QUOTE(db07mufan @ Nov 1 2021, 10:16 PM)

Just submit form to HLA. Dont need agent. LolInsurance Talk V7!, Your one stop Insurance Discussion

Insurance Talk V7!, Your one stop Insurance Discussion

|

|

Nov 2 2021, 04:00 PM Nov 2 2021, 04:00 PM

Return to original view | Post

#21

|

Senior Member

4,724 posts Joined: Jul 2013 |

|

|

|

|

|

|

Nov 3 2021, 09:03 PM Nov 3 2021, 09:03 PM

Return to original view | Post

#22

|

Senior Member

4,724 posts Joined: Jul 2013 |

QUOTE(EDD-ed @ Nov 3 2021, 05:01 PM) Am I right to believe that this policy will Pay the Higher of : hmmm how come i can't open?A)Face Value OR B)Surrender Value How does Converting into Fully Paid-up or Extended Term-Life work ? Thanks try my best to explain Fully Paid up vs Extended Term-Life Full Paid up means, if you stop paying now, what coverage amount will you enjoy until age 100 (if your original is also age 100) so if your coverage now is RM100k, depending on the factor applicable, if you paid up now, maybe is RM40,000 until age 100 Extended Term Life means, if you stop paying now, how long will the RM100k last (instead of age 100), maybe until age 50. Agak-agak ya. need to read the policy. i forgot where is mine, i also buy similar plan but different company note that after any of these 2 action, no more frill benefits. just death/TPD coverage. JIUHWEI liked this post

|

|

|

Nov 4 2021, 10:30 PM Nov 4 2021, 10:30 PM

Return to original view | Post

#23

|

Senior Member

4,724 posts Joined: Jul 2013 |

QUOTE(Deathscythe@@ @ Nov 4 2021, 06:58 PM) Hi, my mother medical card recently price hike from rm248 to rm404 . Age 61. Coverage 100k and room and board rm150. Any advise to cancel and find a new policy? The price hike seems too much while the coverage unchanged. Are you able to pay first rm5000 or rm10000 on your own if your mother needs to use the medical card? If yes, buying medical plan with deductible will be helpful in reducing insurance cost. Policy bought year 2016. Never claim before and no long term illness etc. I wanted to buy lonpac for my mother but my mother age >65 already. Was not successful. Once hit >60, really not easy to swallow the insurance cost. Buying plans with coinsurance and deductible will help slightly. Do it when your mother still young. Buy first, dont cancel so fast. Later kena reject, very sakit. |

|

|

Nov 11 2021, 07:51 AM Nov 11 2021, 07:51 AM

Return to original view | IPv6 | Post

#24

|

Senior Member

4,724 posts Joined: Jul 2013 |

QUOTE(makantido @ Nov 10 2021, 02:17 PM) I recently bought etiqa life insurance 500k online. If you want no frills can consider. Price increase as you grow older. My age cost round 400 a year. Really value for money. But if want more canggih, best to have agent quote then. JIUHWEI liked this post

|

|

|

Nov 18 2021, 08:40 AM Nov 18 2021, 08:40 AM

Return to original view | IPv6 | Post

#25

|

Senior Member

4,724 posts Joined: Jul 2013 |

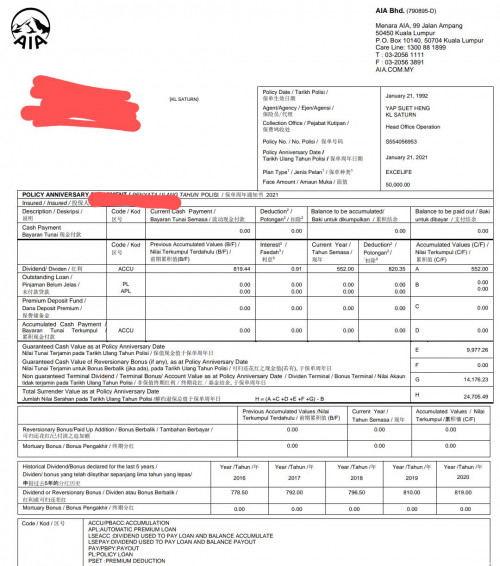

QUOTE(EDD-ed @ Nov 18 2021, 01:40 AM) So, if I surrender the policy now, I get paid the Surrender Value. If not mistaken should be face value + surrender value minus the guaranteed cash value. I dunno what product is this but educated guess. Should be not far off.& in the event of a Death Claim, my next of kin, will get Surrender Value + Insured Value (Face Value). Correct ? Seems too good to be true  |

