Entered 1@$350 exited 1@$75

Sohai one this thing

GME Gamestop, making men in suits BLEED

GME Gamestop, making men in suits BLEED

|

|

Feb 5 2021, 11:39 PM Feb 5 2021, 11:39 PM

|

Senior Member

3,182 posts Joined: Nov 2008 From: KL |

Entered 1@$350 exited 1@$75

Sohai one this thing |

|

|

|

|

|

Feb 6 2021, 10:10 AM Feb 6 2021, 10:10 AM

|

All Stars

21,454 posts Joined: Jul 2012 |

There will be another gme, price rise will be faster and higher. Likewise for price drop. The question is which to ride before price catapult.

|

|

|

Feb 6 2021, 10:11 AM Feb 6 2021, 10:11 AM

|

Senior Member

3,389 posts Joined: Sep 2019 |

|

|

|

Feb 6 2021, 12:43 PM Feb 6 2021, 12:43 PM

Show posts by this member only | IPv6 | Post

#344

|

Senior Member

1,594 posts Joined: Feb 2006 |

QUOTE(icemanfx @ Feb 6 2021, 10:10 AM) There will be another gme, price rise will be faster and higher. Likewise for price drop. The question is which to ride before price catapult. Depends on whether the retards at WSB can influence another pump and dump or not. Too many normies got burned on GME and now they're crying out foul |

|

|

Feb 6 2021, 02:23 PM Feb 6 2021, 02:23 PM

|

All Stars

21,454 posts Joined: Jul 2012 |

QUOTE(red streak @ Feb 6 2021, 12:43 PM) Depends on whether the retards at WSB can influence another pump and dump or not. Too many normies got burned on GME and now they're crying out foul For certain wsb will stage another pump and dump exercise. #retailers after tasted adrenaline rush, many couldn't resist and will jump in more ferociously. |

|

|

Feb 6 2021, 02:46 PM Feb 6 2021, 02:46 PM

Show posts by this member only | IPv6 | Post

#346

|

Junior Member

297 posts Joined: Aug 2010 |

QUOTE(icemanfx @ Feb 6 2021, 10:10 AM) There will be another gme, price rise will be faster and higher. Likewise for price drop. The question is which to ride before price catapult. Look at AACG. Gained +1000% 30 minutes before market closed on Thursday now back to under $10. People made money from gains on Thursday, people also made money on Friday by shorting AACG to $6.33Wsb is not the old wsb now more like gmebets over there. Here interesting to read on about gamma squeeze and ironically not from wsb but from r/options. Wished I had found this post earlier and sold for profit Let's clear up a few misconceptions about gamma squeezes https://www.reddit.com/r/options/comments/l...utm_name=iossmf |

|

|

|

|

|

Feb 6 2021, 02:58 PM Feb 6 2021, 02:58 PM

Show posts by this member only | IPv6 | Post

#347

|

Senior Member

3,497 posts Joined: Dec 2007 |

QUOTE(fuddle_duddle @ Feb 6 2021, 02:46 PM) Look at AACG. Gained +1000% 30 minutes before market closed on Thursday now back to under $10. People made money from gains on Thursday, people also made money on Friday by shorting AACG to $6.33 Should send this link to bursabets lol. Keep saying short squeeze wont happen but gamma squeeze will for topglove.Wsb is not the old wsb now more like gmebets over there. Here interesting to read on about gamma squeeze and ironically not from wsb but from r/options. Wished I had found this post earlier and sold for profit Let's clear up a few misconceptions about gamma squeezes https://www.reddit.com/r/options/comments/l...utm_name=iossmf |

|

|

Feb 6 2021, 03:01 PM Feb 6 2021, 03:01 PM

|

Senior Member

3,182 posts Joined: Nov 2008 From: KL |

|

|

|

Feb 7 2021, 03:03 AM Feb 7 2021, 03:03 AM

Show posts by this member only | IPv6 | Post

#349

|

Senior Member

5,365 posts Joined: Jan 2007 From: KL Malaysia |

good job hedge LOL FUD alright https://wherearetheshares.com/

This post has been edited by Quazacolt: Feb 7 2021, 03:18 AM yunodie liked this post

