Get in now when it is still low to test some luck?

To clarify: iShares Silver Trust

Not SLVEST

This post has been edited by HereToLearn: Jan 30 2021, 12:03 AM

SLV next hype?

SLV next hype?

|

|

Jan 29 2021, 10:42 PM, updated 5y ago Jan 29 2021, 10:42 PM, updated 5y ago

Show posts by this member only | Post

#1

|

Senior Member

2,282 posts Joined: Sep 2019 |

Get in now when it is still low to test some luck?

To clarify: iShares Silver Trust Not SLVEST This post has been edited by HereToLearn: Jan 30 2021, 12:03 AM |

|

|

|

|

|

Jan 30 2021, 09:54 AM Jan 30 2021, 09:54 AM

Show posts by this member only | IPv6 | Post

#2

|

Senior Member

4,998 posts Joined: Dec 2010 |

How to play? Can pm me if private

|

|

|

Jan 30 2021, 10:40 AM Jan 30 2021, 10:40 AM

Show posts by this member only | Post

#3

|

Senior Member

2,282 posts Joined: Sep 2019 |

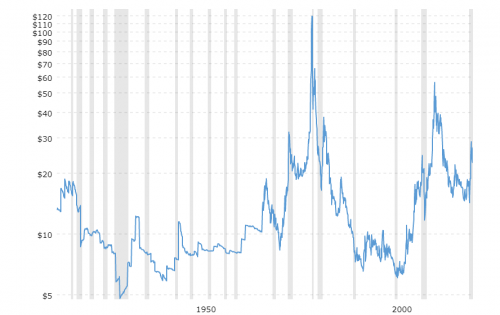

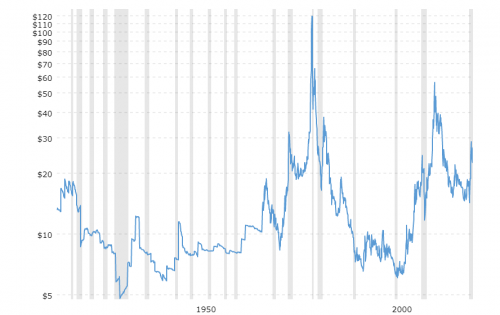

QUOTE(New Klang @ Jan 30 2021, 09:54 AM) Close eye buy? It is a reddit hype If play, must have the mentality that you are ready to lose the money, like how others played the GME hype It think the only advantage SLV over GME is that its chart looks ok, and it hasnt fly as high as GME. The worst case is that if might drop to 13, which erases 50% of your money, but you can always keep silver as an inflationary hedge if you havent got any silver This post has been edited by HereToLearn: Jan 30 2021, 10:42 AM |

|

|

Jan 30 2021, 11:30 AM Jan 30 2021, 11:30 AM

Show posts by this member only | IPv6 | Post

#4

|

Senior Member

4,998 posts Joined: Dec 2010 |

QUOTE(HereToLearn @ Jan 30 2021, 10:40 AM) Close eye buy? It is a reddit hype Which broker?If play, must have the mentality that you are ready to lose the money, like how others played the GME hype It think the only advantage SLV over GME is that its chart looks ok, and it hasnt fly as high as GME. The worst case is that if might drop to 13, which erases 50% of your money, but you can always keep silver as an inflationary hedge if you havent got any silver |

|

|

Jan 30 2021, 12:04 PM Jan 30 2021, 12:04 PM

Show posts by this member only | Post

#5

|

Senior Member

2,282 posts Joined: Sep 2019 |

|

|

|

Jan 30 2021, 12:51 PM Jan 30 2021, 12:51 PM

Show posts by this member only | IPv6 | Post

#6

|

Senior Member

4,998 posts Joined: Dec 2010 |

|

|

|

|

|

|

Jan 30 2021, 02:48 PM Jan 30 2021, 02:48 PM

Show posts by this member only | IPv6 | Post

#7

|

Senior Member

4,503 posts Joined: Mar 2014 |

Wow.. Reddit Horde wants to push SLV.?

