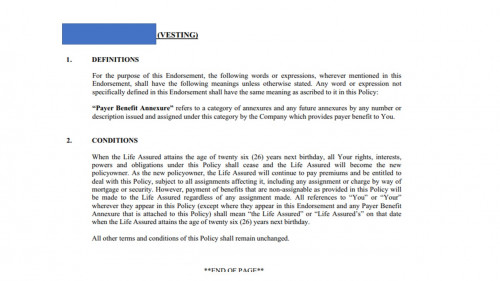

if talking about child policy. Your are the policy owner and ur child is the Life assured. in the policy contract we called it "Vesting Clause" when the child reaches 26yo where the payer benefit cease age. Read my print screen from policy contract.

is not done by "absolute assignment" but vesting clause.

Adult policy don't have this vesting clause only apply on child policy. refer my print screen for more information.

For wan tan mee's case, better refer to ur policy contract and find this statement "if the policy owner death, all her interest, power.. shall transfer to the life assured." Kindly read through the contract to clear ur doubts. Policy contract is much better than all the guessing here.

Aug 2 2021, 09:51 PM

Aug 2 2021, 09:51 PM

Quote

Quote 0.0239sec

0.0239sec

0.18

0.18

7 queries

7 queries

GZIP Disabled

GZIP Disabled