Outline ·

[ Standard ] ·

Linear+

Insurance Talk V7!, Your one stop Insurance Discussion

|

gedebe

|

Feb 2 2024, 03:28 AM Feb 2 2024, 03:28 AM

|

|

I am about to buy Aia ILP medical insurance since after surveying, it looks like it has the least premium increase among the big insurance company in M'sia though our sampling is rather small.

Also, GE has offered us double the insure amount albeit a little higher premium compare to Aia, but I heard bad things about Ge claims

|

|

|

|

|

|

gedebe

|

Feb 3 2024, 04:32 PM Feb 3 2024, 04:32 PM

|

|

QUOTE(adele123 @ Feb 3 2024, 07:40 AM) Please dont do that. that's not a buying decision i support. it's NOT advisable to surrender your current policy and buy a new one. you already paid alot of initial charges in your previous policy. what plan do you have now? i have said this many many times, go back to your existing policy if it's an ILP, ask for changing your current medical rider to a new one if you dont have too much long-term health problem. can you roughly let me know what's your current policy like? standalone or ILP? and medical coverage on room&board amount and annual limit? do you have other important riders like critical illness? I am buying for my kids |

|

|

|

|

|

gedebe

|

Feb 3 2024, 04:36 PM Feb 3 2024, 04:36 PM

|

|

is it an offence if an agent claimed that my premium won't increase until 70 due to sustainability when in face there will be hiking due to increase of age esp. when old and even inflation

|

|

|

|

|

|

gedebe

|

Feb 3 2024, 06:05 PM Feb 3 2024, 06:05 PM

|

|

QUOTE(Ramjade @ Feb 3 2024, 04:38 PM) There is already a clause that say premiums are not guaranteed and can be increased any time with notice from the company. Agents can tell you all sort of stuff. Remember their goal is try to get you to buy from them. That is why look for agent that don't push stuff. This is very important. QUOTE(contestchris @ Feb 3 2024, 04:39 PM) Increase in insurance charges for age is accounted for in your initial premium. It's there in the PDS and SI. However increase for medical repricing is not accounted for (which factors in medical inflation, claims experience etc) means that it is not a offence if an agent say that my medical ILP premium can last until 70? |

|

|

|

|

|

gedebe

|

Feb 4 2024, 12:26 AM Feb 4 2024, 12:26 AM

|

|

QUOTE(Ramjade @ Feb 3 2024, 06:17 PM) All ILP will have a sustainable table with 2% and 5% return and until how many years you are covered. Projected. It's projected. It's not guaranteed. You can tweak the amount by increasing or decreasing your premium. You can pay the minimum recommended premium or increase above recommended premium to increase chances of sustainability can be achieved. Eg. Agent counted estimated premium come up to RM3k/year. You can choose to pay RM4k instead of RM3k the contention is that my agent say my premium won't increase up till the age of 70 so this is not wrong? Only later i learned that hike is due to inflation and steep increase due to aging? |

|

|

|

|

|

gedebe

|

Feb 4 2024, 03:20 AM Feb 4 2024, 03:20 AM

|

|

QUOTE(Ramjade @ Feb 4 2024, 12:48 AM) Ask agent for official black and white that premium won't increase. Agent which tell you premium won't increase is BS you. That's how they sell stuff. You yourself already see first hand here few people here their premium keep going up. Yes there are some insurance that premium is fixed. Unfortunately that is not for medical insurance. You need to understand how ILP works. It is you paying the insurance company some money to invest on your behalf. Regardless of how the investment is performing they get paid annual fees via the fund. The hope is that it will come a time that the investment is large enough to pay for the insurance itself (in theory but in reality it won't happen, well it can happen if like I said you put in more than required as stated in the previous example that. How much extra need to put in, don't know.). Yes hope. So if the investment returns can pay for the insurance itself, yes your premium is stable. Also any agent that tell you that ILP have cash value. They are not telling you the full story. They are telling you half of it. Or else it won't sell. Some way down the road, yes the ILP will have cash value. But say at 70-80 years old, cash value is negative and at best zero. Do not expect to have cash value from your ILP. Cannot tell full story or else no one want to buy ILP. People always like the concept that always have something left over. That's why when my agent tells me that, I was like wow you are the first which tell me this (no cash value in ILP at the end). For me very easy. Find what you want to buy be it ILP or standalone. Be prepared and pay for it. Be prepared for premium hikes. Plan for it. Create buffer for it. Don't over protect. Protect just enough. Don't get tempted by insurance agent I intend to complain the agent to the insurance company and BNM for misguiding me on no premium increase until 70 YO. |

|

|

|

|

|

gedebe

|

Feb 4 2024, 11:34 AM Feb 4 2024, 11:34 AM

|

|

QUOTE(MUM @ Feb 4 2024, 07:09 AM) Jfyi, Decades ago, I was sold a plan that mentioned that I need to pay only 12 yrs then can stop paying....I am still required to pay for it till now. After some digging, it turned out, I can stop after 12 yrs, but the policy may not sustain itself to the duration of my liking. The almost similar wordings used in the letters from for my other plans during each premium increases QUOTE(Ramjade @ Feb 4 2024, 09:41 AM) Well you will need evidence. Either voice recording or black and white documentations. Cause no proof it is just hearsay. I have meet those agents before in my early days of insurance shopping when I was out looking for medical insurance. They told me that there will not be increase in premium if I buy ILP. Lucky for me I already did research before hand by browsing reddit and lowyat. Subsequently meet a few which tell me the truth. Do not expect any cash value out of your ILP. I have whatsapp conversation although it was like 2018 |

|

|

|

|

|

gedebe

|

Feb 4 2024, 11:38 AM Feb 4 2024, 11:38 AM

|

|

Guys, those who are interested in the new practice by Manulfe ncd might want to be informed that ncd deduction does not involve our final premium that we have to pay. The ncd is actually not like motor ncd where it will deduct the final premium. See attachment This post has been edited by gedebe: Feb 4 2024, 11:38 AM Attached File(s) NCD.pdf