Haha..good luck to them. Silver price is global price. I happy also if they can push up silver price. I don't have silver but I have gold. Silver up will usually bring gold up with it. |

|

|

Jan 30 2021, 08:45 PM Jan 30 2021, 08:45 PM

Show posts by this member only | Post

#8

|

Senior Member

3,182 posts Joined: Nov 2008 From: KL |

Now it's full blown pump & dump everywhere.

|

|

|

Jan 30 2021, 08:50 PM Jan 30 2021, 08:50 PM

Show posts by this member only | Post

#9

|

Senior Member

1,072 posts Joined: Jun 2018 |

QUOTE(HereToLearn @ Jan 30 2021, 12:12 AM) You can buy physical Silver and Keep in your Safety Box. HereToLearn liked this post

|

|

|

Jan 30 2021, 09:06 PM Jan 30 2021, 09:06 PM

|

Senior Member

4,390 posts Joined: Oct 2004 From: Cheras, Malaysia |

I bought, blindly emotionally.. not sure why HereToLearn liked this post

|

|

|

Jan 30 2021, 09:24 PM Jan 30 2021, 09:24 PM

|

Senior Member

2,282 posts Joined: Sep 2019 |

QUOTE(Syie9^_^ @ Jan 30 2021, 08:50 PM) Well, it says it is still a good value for medium to long term, which aligns with my views and objective. Might be good to buy some at pullback as an inflationary hedge with so much money printing around. How I value silver with no fundamental metrics? GOLD TO SILVER ratio started at 40:1, now it is at 70:1. I am a retard, I dont know what I am doing. I read somewhere that silver demand will rise because of the rise in solar panels and EVs too Again, to emphasize only buy AS HEDGES. I am really a retard, and have 0 idea how to value any unproductive 'assets'. EDIT: My TP is 70, else will be bagholding as an inflationary hedge This post has been edited by HereToLearn: Jan 30 2021, 09:26 PM |

|

|

Jan 30 2021, 09:40 PM Jan 30 2021, 09:40 PM

|

Senior Member

1,072 posts Joined: Jun 2018 |

QUOTE(HereToLearn @ Jan 30 2021, 10:54 PM) Well, it says it is still a good value for medium to long term, which aligns with my views and objective. Might be good to buy some at pullback as an inflationary hedge with so much money printing around. Watch the video over and over again...Watch the body language and you can see something. and do more DYOR...How I value silver with no fundamental metrics? GOLD TO SILVER ratio started at 40:1, now it is at 70:1. I am a retard, I dont know what I am doing. I read somewhere that silver demand will rise because of the rise in solar panels and EVs too Again, to emphasize only buy AS HEDGES. I am really a retard, and have 0 idea how to value any unproductive 'assets'. EDIT: My TP is 70, else will be bagholding as an inflationary hedge Keyword is well highlighted well there. + Grandpa Mike Maloney, GoldSilver. Panjangkan! |

|

|

Jan 30 2021, 09:49 PM Jan 30 2021, 09:49 PM

|

Senior Member

2,282 posts Joined: Sep 2019 |

QUOTE(Syie9^_^ @ Jan 30 2021, 09:40 PM) Watch the video over and over again...Watch the body language and you can see something. and do more DYOR... Sister, I am not good at reading body language. I can only understand things at face value. I am 钢铁直男.Keyword is well highlighted well there. + Grandpa Mike Maloney, GoldSilver. Panjangkan! Share your views This post has been edited by HereToLearn: Jan 30 2021, 09:52 PM |

|

|

|

|

|

Jan 30 2021, 09:56 PM Jan 30 2021, 09:56 PM

|

Senior Member

1,072 posts Joined: Jun 2018 |

QUOTE(HereToLearn @ Jan 30 2021, 11:19 PM) Sister, I am not good at reading body language. I can only understand things at face value. I am 钢铁直男 You have partially there, BUT you`re still long way away to understand the big big game.Learn more about the $SLV price movement. The ETF you posted, take it like your Basmati rice mixed wrongly for Jasmine rice but cooked in Jasmine rice way. ETF....As small word of advice from Grandpa Mike Maloney, better have the Gold/Silver Bullion in Your Hands. Not in Paper Money. This post has been edited by Syie9^_^: Jan 30 2021, 09:57 PM AbbyCom and HereToLearn liked this post

|

|

|

Jan 30 2021, 09:59 PM Jan 30 2021, 09:59 PM

Show posts by this member only | IPv6 | Post

#15

|

Senior Member

3,502 posts Joined: Dec 2007 |

QUOTE(HereToLearn @ Jan 29 2021, 10:42 PM) Slv also burn the wsb gang last nov once haha. Before slv its the purple mattress play.They basically recycling stuff to hype now since the subscriber base just became big |

