Report: Surging GameStop Stock Prices Inspires Economic Protest Against Wall Street and Hedge Funds

Big tldr

Surging GameStop stock prices have inspired economic protest against Wall Street, with the WallStreetBets subreddit buying shares to harm those who shorted.

We previously covered YouTuber and GameStop whistleblower Camelot331 [1, 2, 3, 4, 5], discussing the company’s allegedly abusive, immoral, and illegal activities. Camelot cited both his own experiences while working at a GameStop store, and stories from other former and existing staff acting as whistleblowers.

Based on information Camelot received, along with his own experiences, he felt GameStop would soon enter bankruptcy. He also proposed there was a “three stage plan” by corporate leaders.

» Click to show Spoiler - click again to hide... «

This would involve doing whatever it took to increase the stock value of the company in the short-term (including closing stores and firing staff) before liquidating the company or filing for bankruptcy. The corporate leaders would maximize bonuses thanks to the success, and sell their own improved shares. The latter is known as a “pump and dump,” and widely considered securities fraud.

Along with partnering with Microsoft in October 2020, the company announced on January 11th their “Additional Board Refreshment to Accelerate Transformation.” In an agreement with RC Ventures, GameStop would assign three new directors. One of these was Ryan Cohen, the manager of RC Ventures.

Due to comments made by several executives in the press release and the press release itself, Camelot theorized in his own video on the press release that GameStop would be shifting heavily towards e-commerce and online shopping. Cohen was also the CEO of Chewy, a dog-food company that operates purely online.

Camelot also notes the foot of the press release sates GameStop is a “digital-first omni-channel retailer;” reportedly the first time describing themselves as such. Combined with the company previously closing large numbers of stores and continues to do so to offset losses, Camelot theorized most if not all stores would close as GameStop became a purely online business.

Camelot also theorized Cohen would soon become CEO of GameStop thanks to the other two new board members, both coming from Chewy. Camelot then claimed that it was well known within GameStop’s “circle” that Cohen would close 90 to 100% of all physical GameStop stores, and fire staff who had worked at those stores.

The day after the news was announced, GameStop’s share value rose 31% to $11.45 USD a share. On January 15th, Bloomberg reported its shares had doubled in that week, and that “leaders of the video-game retailer are cashing in millions before heading for the door.”

“Chairman Kathy Patterson Vrabeck sold $1.4 million of shares at an average price of $27.99 while Raul J. Fernandez, a board member, pocketed $1.22 million as he disposed of shares at an average price of $35.28. Both are slated to step down from the board given the addition of Cohen and two former Chewy employees to help lead the company, filings show.”

Director James Wolf also sold 810,000 shares for $21 million USD. On January 19th Camelot shared a new video on the news, saying he doubted those who felt the shares could rise to as high as $1000 USD a share, as “I don’t know how a company that’s lost $500 million last year in profit can possibly go that high with noting to show for it.”

However, the share price continued to grow, thanks in part to SpaceX and Tesla CEO Elon Musk. After tweeting “Gamestonk!” (in reference to a meme referring to stocks) and linking to the WallStreetBets subreddit; Reuters reports GameStop shares rose 50% that day, in addition to the prior 93%.

This may have been far from good news for GameStop however, as some reportedly began to speculate if the spike would incur an investigation by the U.S. Securities and Exchange Commission.

“Such volatile trading fueled by opinions where there appears to be little corporate activity to justify the price movement is exactly what SEC investigations are made of,” Jacob Frenkel said to Reuters. He is the Securities Enforcement Practice Chair for law firm Dickinson Wright, and a former SEC enforcement attorney. The SEC themselves declined to comment.

Barron’s reports that as of January 26th, GameStop’s stock price had quadrupled since the prior week. William Galvin, the Secretary of the Commonwealth of Massachusetts, issued a statement to Barron’s on his suspicions. “This is certainly on my radar. I’m concerned, because it suggests that there is something systemically wrong with the options trading on this stock.”

Both Barron’s and CNet [1, 2] have reported more on the cause for the spike, as well as how it is turning into a full-blown act of protest against the US stock exchange akin to the Occupy Wall Street protests.

The aforementioned WallStreetBets subreddit is a group dedicated to stocktrading with “every-men” rather than businessmen, focusing on riskier ventures. As such, the group seems to have a disdain for how major businesses and businessmen handle stocks and shares; discouraging and actively working against normal people investing directly, and accusations of corruption.

Self-described as “Like 4chan found a Bloomberg Terminal,” it seems the group had enough. Feeling that GameStop executives had engaged in some kind of fraud, they bought GameStop shares, further inflating the share price. According to MarketShare, GameStop shares are currently worth $355.10 USD at this time of writing.

CNet’s version of events proposes that the group and others encouraged people to buy shares in GameStop, citing the sudden rise in stock value, and discouraging any selling.

Reports suggest it was an act of mockery to analysts, showing how volatile the stock market is with influence by social media, defiance against Wall Street for their alleged corruption and harming of the American people, or combinations of the above.