NCD.pdf ( 966.26k )

Number of downloads: 10 |

|

|

|

|

|

gedebe

|

Feb 4 2024, 11:54 AM Feb 4 2024, 11:54 AM

|

|

QUOTE(MUM @ Feb 4 2024, 11:43 AM) Just saw this... https://www.google.com/url?sa=t&source=web&...5Sxke-nOqqzym6IAre what apps conversations or video recordings be termed as sales illustration? Buyers had been given the look free period to do all the reviews of the legal contracts... You may use that WhatsApp conversation to make a case with the company regarding that agent....for possible mis-selling. hmm, in that case, i can only argue that agent tried to mislead me to get sale! This post has been edited by gedebe: Feb 4 2024, 11:55 AM |

|

|

|

|

|

gedebe

|

Feb 4 2024, 12:24 PM Feb 4 2024, 12:24 PM

|

|

QUOTE(MUM @ Feb 4 2024, 12:06 PM) Yes, if only what is written in that WhatsApp is clear for both what is asked and replied. Just an example,... For my earlier mentioned pay 12 yrs no need to pay anymore issue. If I were to ask, "so I need to pay fir 12 yrs only? The "yes" no need to pay anymore answers in the whatsapp may not includes full details like in the attached image. Whatsapps conversation are usually short and fast thus may obmit alot of info spelled out in the policy contract thanks for all those important info, I inferred that you did not achieve what you want after making the complaint due to the fact that the onus lies on the buyer to read the policy rather than just getting advice from agent. So why we need agent who can mislead us and still get away, I wonder! |

|

|

|

|

|

gedebe

|

Feb 4 2024, 12:34 PM Feb 4 2024, 12:34 PM

|

|

QUOTE(MUM @ Feb 4 2024, 12:29 PM) Bcos not all insurance plans can be bought online DIY. I wanna an insurance agent! |

|

|

|

|

|

gedebe

|

Feb 4 2024, 05:12 PM Feb 4 2024, 05:12 PM

|

|

QUOTE(MUM @ Feb 4 2024, 12:37 PM) Good, ...as you knew alot more than many people. After having taken all necessary exams and also beware of what you communicates to your clients and potential clients ... You could be called to explain your communications but when agent can say anything but Piam guideline put the onus on customer to understand the policy, this not fair, Piam of course will defend agent. Is the guideline by Piam approved by BNM? |

|

|

|

|

|

gedebe

|

Feb 5 2024, 12:08 AM Feb 5 2024, 12:08 AM

|

|

QUOTE(MUM @ Feb 4 2024, 05:54 PM) That is why they hv that "Free look" period established. And also established channels for customers to voice out dissatisfaction and seek resolve to issues. so are we just confine to the Piam guideline or do we have our right when dealing with agent who mislead. for you case, you loose right, no bad intention here, just want to see how far do our consumer rights go in this bolehland. |

|

|

|

|

|

gedebe

|

Feb 10 2024, 02:53 AM Feb 10 2024, 02:53 AM

|

|

I have an example of a insured person from my agent, who standalone medical policy rose from rm1927.08 (age 52) to rm4231.24 (age 61). She claim that the sharp increase was due to the standalone nature and inferring that using a ILP will slow down the sharp increase.

|

|

|

|

|

|

gedebe

|

Feb 16 2024, 02:45 AM Feb 16 2024, 02:45 AM

|

|

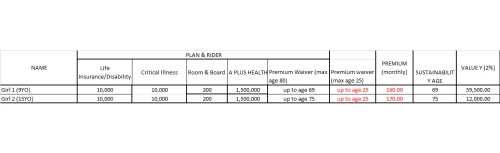

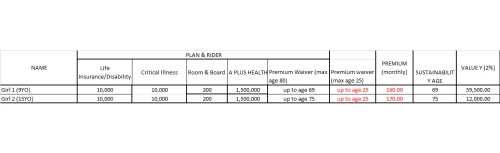

QUOTE(ycs @ Feb 15 2024, 01:54 PM) got AIA quote; is the comparison correct? investment link only slightly more expensive than standalone?  I am also looking at buying from AIA ILP medical for my children which are still young, it looks like yours is much more cheaper  This post has been edited by gedebe: Feb 16 2024, 02:46 AM This post has been edited by gedebe: Feb 16 2024, 02:46 AM |

|

|

|

|

|

gedebe

|

Feb 22 2024, 04:28 AM Feb 22 2024, 04:28 AM

|

|

what if a person miss to inform insurance about and pre existing condition but later honestly report the case to the insurance?

My logic says that insurance has the right to cancel it but is there a possibility that the insurance ask to underwrite the case again

|

|

|

|

|

Feb 2 2024, 03:28 AM

Feb 2 2024, 03:28 AM

Quote

Quote

0.0265sec

0.0265sec

0.41

0.41

7 queries

7 queries

GZIP Disabled

GZIP Disabled