|

|

Dec 22 2021, 01:53 PM Dec 22 2021, 01:53 PM

Return to original view | Post

#26

|

Senior Member

4,724 posts Joined: Jul 2013 |

QUOTE(CoolStoryWriter @ Dec 22 2021, 12:21 PM) Okay hmm but is the 200k important? Depends on a lot of factors wo. Your spouse earning capability if something happen to you. Kids? Other commitment? Imagine house can settle with the MRTA...then got extra cash of 200kk... Do I still need another 200k? That's 400k, what determines I need only 200k and not 400k? Different people different circumstances. Extreme example, if today no money to buy food to feed youself already, then buying insurance that takes up a huge portion of your salary is also not helpful. This post has been edited by adele123: Dec 22 2021, 01:53 PM |

|

|

|

|

|

Feb 18 2022, 09:21 AM Feb 18 2022, 09:21 AM

Return to original view | Post

#27

|

Senior Member

4,724 posts Joined: Jul 2013 |

QUOTE(daniel_g888 @ Feb 17 2022, 03:51 PM) 1) actually, what i worry is whether when the agent quote you for prudential, is it upgrade on existing policy or ask you buy new policy. anyway, gut feel also, i dont think upgrade is as cheap as you think because your age increase, many things increase. it is not like you can add RM10 and move on la. maybe really is upgrade, just become more $ because the new pru plan is more expensive or prudential stupid, make it expensive for you to upgrade. 2) the plan says pruvalue but you say GE? i would suggest pester the prudential agent abit on the upgrade and see what you get. This post has been edited by adele123: Feb 18 2022, 09:22 AM |

|

|

Mar 10 2022, 11:38 PM Mar 10 2022, 11:38 PM

Return to original view | Post

#28

|

Senior Member

4,724 posts Joined: Jul 2013 |

QUOTE(Nescafe321 @ Mar 10 2022, 08:15 PM) for the GE investment link policy, can i just self lumsump top up the money to increase the total unit of fund? Yes. (Answering as a general sense not because i know GE very well. Almost a crime if they dont let you top up lump sum. Just keep in mind lumpsum top up of course dont allow credit card payment ya) |

|

|

Mar 10 2022, 11:42 PM Mar 10 2022, 11:42 PM

Return to original view | Post

#29

|

Senior Member

4,724 posts Joined: Jul 2013 |

QUOTE(telurhilang @ Mar 8 2022, 05:55 PM) Thanks a lot for the input. Maybe just get 2 or 3 quote agent you. Getting one plan for entire family gonna be slightly cheaper than getting one plan for each of you. Just that got some minor downside because family plan like medik famili probably covers your kid until certain age only and generally means the limit are shared. Ok, no worries I do understand this is just an estimate. 5-6k year sound reasonable and within budget. Any suggestion which insurance plan can suit this? I'm thinking something like AIA A-Life Medik Famili But when they become old enough, just kick them and ask them buy for themselves. Hahaha. Then you save some money la. Get something with low deductible like 300 500 to keep your cost lower. |

|

|

Mar 24 2022, 09:39 AM Mar 24 2022, 09:39 AM

Return to original view | Post

#30

|

Senior Member

4,724 posts Joined: Jul 2013 |

QUOTE(onthefly @ Mar 24 2022, 02:02 AM) Is it only one so far? if only one company increase, one would naturally that the affected company's investment portion is bad or companies had lots of claim made, creating unbalance sustainability. Bank Negara does look into these issues quite seriously. truth be told, the real reason of claim is purely just medical inflation. nothing that "serious" per seIs it correct to think in that sense ? If your teh tarik price increase from RM2.70 to RM3, then same goes to Medical Supplies also. every year, there will be at least one company doing medical repricing. it's a cycle. Is there anything you can do to avoid this? No, not really. just like you can't avoid the teh tarik price increased to RM3. Is there anything customers can do to mitigate the effects? well, you sort-of can, buy medical plans with deductible or Co-insurance. In theory, those plans are cheaper. so even if increase 30% or 50%, it's still 30% and 50% of a smaller number. My own medical plan also increase price even though deductible 15,000. This post has been edited by adele123: Mar 24 2022, 09:40 AM JIUHWEI liked this post