The group then reportedly attempted to do the same with other companies with historically low stock value, such as BlackBerry and AMC Entertainment. This could be an act of protest against those who sell short- effectively betting a company will fail.

“Effectively, the WallStreetBets crowd created artificial demand for GameStop and BlackBerry shares with their own money. There are 2.2 million members of the WallStreetBets community, though it’s nearly impossible to determine how many people are involved in the GameStop and BlackBerry schemes.

What happens is that by buying a lot of GameStop shares quickly, the price rises. That’s normal. With GameStop, though, there are also a lot of short sellers, or people who effectively bet the stock will drop rather than rise.

But there’s a hitch. If GameStop’s price rises too much too quickly, short sellers — the people betting on GameStop’s struggles — are forced to buy even more stock to cover their losses. That pushes the stock up even more.

That’s how we suddenly see GameStop’s value jump.”

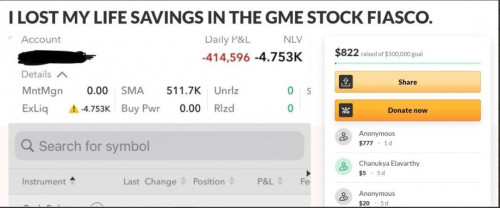

CNet report that those who shorted GameStop- one of the most shorted companies on the market- have lost $3.3 billion USD this year, with $1.6 billion USD happening January 22nd.

William LeGate, founder and CEO of Everipedia and PredIQt cataloged WallStreetBet’s actions and other’s reactions in a Twitter thread. He predicted that Melvin Capital, a hedge fund who shorted GameStop, would declare bankruptcy thanks to the GameStop price surge. “$13.1 billion in wealth transferred from Wall St to Reddit trolls.”

UPDATE: Financial News also reported Melvin Capital made $25 million USD from shorting CD Projekt Red over the disastrous launch of Cyberpunk 2077 in December 2020. CD Projekt’s founders lost $1 billion USD over the debacle.

As of this time of writing, there are unconfirmed reports Melvin Capital have filed for bankruptcy, while others claim they have passed their debt onto others in the short term so they can stop trading.

UPDATE 2: In addition, it seems Musk’s previous actions may have had some motivation. As pointed out by a user on WallStreetBets (thanks @Monodo) Melvin Capital had previously shorted both SpaceX and Tesla.

Gabriel Plotkin- a man who worked for Steve Cohen- discussed with Bloomberg how both he and Cohen achieved high returns on their investment into Melvin Capital. He claimed 70% of Melvin Capital’s first year profits came from “bearish bets” in shorting, and was skeptical about “mall real estate investment trusts, as well as electric-car maker Tesla Inc.”

Original article continues:

“What we’re witnessing isn’t a traditional pump & dump,” LeGate explains, “it is an unorganized, yet collective effort of memelords & avg Americans to completely ignore all market fundamentals &, thru the power of social media, bankrupt hedge funds overnight, taking their funds. Legality unclear.”

Speaking further to Decrypt, LeGate added “The rich get richer, and whenever anything fails, the Fed just prints more money and distributes it to Wall Street, not Main Street. Many Americans, particularly the newer generations, have lost trust in our banking and financial systems which are widely perceived to be rigged against working-class Americans.”

On Twitter, LeGate predicted this may result in backlash. “Wall Street is about to put a LOT of pressure on the SEC to make stock memes illegal & for it to be harder for everyday Americans to trade. They don’t want it to be legal for everyday Americans to organize via social media to do what they do to profit.”

In a now deleted tweet, GameStop investor Michael Burry stated “If I put $GME on your radar, and you did well, I’m genuinely happy for you. However, what is going on now – there should be legal and regulatory repercussions. This is unnatural, insane, and dangerous.”

However, Wall Street Journal and Guardian US journalist Heidi N. Moore tweeted “They cannot do anything. I cannot emphasize enough that there is no crime here.” James Cox, a professor at Duke University School of Law told Bloomberg “It’s an enforcement nightmare for the SEC. The question is: where does the manipulation start and when does trading on your own hunches and publicizing your hunches start?”

LeGate also notes that “hedge funds shorted more GameStop shares than there are GameStop shares in existence, and by a considerable margin. In hindsight this chaotic, meme-powered short-squeeze isn’t as crazy as it may appear at first-sight. Short squeeze inevitable with that leverage.”

One user on WallStreetBets even offered an open letter to CNBC, condemning their coverage of the subreddit. CNBC interviewed former SEC lawyer Jacob Frenkel, who called for the FCC to suspend all trading as the stock value was being manipulated.

WallStreetBets condemned how seemingly only those on Wall Street can allegedly manipulate public opinion on a company’s value.

“These funds can manipulate the market via your network and if they screw up big because they don’t even know the basics of portfolio risk 101 and using position sizing, they just get a bailout from their billionaire friends at Citadel. Then they have the nerve to turn us into public enemy #1 just because we believe in an underdog company getting a second chance.

