QUOTE(MUM @ Jan 16 2024, 12:20 PM)

Life Engineering was removed from the alert list when BNM realized that the program is not breaking any guideline for insurance and takaful products, because it's not in that category to begin with.

Thus it is not under the purview of BNM as it is not an insurance nor a takaful operator.

If shits happens, contact BNM or SSM or ??? To help resolves matters?

Likely BNM. Cause you cannot collect money form public without a license. If you do so like JJPTR, sure get raided and shut down.Thus it is not under the purview of BNM as it is not an insurance nor a takaful operator.

If shits happens, contact BNM or SSM or ??? To help resolves matters?

QUOTE(ronnie @ Jan 16 2024, 05:45 PM)

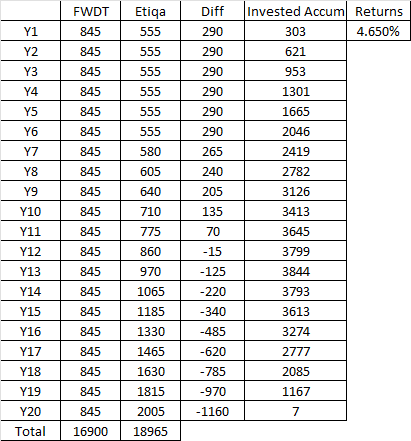

is this plan by Great Eastern any good ?

https://www.greateasternlife.com/my/en/pers...gen-wealth.html

Er I think you should know my answer. Come I show you a better way. Open interactive broker, dump in insurance premium that you would be paying for the plan above into S&P500. You will have better returns than whatever GE can cough up. And yes fractional shares are allowed by IBKR.https://www.greateasternlife.com/my/en/pers...gen-wealth.html

This post has been edited by Ramjade: Jan 16 2024, 05:55 PM

Jan 16 2024, 05:54 PM

Jan 16 2024, 05:54 PM

Quote

Quote

0.0571sec

0.0571sec

0.39

0.39

7 queries

7 queries

GZIP Disabled

GZIP Disabled