Hi, Manu Secure & Manu Wealth a good insurance cum saving plan ?

Any pro can describe more?

Thanks

Insurance Talk V7!, Your one stop Insurance Discussion

Insurance Talk V7!, Your one stop Insurance Discussion

|

|

Mar 23 2021, 03:15 PM Mar 23 2021, 03:15 PM

|

Junior Member

157 posts Joined: Aug 2012 |

Hi, Manu Secure & Manu Wealth a good insurance cum saving plan ?

Any pro can describe more? Thanks |

|

|

|

|

|

Mar 23 2021, 03:19 PM Mar 23 2021, 03:19 PM

|

Senior Member

2,353 posts Joined: Apr 2009 |

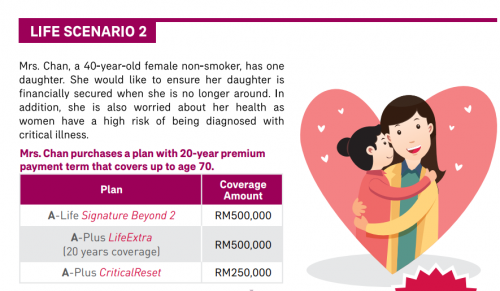

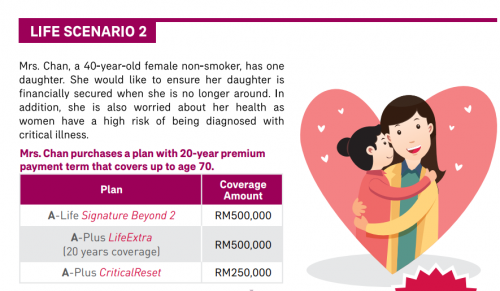

QUOTE(ckdenion @ Mar 23 2021, 02:54 PM) hi ragk, you can look on A-Plus Critical Reset details here.. Through the provided linked i found my planYou can opt to remove this rider. perhaps before you do so, review again your risk management needs. perhaps this CI payout will really benefit you. best to discuss with your agent and see will this benefit help. other than that, cant give much advise cuz I don't know much about your needs and situation. https://www.aia.com.my/content/dam/my/en/do...ct-brochure.pdf So my main plan doesn't cover critical illness... If that's the case im fine to maintain my CriticalReset plan... Thanks Just out of curiosity, im non-smoker, never admitted to hospital b4, bought my plan at 30 age the example cost in the brochure is way cheaper than mine (30 y/o 15.8k vs 40 y/o 9k), what cause the huge different here? Because my plan cover to 80 y/o? |

|

|

Mar 23 2021, 03:47 PM Mar 23 2021, 03:47 PM

|

Junior Member

474 posts Joined: Mar 2011 From: Kuala Lumpur |

QUOTE(ragk @ Mar 23 2021, 03:19 PM) Through the provided linked i found my plan Probably yes, as the example in the brochure is till age 70; whereas your extends till Age 80. The premium varies based on payment term and sum assured. I think you need to sit with your agent to better understand what you bought 😁.https://www.aia.com.my/content/dam/my/en/do...ct-brochure.pdf So my main plan doesn't cover critical illness... If that's the case im fine to maintain my CriticalReset plan... Thanks Just out of curiosity, im non-smoker, never admitted to hospital b4, bought my plan at 30 age the example cost in the brochure is way cheaper than mine (30 y/o 15.8k vs 40 y/o 9k), what cause the huge different here? Because my plan cover to 80 y/o? |