|

|

Jan 30 2021, 10:02 PM Jan 30 2021, 10:02 PM

|

Senior Member

2,282 posts Joined: Sep 2019 |

|

|

|

Jan 30 2021, 10:18 PM Jan 30 2021, 10:18 PM

|

Senior Member

1,072 posts Joined: Jun 2018 |

|

|

|

Jan 30 2021, 10:19 PM Jan 30 2021, 10:19 PM

|

Senior Member

1,072 posts Joined: Jun 2018 |

|

|

|

Jan 31 2021, 11:26 PM Jan 31 2021, 11:26 PM

|

Senior Member

1,072 posts Joined: Jun 2018 |

MARKETS A LOOK AHEAD: Physical Silver Supply Running Out! M. HereToLearn !!! Told You. Just go store and ask for PHYISCAL Silver...Bullion. HereToLearn liked this post

|

|

|

Jan 31 2021, 11:40 PM Jan 31 2021, 11:40 PM

|

Senior Member

2,282 posts Joined: Sep 2019 |

QUOTE(Syie9^_^ @ Jan 31 2021, 11:26 PM) MARKETS A LOOK AHEAD: Physical Silver Supply Running Out! M. Yeah I saw I saw SD bullion and JP bullion running out of silver bars, but I saw the spread of physical silver in Malaysia. DAMN huge. So didnt go ahead to buy physical silver.HereToLearn !!! Told You. Just go store and ask for PHYISCAL Silver...Bullion. Anyway, SLV TO THE MOON. Raising TP to 200-210, at gold to silver production ratio of 9:1. I dont think it is due to the industrial demand from solar panels and EV batteries, but demand from WSB and people want to hold silver as an inflationary hedge. So sister holding how much physical silver? Can treat nasi lemak? This post has been edited by HereToLearn: Jan 31 2021, 11:41 PM |

|

|

Jan 31 2021, 11:44 PM Jan 31 2021, 11:44 PM

|

Senior Member

1,072 posts Joined: Jun 2018 |

QUOTE(HereToLearn @ Feb 1 2021, 01:10 AM) Yeah I saw I saw SD bullion and JP bullion running out of silver bars, but I saw the spread of physical silver in Malaysia. DAMN huge. So didnt go ahead to buy physical silver. Anyway, SLV TO THE MOON. Raising TP to 200-210, at gold to silver production ratio of 9:1. I dont think it is due to the industrial demand from solar panels and EV batteries, but demand from WSB and people want to hold silver as an inflationary hedge. So sister holding how much physical silver? Can treat nasi lemak? that iShares ETF SLV...probably going to be tank-ed hard with issuance of more ETFs... i dont know, I probably will buy something more than that. I want diamond hands |

|

|

Jan 31 2021, 11:46 PM Jan 31 2021, 11:46 PM

Show posts by this member only | IPv6 | Post

#22

|

Junior Member

457 posts Joined: Mar 2020 |

Just checking, ETF is supposed to track the price of the base asset it is tracking. Buying SLV alone won't jack up the price of SLV, you need to jack up the price of real silver, no?

Let me know if I understand wrongly. |

|

|

Feb 1 2021, 12:56 AM Feb 1 2021, 12:56 AM

|

Senior Member

2,282 posts Joined: Sep 2019 |

QUOTE(Syie9^_^ @ Jan 31 2021, 11:44 PM) that iShares ETF SLV...probably going to be tank-ed hard with issuance of more ETFs... i dont know, I probably will buy something more than that. I want diamond hands CFD have overnight fees. You can put leverage on it, and ride the wave to get big gains. But I dont like to use leverage, I no balls, a conservative investor. GO sister, make malaysia great again. Milk them dry and bring the money back into MY. QUOTE(AbbyCom @ Jan 31 2021, 11:46 PM) Just checking, ETF is supposed to track the price of the base asset it is tracking. Buying SLV alone won't jack up the price of SLV, you need to jack up the price of real silver, no? I think you are right. If you are in SG, maybe can get some physical silver if the spread is not as huge as in MY. Again, I am a retard, please do your own DD.Let me know if I understand wrongly. People are buying silver, they are jacking up silver ETF indirectly IF I AM RIGHT I DONT KNOW WHAT I AM DOING, I am just here riding the wave. Bought silver ETF cause it is easier and more worth it for me to sell later than physical silver. The spread of physical silver is too damn big in MY. |