We don’t have billionaires to bail us out when we mess up our portfolio risk and a position goes against us. We can’t go on TV and make attempts to manipulate millions to take our side of the trade. If we mess up as bad as they did, we’re wiped out, have to start from scratch and are back to giving handjobs behind the dumpster at Wendy’s.”

One user succinctly covered why so many wants revenge against Wall Street, and for large economic change from how things have been done in the past. This was in a thread titled “This is personal. For all of us.”

“I’ve never seen anything like what’s happening with $GME before, and I don’t think I’ll ever see anything like this. This is a big moment. A tug of war between tradition and the future.

Hedge fund managers live in the past, and continue to look down upon the retail investors. They truly believe that we, the average retail investors, don’t know anything about finances or the market (which may be true), and we’re just gambling our money away.

We don’t know any better. WE NEED HEDGE FUND MANAGERS TO TELL US WHAT TO DO! SAVE US! This is the world they want to live in. This was the past.

Remember that scene from the Sopranos, where Tony’s wife calls to buy 5000 shares of Webonics, after she was manipulated emotionally to so? Institutions and hedge funds want us to be stuck in that world.

They’re scared of the future. They’re scared because, so much information is available for free now. THere’s no more fees for trading. We have large communities that discuss stocks and trading openly. We can think and make decisions for ourselves, which scares the FUCK out of old school institutions and hedge funds.

Fuck them all. This affects every single one of you, whether or not you’re holding $GME.”

sos stonksTldr, wall street millionaires understimated the autistic power of gamers and are paying out their asses cause of it.

Also said millionaires are asking uncle Baiden for bailout from fucking with gamers. Fucking ironic.

.

Surprisingly, all the major shareholders of the dying company Gamestop/GME are Hedge-funds and Mutual funds who are profiting from this saga and the prime market mover/influencer on social media like r/Wallstreetbets is a HF/MF insider, ie Keith Patrick Gill aka #DeepFuckingValue. .......

https://www.reuters.com/article/us-retail-t...y-idUSKBN29Y0AF - January 29, 2021, 6:01 PM, Updated 2 days ago - Famed GameStop bull 'Roaring Kitty' is a Massachusetts financial advisor

WASHINGTON (Reuters) - A YouTube streamer who helped drive a surge in the shares of GameStop Corp is a 34-year-old financial advisor from Massachusetts and until recently worked for insurance giant MassMutual, public records and social media posts show.

Keith Patrick Gill is the person behind the Roaring Kitty YouTube streams which, along with a string of posts by Reddit user DeepF***ingValue, helped attract a flood of retail cash into GameStop, burning hedge funds who had bet against the company and roiling the broader market. ... For all we know, this could be a new scam masterminded by the HF/MF to dupe online Retail investors into buying GME shares at >US$200 per share = the HF/MF who had bought millions of GME shares at <US$20 a few months ago are laughing all their way to the banks.

Note that masterminds of MLM and Ponzi money scams also have to come out with new modus operandi in their scams, every scam cycle of a few years.

Caveat Emptor..

.

Who thrusted the share price to >US$300 and may thrust it further to US$1k.? The HF/MF masterminds or the posse of online Retail investors seeking revenge against Hedge-funds/MF.?

Note that such prices can be manipulated by secret cartels/groups/"gangsters", eg near zero bank interest rates are set by the Federal Reserve Bank of USA, which is controlled by the US Federal government = the BIGGEST cartel/"gangsters" in the world, eg Obamacare enriched Obama and Michelle = the health insurance lobby, the Iraq Invasion was supposed to enrich Bush Jr and Dick Cheney = the oil lobby, etc.

Remember, the herd/posse of online Retail investors who bought GME shares at >US$300 or may buy at US$1k will suffer BIG losses when the "short-squeeze" game eventually ends(after a few weeks.?) with the price dropping back to earth to about US$10, since Gamestop is essentially a dying or non-performing company.

.

.

Gullible/foolish people believing in the Gamestop short-squeeze of HF short-sellers story in social media and the mass media(which can be manipulated for brainwashing) could be similar to such people believing in the FUD stories set up by a group/"gangsters" of Macau scammers.

.

.

Looks like I may be right about this being a likely Money Scam via r/Wallstreetbets because Gamestop/GME share price closed today at US$225 = a BIG drop from Friday's close of US$325.

Pity those online Retail investors who bought at >US$300 per GME share on Friday seeking to revenge against the HF short-sellers by manipulating the shares towards US$1k or even towards US$100k per share = kena gamed and stung = Gamestung.

....... Similarly for those who piled into Topglove stocks via r/Bursabets.

.

P S - Seems, got a few online Retail investors have betted against those on r/WSB by short-selling GME shares at >US$300 on Friday and today.

.

Jan 29 2021, 11:37 AM

Jan 29 2021, 11:37 AM

Quote

Quote

0.0631sec

0.0631sec

0.35

0.35

7 queries

7 queries

GZIP Disabled

GZIP Disabled