QUOTE(billyboy @ Jan 28 2021, 09:49 PM)

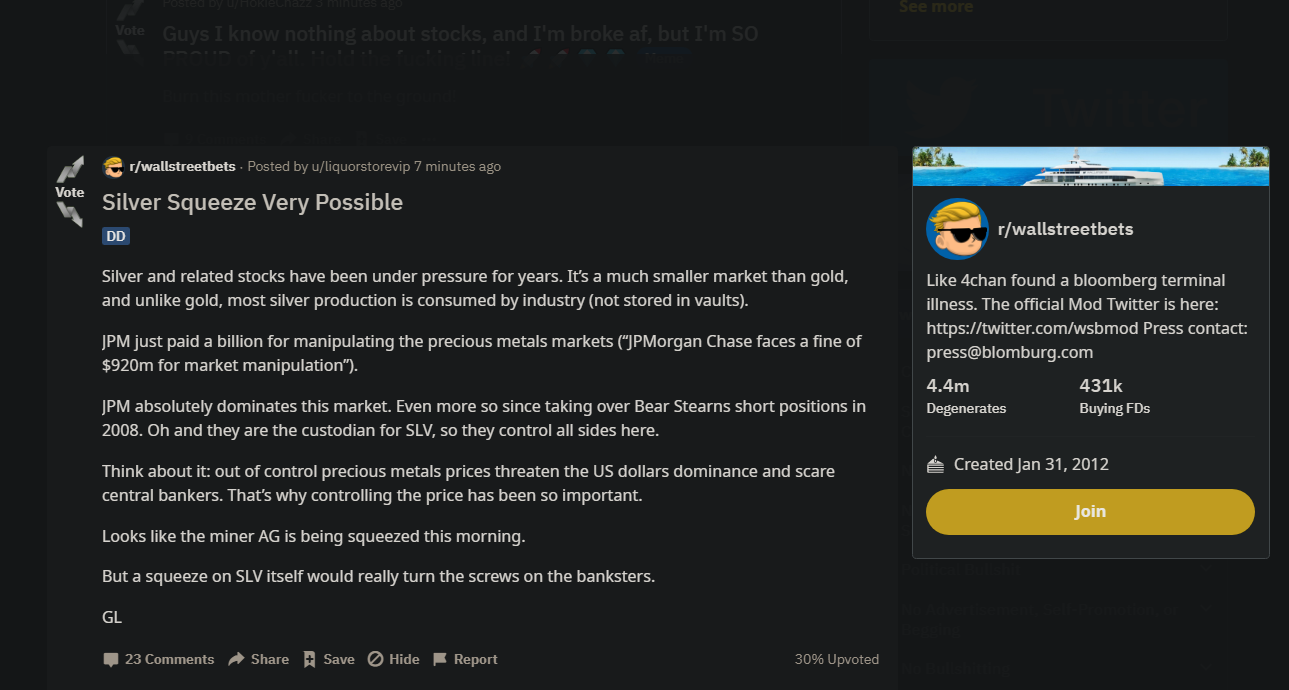

the issue with Gld and Slv to me is that its being - in my opinion - being manipulated with the nod and wink of the Federal Reserve.

mainly to maintain the primacy of the USD.

in which case, are you ready to fight an institution which can magically print out Billions / Trillions of USD faster than a rub on Aladdin's Lamp ? Every Comex expiration, they smash down the price of Gld / Slv......

difficult to fight an institution which has unlimited money.

at least Melvin Capital has limits.

The time will come.mainly to maintain the primacy of the USD.

in which case, are you ready to fight an institution which can magically print out Billions / Trillions of USD faster than a rub on Aladdin's Lamp ? Every Comex expiration, they smash down the price of Gld / Slv......

difficult to fight an institution which has unlimited money.

at least Melvin Capital has limits.

Cant wait more confetti of bankers come raining down in near near future

Jan 28 2021, 08:23 PM

Jan 28 2021, 08:23 PM

Quote

Quote

0.0166sec

0.0166sec

0.22

0.22

6 queries

6 queries

GZIP Disabled

GZIP Disabled