|

|

Feb 1 2021, 12:59 AM Feb 1 2021, 12:59 AM

Show posts by this member only | IPv6 | Post

#24

|

Junior Member

63 posts Joined: Dec 2006 |

Buy using Maybank Silver Investment Account HereToLearn liked this post

|

|

|

Feb 1 2021, 09:28 AM Feb 1 2021, 09:28 AM

Show posts by this member only | IPv6 | Post

#25

|

Senior Member

4,503 posts Joined: Mar 2014 |

QUOTE(AbbyCom @ Jan 31 2021, 11:46 PM) Just checking, ETF is supposed to track the price of the base asset it is tracking. Buying SLV alone won't jack up the price of SLV, you need to jack up the price of real silver, no? Correcto Mundo... U need to jack up the global silver market. Let me know if I understand wrongly. Unlike a company like GME where the shares are fixed in number, an ETF can issue new shares if there is imbalance between demand and supply. For SLV ETF, which is backed by silver bullion, if demand for its shares increases, it will buy more silver from the physical bullion market. It will then create more shares from this new bullion and sells it on the market at whatever the silver market price is at that time. That's how SLV works, that's how GLD works. This post has been edited by Cubalagi: Feb 1 2021, 09:28 AM LoTek and HereToLearn liked this post

|

|

|

Feb 1 2021, 09:50 AM Feb 1 2021, 09:50 AM

|

Senior Member

2,282 posts Joined: Sep 2019 |

QUOTE(Cubalagi @ Feb 1 2021, 09:28 AM) Correcto Mundo... U need to jack up the global silver market. It still tracks the silver price right? As long as worldwide people keep buying silver, SLV will continue to up?Unlike a company like GME where the shares are fixed in number, an ETF can issue new shares if there is imbalance between demand and supply. For SLV ETF, which is backed by silver bullion, if demand for its shares increases, it will buy more silver from the physical bullion market. It will then create more shares from this new bullion and sells it on the market at whatever the silver market price is at that time. That's how SLV works, that's how GLD works. |

|

|

Feb 1 2021, 11:02 AM Feb 1 2021, 11:02 AM

Show posts by this member only | IPv6 | Post

#27

|

Senior Member

4,998 posts Joined: Dec 2010 |

I feel the shorties are too big for us. Price has risen a lot since the last big drop

|

|

|

Feb 1 2021, 11:13 AM Feb 1 2021, 11:13 AM

Show posts by this member only | IPv6 | Post

#28

|

Senior Member

4,503 posts Joined: Mar 2014 |

QUOTE(HereToLearn @ Feb 1 2021, 09:50 AM) It still tracks the silver price right? As long as worldwide people keep buying silver, SLV will continue to up? Yes. SLV price tends to track the silver futures market prices.Let's see if the Reddit group can push up silver prices. It could be possible in the short run. You can already see futures traders anticipating this and pushing up silver prices in the futures prices this morning. However ultimately silver price will depend on supply n demand of the metal itself. HereToLearn liked this post

|

|

|

Feb 1 2021, 01:03 PM Feb 1 2021, 01:03 PM

|

Senior Member

2,282 posts Joined: Sep 2019 |

|

|

|

Feb 1 2021, 03:49 PM Feb 1 2021, 03:49 PM

Show posts by this member only | IPv6 | Post

#30

|

Junior Member

137 posts Joined: Apr 2018 |

I still have a few kg of silver that I've been sitting on since 2011. There are a few things here. Be careful of Youtube videos. There are guys out there that have been pumping silver for decades. They go on each others' shows and all agree that silver is way undervalued and that you should buy it now. It's all bullshit. Kitco have a respectable looking Youtube channel that has a load of these guys on it because sell metals. The silver price has moved a lot on Sunday night. When markets open tomorrow (US time), it's likely to move further. We could see another spike like 2011. If we do, we'll see another crash like 2011. There is a shortage of physical silver but in my book, it's much easier as a retail investor to trade the ETFs or miners. You can probably make money in this if you get out early. Don't get left holding the bag for a decade like me. HereToLearn, Syie9^_^, and 1 other liked this post