|

|

|

Mar 24 2022, 05:46 PM Mar 24 2022, 05:46 PM

Return to original view | Post

#31

|

Senior Member

4,724 posts Joined: Jul 2013 |

lifebalance

Yes you are right. If there is a claim. I lazy quote the original long message. I did highlight that there is almost nothing most customers can do, just like the teh tarik. Co-insurance plan and deductible plan has been proven methods to help insurance companies contain claims. So similarly it will be lesser repricing impact also. This one you also should know. But i didnt highlight in my post. That's why i say "sort-of" customer can do something about it. But not really. It's reduce impact only. Actually alot of ppl can indeed pay the deductible if something happen to them. But just not highly promoted. But customer also dont really understand but given the audience in this forum should be more educated, chances are higher ppl reading my post can understand abit more. That's all la. Anyhow dont need super high deductible. Recently just found out my kawan baik buy zero deductible. I was like, please buy 300. Save alot. But any close friends and family i still recommend buy small deductible. Buying enough CI is more important. This is my very real and personal experience. More cost efficient. This post has been edited by adele123: Mar 24 2022, 05:48 PM |

|

|

Mar 25 2022, 12:37 AM Mar 25 2022, 12:37 AM

Return to original view | Post

#32

|

Senior Member

4,724 posts Joined: Jul 2013 |

QUOTE(onthefly @ Mar 24 2022, 10:43 PM) Could i ask the reason for your high deductible ? Is it because have company insurance that covers the first 15k? Or you are okay to deal with paying 15k in the event of claiming. 1) company covering my insurance. As long as i'm working this is not an issue. But if due to company insurance, what's your plan if you no longer with the company ? or you are thinking to change the deductible at a later stage to keep the premier lower. 2) yes. I will also be ok to pay the 15k on my own even if something happened. But to be fair the 15k is really because of reason 1. 3) i wont have the option to switch to lower deductible easily. Havent think that far. But i'm still ok with this. |

|

|

Apr 18 2022, 10:41 PM Apr 18 2022, 10:41 PM

Return to original view | Post

#33

|

Senior Member

4,724 posts Joined: Jul 2013 |

QUOTE(OptimusStar @ Apr 18 2022, 07:49 PM) Is it better to get a term insurance ? its seem renewal is not guaranteed, so they can stop renewing me if they want to. Find those that guarantee renewal?Or is it better to go with life policy with cash value ? Can look into other companies, if you just want simple term life insurance. I bought mine with etiqa online, i dunno if it's guaranteed renewable though. It was cheap. And i just got used to using etiqa to buy. Although their customer portal abit cacat. Luckily dont need to use at all. Haha. Not supporting etiqa or anything but i buy cause cheap. Just like car insurance shopping, i also shop a few before buying. You should do that too. This post has been edited by adele123: Apr 18 2022, 10:42 PM |

|

|

|

|

|

Apr 26 2022, 10:40 AM Apr 26 2022, 10:40 AM

Return to original view | Post

#34

|

Senior Member

4,724 posts Joined: Jul 2013 |

QUOTE(ykaism @ Apr 26 2022, 10:37 AM) Hello sifus sekalian, Yes. Your example make sense and do-able. But involve some time and effort because you need to deal with 2 companies.My friend has 2 medical cards. First medical card purchased many years ago and due to low annual limit, second medical card (Other company) with RM5,000 deductible amount purchased, however with exclusion (eg spine) due to health condition. The first medical card is now planned to be reserved only for spine issues in the future. Therefore, let's say in the future admit to the hospital due to other reasons (eg heart problem and cost RM50k), plan to use 2nd medical card for admission, by paying the RM5k deductible. Question to ask: can he claim/reimburse back the RM5k deductible amount from the first medical card later on? while 2nd medical card bears the remaining RM45k. Or can have others better arrangements? How much is the annual limit for both 1st and 2nd card? |

|

|

Apr 26 2022, 11:06 AM Apr 26 2022, 11:06 AM

Return to original view | Post

#35

|

Senior Member

4,724 posts Joined: Jul 2013 |

QUOTE(ykaism @ Apr 26 2022, 10:57 AM) Icic, thank you for your clarification. Then can I advise him to always utilize the 2nd medical card first and reimburse the 5k from the 1st medical card provider later on? Will there be any risk that can't reimburse back the amount? Time and effort should be fine. Yes. You can do that. The annual limit for 1st card is only RM50k while RM120k for 2nd card. He is 60+ years old and both the cards are stand-alone. I'm not 100% familiar with processes in general. I'm more aware of how things work. The likely situation would be the remaining 5k need to submit to 1st company with proof that you pay for the 5k yourself. You probably have some documents to submit, to them. The 2nd card likely is the card you will "check in" to the hospital and request GL from la. But if and when really masuk hospital, the carer must ensure all documents available. I'm not sure if your agent still actively serving, if no just abit slower. Because you may miss out certain docs required by 1st company. The 2nd company should also provide document on what they cover what they dont cover which is the 5k. Last time saw this with another claim of a family member. Roughly only ya. I am really not claims process expert. The 5k obviously claim after discharge. Hopefully the claims submission will get easier moving forward with tech available. As long as genuine claim, insurance company will pay geh. Let me guess. 1st card pru, 2nd card HLA? This post has been edited by adele123: Apr 26 2022, 11:11 AM |