|

|

Mar 23 2021, 03:52 PM Mar 23 2021, 03:52 PM

|

All Stars

10,162 posts Joined: Nov 2014 |

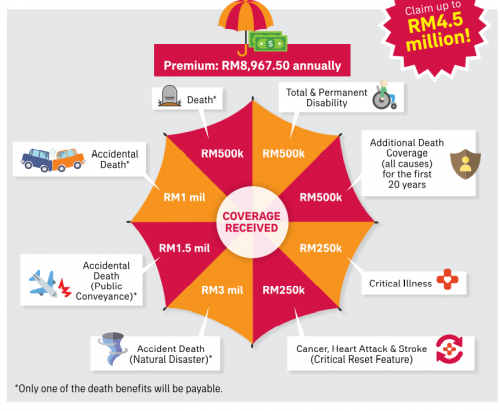

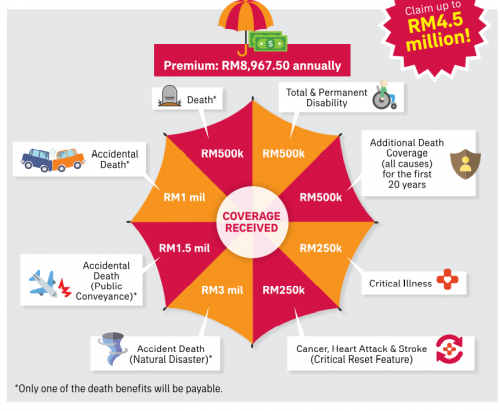

QUOTE(Macam Yes @ Mar 23 2021, 03:15 PM) What's your goal ?QUOTE(ragk @ Mar 23 2021, 03:19 PM) Through the provided linked i found my plan I don't think you understand what you've bought.https://www.aia.com.my/content/dam/my/en/do...ct-brochure.pdf So my main plan doesn't cover critical illness... If that's the case im fine to maintain my CriticalReset plan... Thanks Just out of curiosity, im non-smoker, never admitted to hospital b4, bought my plan at 30 age the example cost in the brochure is way cheaper than mine (30 y/o 15.8k vs 40 y/o 9k), what cause the huge different here? Because my plan cover to 80 y/o?   this is a clear cut illustration on the benefit's payout on the CriticalReset. any idea why you're not asking your agent to explain to you? |

|

|

Mar 23 2021, 03:57 PM Mar 23 2021, 03:57 PM

|

Junior Member

157 posts Joined: Aug 2012 |

high return saving plan bro

|

|

|

Mar 23 2021, 04:04 PM Mar 23 2021, 04:04 PM

Show posts by this member only | IPv6 | Post

#246

|

Senior Member

859 posts Joined: Feb 2008 |

QUOTE(ragk @ Mar 23 2021, 03:19 PM) Through the provided linked i found my plan ya same with others that point out , seems you not sure what you had bought.https://www.aia.com.my/content/dam/my/en/do...ct-brochure.pdf So my main plan doesn't cover critical illness... If that's the case im fine to maintain my CriticalReset plan... Thanks Just out of curiosity, im non-smoker, never admitted to hospital b4, bought my plan at 30 age the example cost in the brochure is way cheaper than mine (30 y/o 15.8k vs 40 y/o 9k), what cause the huge different here? Because my plan cover to 80 y/o? try to check coverage , sustainability/maturity , if got time best read the policy document although it is long. hope your servicing agent can explain to you as detail as possible. its better for you to understand it earlier rather than wait until paid for 10-20 years then only regretted. |

|

|

|

|

|

Mar 23 2021, 04:16 PM Mar 23 2021, 04:16 PM

|

All Stars

10,162 posts Joined: Nov 2014 |

QUOTE(Macam Yes @ Mar 23 2021, 03:58 PM) All insurance products are illustrated @ Low 2% and High 5%Bear in mind that you're required to stay throughout the entire term of the saving plan (Ranges from 15 - 35 years) if you want to see at least 2 - 5% return otherwise you'll be getting less than that after deducting all the cost. If you're looking for liquidity then putting your money in insurance saving plan is not ideal. |

|

|

Mar 23 2021, 04:20 PM Mar 23 2021, 04:20 PM

|

Junior Member

157 posts Joined: Aug 2012 |

QUOTE(lifebalance @ Mar 23 2021, 04:16 PM) All insurance products are illustrated @ Low 2% and High 5% But this manu secure & manu wealth looks attractiveBear in mind that you're required to stay throughout the entire term of the saving plan (Ranges from 15 - 35 years) if you want to see at least 2 - 5% return otherwise you'll be getting less than that after deducting all the cost. If you're looking for liquidity then putting your money in insurance saving plan is not ideal.  |