|

|

|

Feb 1 2021, 03:59 PM Feb 1 2021, 03:59 PM

Show posts by this member only | IPv6 | Post

#31

|

Senior Member

3,502 posts Joined: Dec 2007 |

QUOTE(SgtScoop @ Feb 1 2021, 03:49 PM) I still have a few kg of silver that I've been sitting on since 2011. I dont think many here or even wsb remember 2011. That time they are also trying to squeeze jpm. The bankrupt jp morgan buy silver campaign is not widely known outside of US. In the end it dint bankrupt jp morgan but it does cause alot of bag holders.There are a few things here. Be careful of Youtube videos. There are guys out there that have been pumping silver for decades. They go on each others' shows and all agree that silver is way undervalued and that you should buy it now. It's all bullshit. Kitco have a respectable looking Youtube channel that has a load of these guys on it because sell metals. The silver price has moved a lot on Sunday night. When markets open tomorrow (US time), it's likely to move further. We could see another spike like 2011. If we do, we'll see another crash like 2011. There is a shortage of physical silver but in my book, it's much easier as a retail investor to trade the ETFs or miners. You can probably make money in this if you get out early. Don't get left holding the bag for a decade like me. Now this crappy conspiracy theory is back. And funny thing is jp morgan more or less is still in control of slv due to their large physical holdings at comex. HereToLearn and SgtScoop liked this post

|

|

|

Feb 1 2021, 04:27 PM Feb 1 2021, 04:27 PM

|

Senior Member

1,072 posts Joined: Jun 2018 |

QUOTE(HereToLearn @ Feb 1 2021, 02:33 PM) That is Physical Bullion. at Retail Level. in banks, still got alot.... unless it wasnt anymore. HereToLearn liked this post

|

|

|

Feb 1 2021, 04:31 PM Feb 1 2021, 04:31 PM

|

Senior Member

1,072 posts Joined: Jun 2018 |

QUOTE(SgtScoop @ Feb 1 2021, 05:19 PM) I still have a few kg of silver that I've been sitting on since 2011. 2011, were you at peak? That`s still long way to go.There are a few things here. Be careful of Youtube videos. There are guys out there that have been pumping silver for decades. They go on each others' shows and all agree that silver is way undervalued and that you should buy it now. It's all bullshit. Kitco have a respectable looking Youtube channel that has a load of these guys on it because sell metals. The silver price has moved a lot on Sunday night. When markets open tomorrow (US time), it's likely to move further. We could see another spike like 2011. If we do, we'll see another crash like 2011. There is a shortage of physical silver but in my book, it's much easier as a retail investor to trade the ETFs or miners. You can probably make money in this if you get out early. Don't get left holding the bag for a decade like me. |

|

|

Feb 1 2021, 08:57 PM Feb 1 2021, 08:57 PM

Show posts by this member only | IPv6 | Post

#34

|

Junior Member

137 posts Joined: Apr 2018 |

|

|

|

Feb 1 2021, 09:10 PM Feb 1 2021, 09:10 PM

|

Senior Member

1,072 posts Joined: Jun 2018 |

QUOTE(SgtScoop @ Feb 1 2021, 10:27 PM) Legend, Bag-Holder. HoDOR will be with you slightly. SgtScoop liked this post

|

|

|

Feb 1 2021, 09:12 PM Feb 1 2021, 09:12 PM

Show posts by this member only | IPv6 | Post

#36

|

Junior Member

137 posts Joined: Apr 2018 |

|

|

|

Feb 1 2021, 09:31 PM Feb 1 2021, 09:31 PM

|

Senior Member

1,072 posts Joined: Jun 2018 |

|

|

|

Feb 1 2021, 09:49 PM Feb 1 2021, 09:49 PM

|

Senior Member

2,282 posts Joined: Sep 2019 |

|

|

|

Feb 1 2021, 09:52 PM Feb 1 2021, 09:52 PM

|

Senior Member

1,072 posts Joined: Jun 2018 |

HereToLearn liked this post

|

|

|

Feb 1 2021, 10:40 PM Feb 1 2021, 10:40 PM

|

Senior Member

2,282 posts Joined: Sep 2019 |

|

|

|

Feb 1 2021, 10:48 PM Feb 1 2021, 10:48 PM

Show posts by this member only | IPv6 | Post

#41

|

Senior Member

3,502 posts Joined: Dec 2007 |

QUOTE(HereToLearn @ Feb 1 2021, 10:40 PM) Some are pros and some are posers. Value investing 101. Separating the wheat from the chaff in an anonymous forum hahaha. AbbyCom liked this post