|

|

Apr 29 2022, 12:39 PM Apr 29 2022, 12:39 PM

Return to original view | Post

#36

|

Senior Member

4,724 posts Joined: Jul 2013 |

QUOTE(mini orchard @ Apr 26 2022, 12:44 PM) On what basis can the first insurer pay the balance 5k ? Based on the leftover of 2nd insurer ? I dont think is that straight forward. It's not straight forward. But it can be claimed. That's why i did tell the original poster it takes time and effort. Especially if no agent serving. And you are right. The 1st insurer will need to evaluate againI believed the first insurer will evaluate the entire claim again and then minus the second insurer payment. The balance is then paid to the insured. It can be 5k or less as each insurer approve claims differently. QUOTE(lifebalance @ Apr 26 2022, 12:08 PM) Apparently, there is a mixed answer to this. I like to request you ask the companies you represent again. Certain company would honour it whereas another may say "no". So better check on who is the insurance provider. The terms and conditions are quite consistent across most companies. As long as no double claim it will be honoured provided legit hospitalisation of course. ykaism you should also clarify with the person who sell you the 5k deductible policy. Pretty sure their sales pitch was, the 5k claim from 1st company. 2nd company need to provide some documents of claims payment discharge etc. Something like that la. |

|

|

May 10 2022, 03:19 PM May 10 2022, 03:19 PM

Return to original view | Post

#37

|

Senior Member

4,724 posts Joined: Jul 2013 |

|

|

|

May 18 2022, 01:49 PM May 18 2022, 01:49 PM

Return to original view | IPv6 | Post

#38

|

Senior Member

4,724 posts Joined: Jul 2013 |

QUOTE(plouffle0789 @ May 17 2022, 09:36 PM) You have been not informative about what you want and what you are looking for and what you have now. So i think the other 2 tried to help. What i can see is... you are talking about paying rm40k for axia, paying 90k for city/vios and paying 200k for camry. Analogy only. So what is your budget and what car are you looking for? Do you even need a car? Do you even know how is the condition of your current car? These are the questions you need to ask on your "car". |

|

|

May 20 2022, 09:11 AM May 20 2022, 09:11 AM

Return to original view | Post

#39

|

Senior Member

4,724 posts Joined: Jul 2013 |

QUOTE(OptimusStar @ May 19 2022, 08:21 PM) Actually, all the companies have it. But i doubt they promote it. So when you go their website, it takes awhile to find it.It should say online/direct. This is not a financial advise and certainly from some random person on forum but i myself bought etiqa. But it has its own pros and cons. Please read properly. I'm ok with the pros and cons so i bought 500k. |

|

|

May 22 2022, 11:40 AM May 22 2022, 11:40 AM

Return to original view | Post

#40

|

Senior Member

4,724 posts Joined: Jul 2013 |

QUOTE(kerolzarmyfanboy @ May 21 2022, 10:04 PM) Hi fellas, first time insurance buyer here. So... Personal experience from family members who are older. Medical plan only cover cost of hospitalisation. When you exit the hospital, other things are not covered (medical plan do cover some follow up) Or rather, when you are super sick, likely you need money to recover at home. Getting a critical illness coverage is also important (both are important).been reading on ringgitplus as well and seem a standalone medical card is better suited for me I think, since I just want a simple medical insurance.. but not exactly certain which one would be best and most convenient. Looking from Ringgitplus site, AIA A-Life Med Regular medical card seem to be suitable but would love to hear your opinions as well. some personal details and my criteria: - Age 28 - no illnesses - non-smoker - working in IT sector - covers room at least RM250 per day - preferably monthly premium less than RM300 I guess? But you are still young, chances of happening will be low. But I still recommend getting it. Like me, now want to buy sure will have special condition/exclusion. Cause when core family member get sick, affects your insurance application even though I'm normal. Get in touch with an agent to work this out. Btw, your employer no cover your hospitalisation? This post has been edited by adele123: May 22 2022, 11:41 AM denion liked this post

|

| Change to: |  0.0302sec 0.0302sec

0.99 0.99

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 2nd December 2025 - 02:26 PM |