QUOTE(Altrost @ Oct 8 2025, 11:04 AM)

Hi all, continuing on the ILP discussion previously.. There's one more benefit I missed which is the option to have the "waiver" rider so the person insured can waive paying the premium after CI/Disability.

I also had a thought, wondering if it makes sense:

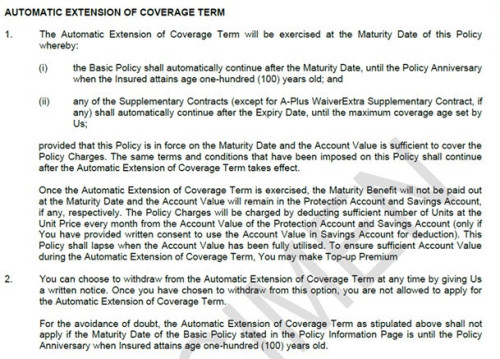

Since ILP won't lapse as long as there is enough cash value, isn't it possible to not follow the suggested premium?

Example:

Premium supposed to be 4K but actually Cost of Insurance is 1K

Mr X pays RM1.5K only (some extra for safety and cover fluctuations) and self invest the other 2.5K

This way Mr X can have ILP forementioned benefits but still invest (some of) his money himself.

Any thoughts?

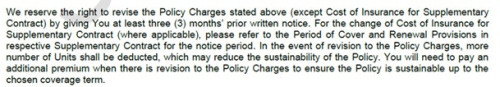

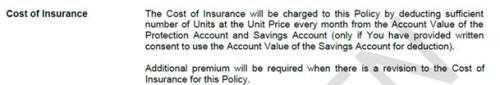

First we gta establish that there is cost of insurance (COI) involved and we gta keep in mind that the COI doesn't stay stagnant. It increases with age, for the sole reason that the risk factor increases as we age. This applies to every personal insurance product except for PA (yes, I am aware that insurers are trying their best to continue to either accept applicants past age 70 or allow to renew past age 70). I also had a thought, wondering if it makes sense:

Since ILP won't lapse as long as there is enough cash value, isn't it possible to not follow the suggested premium?

Example:

Premium supposed to be 4K but actually Cost of Insurance is 1K

Mr X pays RM1.5K only (some extra for safety and cover fluctuations) and self invest the other 2.5K

This way Mr X can have ILP forementioned benefits but still invest (some of) his money himself.

Any thoughts?

The waiver of premium is a great product, I would suggest it to all my customers who opt for the ILP structure.

Possible to not follow the suggested premium? Yes, ILP is a plan where the consumer has the most control. Well, you can't control the COI, but you can have control over how much you pay, how long you want the policy to sustain, and withdraw the fund values as you please.

Of course there are minimums that the insurance company can suggest for you to maintain. Even so, you can choose to ignore it as well, bearing the consequences lah.

You can even opt to pay the future premiums in advance.

That being said, here's my two cents lah:

I save and invest with objectives in mind. Education lah, house lah, car lah, fam vacays lah, etc.

Among my objectives, none of it includes "hopefully I have enough to pay the COI in the future".

None of my objectives involves anything that doesn't revolve around fun and my desires. I believe this is the same for a lot of people.

So for my ILP policies, I front-load it. Especially for my kid. I much prefer small tickets over the years, as opposed to constantly have to worry about something as trivial as the premiums and COI. Yes, the medical COI will rise, this is how I prepare for it.

Maybe it vibes with you, maybe it doesn't.

I am a second gen in the insurance business, my (father's) data tells me enough to shape my outlook and directions.

So I can spend my nights planning weekends, family dinners, gardening stuff, etc.

With that, I would like to again point out that that doesn't mean the ILP policies are gna solve all my problems.

Front-loading it takes my mind off having to worry about COI increases.

Then I have other concerns just like everybody here too. Hence I also have my own investments into other businesses, rent-seeking properties, dividend stocks, my self development, etc.

Got tenant problems or not? Memang ada

Got failed in side business? Memang, totally lost everything that I put into it. Learned very expensive lesson.

Am I ignorant about greater returns elsewhere?

Maybe I am, because as you can see, I am a rather risk-averse person from my past.

Perhaps you have your own experiences, and that's personal to you.

So then just get an insurance plan in the way that works for you, that you agree with.

Is the insurance company gna make some money from you? Semestinya. Without a doubt.

Come the question of insurance company fund performances vs investing on your own...

Insurance company funds cannot invest as they like or take chances like retail investors.

Even the equity funds are bound by clearly defined parameters, and meticulously followed.

But if all that is not for you, then its not for you, buy term and standalone plans and products.

Nobody is stopping you from investing on your own.

And if budget is an issue, let's work with the budget rather than forcing something through just because it "sounds better".

No such thing as better or worse.

If it fits, it fits. If it doesn't, then everybody also susah.

What's the point then?

This post has been edited by JIUHWEI: Oct 10 2025, 11:51 AM

Oct 9 2025, 11:29 AM

Oct 9 2025, 11:29 AM

Quote

Quote

0.0264sec

0.0264sec

0.24

0.24

7 queries

7 queries

GZIP Disabled

GZIP Disabled