|

|

|

Feb 1 2021, 11:13 PM Feb 1 2021, 11:13 PM

|

Senior Member

1,033 posts Joined: Dec 2009 |

QUOTE(Syie9^_^ @ Feb 1 2021, 09:31 PM) Inflation adjusted silver price.... For sure but the commodities markets are controlled by various large players so this happens. Take a guess who is the custodian bank for SLV.... JPM. Ask those who trade natural gas or the countless allegations over the years in various commodities yet a few ever get brought to daylight. https://www.globenewswire.com/news-release/...ing-Cartel.html https://www.internationallawoffice.com/News...ower-oil-market QUOTE(ChAOoz @ Feb 1 2021, 10:48 PM) Some are pros and some are posers. As long as it doesn't turn into k then should be fine but lately doesn't fell like it.Value investing 101. Separating the wheat from the chaff in an anonymous forum hahaha. Sadly facts don't matter much these days. A certain billionaire was criticizing Robinhood yet forgot the biz he invested in has the exact same model and just that no one demanded a massive increase in collateral from them. |

|

|

Feb 2 2021, 03:53 AM Feb 2 2021, 03:53 AM

|

Senior Member

6,427 posts Joined: Jan 2003 From: Autobiography!!! |

|

|

|

Feb 2 2021, 11:56 AM Feb 2 2021, 11:56 AM

|

Senior Member

1,072 posts Joined: Jun 2018 |

QUOTE(HereToLearn @ Feb 2 2021, 12:10 AM) i`m just Here to Learn too.QUOTE(ChAOoz @ Feb 2 2021, 12:18 AM) Some are pros and some are posers. some are chad + lurker. Value investing 101. Separating the wheat from the chaff in an anonymous forum hahaha. QUOTE(zacknistelrooy @ Feb 2 2021, 12:43 AM) Inflation adjusted silver price.... Price was very high in late 1950-60.  For sure but the commodities markets are controlled by various large players so this happens. Take a guess who is the custodian bank for SLV.... JPM. Ask those who trade natural gas or the countless allegations over the years in various commodities yet a few ever get brought to daylight. https://www.globenewswire.com/news-release/...ing-Cartel.html https://www.internationallawoffice.com/News...ower-oil-market As long as it doesn't turn into k then should be fine but lately doesn't fell like it. Sadly facts don't matter much these days. A certain billionaire was criticizing Robinhood yet forgot the biz he invested in has the exact same model and just that no one demanded a massive increase in collateral from them. hypocrite billionaire at their best right? |

|

|

Feb 2 2021, 12:39 PM Feb 2 2021, 12:39 PM

Show posts by this member only | IPv6 | Post

#45

|

Senior Member

3,502 posts Joined: Dec 2007 |

QUOTE(Syie9^_^ @ Feb 2 2021, 11:56 AM) It was the 70s and 80s when the hunt brother corner the silver market and subsequently got shut down by the gov. Even the most capitalist market in the world does not have total free market freedom. Does the recent gme ring a bell hehe. |

|

|

Feb 2 2021, 12:46 PM Feb 2 2021, 12:46 PM

|

Senior Member

1,072 posts Joined: Jun 2018 |

QUOTE(ChAOoz @ Feb 2 2021, 02:09 PM) It was the 70s and 80s when the hunt brother corner the silver market and subsequently got shut down by the gov. Even the most capitalist market in the world does not have total free market freedom. Yes But the SLV thesis.... is just a distraction.Does the recent gme ring a bell hehe. The only issue soon will be, Silvergate? |

|

|

Feb 2 2021, 01:59 PM Feb 2 2021, 01:59 PM

Show posts by this member only | IPv6 | Post

#47

|

Junior Member

137 posts Joined: Apr 2018 |

QUOTE(Syie9^_^ @ Feb 2 2021, 12:46 PM) Yep, WSB deleted the original post. It failed to break $30. I've already sold my SILJ. Top Glove is stonking though. #bursabets HereToLearn liked this post

|

|

|

Feb 2 2021, 02:59 PM Feb 2 2021, 02:59 PM

Show posts by this member only | IPv6 | Post

#48

|

Junior Member

137 posts Joined: Apr 2018 |

Just sold out of my physical silver too. Thanks to changes in the exchange rate, I'll actually make RM250. A terrible return for 10 years of "investment" but it was a terrible investment to begin with. I'm delighted to get my money back considering it went from $48 to $15 pretty fast. HereToLearn liked this post

|

| Change to: |  0.0337sec 0.0337sec

0.42 0.42

5 queries 5 queries

GZIP Disabled GZIP Disabled

Time is now: 24th December 2025 - 01:41 AM |