|

|

Mar 23 2021, 04:35 PM Mar 23 2021, 04:35 PM

|

Senior Member

2,353 posts Joined: Apr 2009 |

QUOTE(lifebalance @ Mar 23 2021, 03:52 PM)   this is a clear cut illustration on the benefit's payout on the CriticalReset. any idea why you're not asking your agent to explain to you? i tot my plan is A-Life Signature (Accident + Death + disablility + CI) + CriticalReset (Reset only), but actually is A-Life Signature (Accident + Death + disablility ) + CriticalReset (Reset + CI) usually i like to ask around, whos know what she might hiding from me, and also getting different opinion from diff ppl often giving new insight This post has been edited by ragk: Mar 23 2021, 04:42 PM |

|

|

Mar 23 2021, 04:51 PM Mar 23 2021, 04:51 PM

|

All Stars

10,162 posts Joined: Nov 2014 |

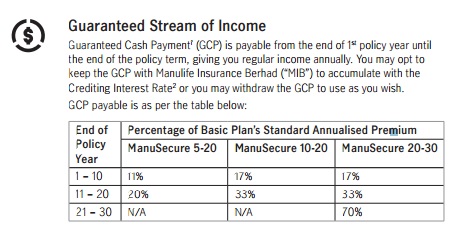

QUOTE(Macam Yes @ Mar 23 2021, 04:20 PM) Do take note that this is payable based on the annualized premium, Here’s a quick example: If you purchased ManuSecure 5-20, you will receive payments equal to 11% of your basic plan’s standard annualised premium for the first ten policy years. With an annual premium of RM10,000, this GCP payment will amount to RM1,100 per year. This then increases to 20% – which amounts to RM2,000 a year – for the remaining ten years of the policy. QUOTE(ragk @ Mar 23 2021, 04:35 PM) I know i have CI coverage, but misunderstood on the combination Looks like you got it right i tot my plan is A-Life Signature (Accident + Death + disablility + CI) + CriticalReset (Reset only), but actually is A-Life Signature (Accident + Death + disablility ) + CriticalReset (Reset + CI) usually i like to ask around, whos know what she might hiding from me, and also getting different opinion from diff ppl often giving new insight Sure, feel free to ask |

|

|

Mar 23 2021, 05:06 PM Mar 23 2021, 05:06 PM

|

|

Staff

25,802 posts Joined: Jan 2003 From: Penang |

Saving plan guaranteed cash back is not like FD interest rate.

Cash back /= your net return/profit/interest. A portion of cash back amount may come from your own premium paid, cash back amount is not net total interest/return earned. Please distinguish properly between cash back vs return rate. |

|

|

Mar 23 2021, 05:52 PM Mar 23 2021, 05:52 PM

|

Junior Member

157 posts Joined: Aug 2012 |

QUOTE(lifebalance @ Mar 23 2021, 04:51 PM) Do take note that this is payable based on the annualized premium, mean how ya?Here’s a quick example: If you purchased ManuSecure 5-20, you will receive payments equal to 11% of your basic plan’s standard annualised premium for the first ten policy years. With an annual premium of RM10,000, this GCP payment will amount to RM1,100 per year. This then increases to 20% – which amounts to RM2,000 a year – for the remaining ten years of the policy. Looks like you got it right Sure, feel free to ask example yearly RM10k for 5 years...then end of 20 years can get back how much? |

|

|

Mar 23 2021, 05:57 PM Mar 23 2021, 05:57 PM

|

Junior Member

157 posts Joined: Aug 2012 |

QUOTE(lifebalance @ Mar 23 2021, 04:51 PM) Do take note that this is payable based on the annualized premium, mean RM10,000 for 5 years then get back total RM31,000 interest?Here’s a quick example: If you purchased ManuSecure 5-20, you will receive payments equal to 11% of your basic plan’s standard annualised premium for the first ten policy years. With an annual premium of RM10,000, this GCP payment will amount to RM1,100 per year. This then increases to 20% – which amounts to RM2,000 a year – for the remaining ten years of the policy. Looks like you got it right Sure, feel free to ask |

