I can't give you advice cause you need to decide what is best for your own money.

I was with GE for one reason because their total premium for standalone is cheaper than AIA if I choose to cover until 80. Yes I count my premium. But then I exercise my cooling period within 14 days of buying my insurance. Why? For 2 reasons.

1. You see I have friends working in private hospitals and I asked their opinion, among all the insurance which you guys deal with, which one is the one most problematic (denied insurance or ask lots of questions)

The answer came out to be cuepacs care and GE. I was like if it is one person saying it, it might be nothing. If 3 people telling me the same thing, something is not right. Don't get me wrong about GE, they do approve your GL but the way they asked lots of questions and try delaying your admission shows they are "not sincere". Yes even simple food poisoning GE asking reasons for admission.

I then asked them the next question. Which do you guys prefer? They tell me AIA or prudential. Usually no questions asked as long as you pay on time and in full (insurance not lapse and you let your insurance mature 2 years). Since prudential have no standalone and I am not getting an ILP after all the research I found, AIA it is.

For me very simple. I am honest with my insurance company, already pay on time and in full. I want to be covered when I need the coverage. I expect them to honour their part of the bargain as I already honour mine.

2. Saw the news about GE denied someone their cancer payout in the news just because they didn't declare anxiety? Yeah. That. What does anxiety got to do with cancer? Maybe got I don't know.

https://www.thestar.com.my/news/nation/2021...surance-companyWhat should you be need to be aware of if you buy a new standalone plan from GE?

1. You no longer have investment part to cover your insurance premium. You are now your own ILP. You are not paying anyone to manage your investment part anymore and you want to use your insurance when you are old right?

If you cannot pay your premium when you are at 50-80 years old (the time when you will use the insurance the most), then how are you going to use your insurance?

So if you were to go down the standalone route, whatever savings you have dump it into EPF (the difference between paying for standalone premium Vs ILP). This is the easiest way for people don't want to invest overseas or think about opening foreign brokerage. Do not spend this money in any way. Many people spend this money. This is you doing your own ILP without paying additional fees and you are getting more or less fixed 5%p.a (being conservative here).

At age 55 years old, you can take out your EPF money and slowly use it to pay your insurance premium. If you have been doing this regularly every year until you retire, you have quite a large sum. The large sum can sustain your medical insurance until it expires or you expire. You got RM100k by the govt. Use it if you want.

Remember by going ILP route first 2-3 years only 60% of what you pay is premium and investment. The rest is commission. So you lose 2-3 of compounding already.

2. Any new medical insurance does not cover any existing illness. If you got any existing illness, read back mini orchard post to see if you want get new insurance.

3. You likely will get back less money than you paid for your ILP. Cause as mentioned money paid out as commission already and possible market loss

4. Waiting period of 2 years. This applies to all medical insurance. Apart from viral fever, dengue and accident, all insurance have the right to ask you to pay and claim first if you want to use the insurance within 2 years. During this waiting period, by asking you to pay and claim first, they are trying to dig up info and see if you committed any fraud.

5. You lose access to premium holiday. Unlike ILP you can choose to not pay for few months and insurance won't lapse. No such thing with standalone. You don't pay within 30 days of deadline, it will be lapse. If you pay after the 30 days, your waiting period starts again. No issue if you are a good pay master.

6. There is no cash value in stand alone medical insurance. It's money burn yo. Some people cannot accept this fact. Only way to get your money back is get yourself admitted. There is no other way.

7. You lose your rider like your life insurance, critical insurance, waiver if you have them as it is now a pure medical insurance.

8. Be prepared for the premium increase as you age. What you see is generally what you pay. Increment is normal. You cannot run away. Embrace it. Prepare for it. But on the upside you are not subjected to more increase if market is not doing well cause as mentioned you are your own ILP now.

9. The above stuff about GE.

10. You save on management fees as you are not paying annual management fees for your unit trust anymore.

Hope this help. Again sorry for the wall of text.

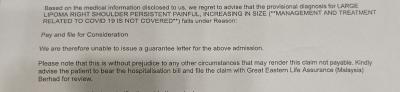

This GE is f*C* up.

My spouse with them for over 20 years and beginning of this year was ask to pay first and claim later 😡.

Ask agent why, also cannot explain.

Spouse so upset and will try another admission year end or next year.

Just for lipoma operation only wor.

Oct 4 2023, 10:06 PM

Oct 4 2023, 10:06 PM

Quote

Quote

0.1656sec

0.1656sec

0.67

0.67

7 queries

7 queries

GZIP Disabled

GZIP Disabled