|

|

|

|

|

Mar 23 2021, 11:04 PM Mar 23 2021, 11:04 PM

|

Junior Member

35 posts Joined: Feb 2012 |

QUOTE(ragk @ Mar 23 2021, 04:35 PM) I know i have CI coverage, but misunderstood on the combination ragk,i tot my plan is A-Life Signature (Accident + Death + disablility + CI) + CriticalReset (Reset only), but actually is A-Life Signature (Accident + Death + disablility ) + CriticalReset (Reset + CI) usually i like to ask around, whos know what she might hiding from me, and also getting different opinion from diff ppl often giving new insight If only A-Life Signature basic sum assured (BSA), it only cover death and total permanent disability. It also provide indemnity of BSA x2, x3, x4 or x6 for accidental death, public transport accidental death, oversea accidental death and natural disaster accidental death if I'm not mistaken. NO personal accident (PA) nor accidental medical reimburse coverage. CriticalReset rider cover 39 CI. It also has a Reset feature that restores the coverage back to 100% after 3 years from the date of diagnosis of a critical illness or covered surgery in which the rider coverage amount is fully claimed. The restored coverage amount will only be payable upon Stroke, Cancer or Heart Attack, hereafter the coverage shall terminate. |

|

|

Mar 23 2021, 11:32 PM Mar 23 2021, 11:32 PM

Show posts by this member only | IPv6 | Post

#255

|

Senior Member

2,866 posts Joined: Sep 2008 From: Wangsa Maju, KL |

QUOTE(ragk @ Mar 23 2021, 03:19 PM) » Click to show Spoiler - click again to hide... « 1. payment term. how long is your payment term btw? the illustration inside is 20 years payment term. 2. coverage term. your coverage term is 80y/o vs illustration 70 y/o 3. funds selection. not sure what are the funds used in the illustration, but normally for investment-linked policies, if higher risk funds are selected, premium will be lowered compared to lower risk funds. if you dont mind to review your plan details (benefits, payment term, coverage term and etc), then it gives clearer picture. likely you are also paying more to "save" aside more to build up the account value. |

|

|

Mar 23 2021, 11:39 PM Mar 23 2021, 11:39 PM

Show posts by this member only | IPv6 | Post

#256

|

Senior Member

2,866 posts Joined: Sep 2008 From: Wangsa Maju, KL |

|

|

|

Mar 24 2021, 10:49 AM Mar 24 2021, 10:49 AM

Show posts by this member only | IPv6 | Post

#257

|

Junior Member

157 posts Joined: Aug 2012 |

Wonder how much medical + CI cost now?

How much Annual limit is good enough? |

|

|

Mar 24 2021, 10:58 AM Mar 24 2021, 10:58 AM

|

All Stars

10,162 posts Joined: Nov 2014 |

QUOTE(Macam Yes @ Mar 24 2021, 10:49 AM) Depends on the person's age, gender, occupation, smoker status and the benefits you're applying for.How much annual limit is good enough ? It's a personal preference, insurance companies offers from RM25,000 Annually up to RM3,000,000 Annually. If you can secure somewhere at least RM500,000 Annually, that would be the average to cover most of the hospitalization cost. Most companies offer newer plans starting from RM1,000,000 Annually nowadays. |

|

|

Mar 24 2021, 11:16 AM Mar 24 2021, 11:16 AM

Show posts by this member only | IPv6 | Post

#259

|

Junior Member

157 posts Joined: Aug 2012 |

QUOTE(lifebalance @ Mar 24 2021, 10:58 AM) Depends on the person's age, gender, occupation, smoker status and the benefits you're applying for. Start from 1mil? Roughly how much ya monthlyHow much annual limit is good enough ? It's a personal preference, insurance companies offers from RM25,000 Annually up to RM3,000,000 Annually. If you can secure somewhere at least RM500,000 Annually, that would be the average to cover most of the hospitalization cost. Most companies offer newer plans starting from RM1,000,000 Annually nowadays. |

|

|

Mar 24 2021, 11:42 AM Mar 24 2021, 11:42 AM

Show posts by this member only | IPv6 | Post

#260

|

Junior Member

685 posts Joined: Jul 2012 From: Kuala Lumpur |

|

| Change to: |  0.0182sec 0.0182sec

0.82 0.82

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 2nd December 2025 - 02:29 PM |