|

|

|

Feb 7 2021, 11:55 AM Feb 7 2021, 11:55 AM

Show posts by this member only | IPv6 | Post

#350

|

Senior Member

7,066 posts Joined: Sep 2019 From: South Klang Valley suburb |

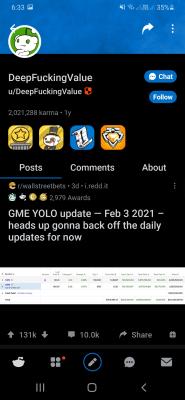

QUOTE(fuddle_duddle @ Feb 5 2021, 02:42 AM) Next week on Feb 9th people said the report for shorts coming out. I AM CURIOUS TO SEE THE NUMBER AND THEN DECIDE TO BUY BACK IN OR NOT. Something tells me gme story isn't over. Tomorrow also very curious about what would happen because options expire. I saw someone strike the price in options calls to $800 for tomorrow. Wrong beliefs can have very bad consequences, eg gullible Retail investors suffering huge losses, eg losing their life savings, macam believing in the fearful/greedy stories of Macau scams.. QUOTE(icemanfx @ Feb 5 2021, 07:19 PM) The prime advocate for the GME/Gamestop short-squeeze at r/Wallstreetbets about 2 months ago, is a Mutual-fund or HF insider, ie #DeepFuckingValue aka Keith Patrick Gill. ....... https://en.wikipedia.org/wiki/DeepFuckingValue "Gill is a Chartered Financial Analyst, formerly employed at MassMutual." And the major shareholders of GME/Gamestop shares at about 100 million shares are/were HF/MF, who bought them at US$5 or less in Aug 2020 or earlier. ....... https://money.cnn.com/quote/shareholders/sh...w=institutional . This post has been edited by lurkingaround: Feb 7 2021, 01:05 PM |

|

|

Feb 7 2021, 02:43 PM Feb 7 2021, 02:43 PM

|

Junior Member

297 posts Joined: Aug 2010 |

QUOTE(Quazacolt @ Feb 7 2021, 03:03 AM) Nice site. I can’t wait feb 9th to see the latest number. Update me if you have the number. I hate going to wsb now cuz just full of gme stuffs here and there lol |

|

|

Feb 7 2021, 02:50 PM Feb 7 2021, 02:50 PM

Show posts by this member only | IPv6 | Post

#352

|

Senior Member

5,365 posts Joined: Jan 2007 From: KL Malaysia |

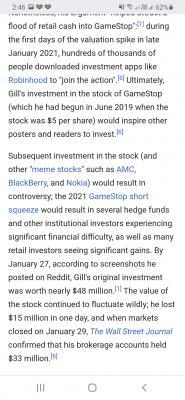

QUOTE(lurkingaround @ Feb 7 2021, 11:55 AM) » Click to show Spoiler - click again to hide... « The prime advocate for the GME/Gamestop short-squeeze at r/Wallstreetbets about 2 months ago, is a Mutual-fund or HF insider, ie #DeepFuckingValue aka Keith Patrick Gill. ....... https://en.wikipedia.org/wiki/DeepFuckingValue "Gill is a Chartered Financial Analyst, formerly employed at MassMutual." » Click to show Spoiler - click again to hide... « https://en.wikipedia.org/wiki/DeepFuckingValue

QUOTE By January 27, according to screenshots he posted on Reddit, Gill's original investment was worth nearly $48 million.[1] The value of the stock continued to fluctuate wildly; he lost $15 million in one day, and when markets closed on January 29, The Wall Street Journal confirmed that his brokerage accounts held $33 million.[6] TLDR:. DFV still holding and lost his millions of gains along with "supposedly gullible retail investors/Macau scams"On February 4th, it was announced that William Galvin, Massachusetts's secretary of the commonwealth, wrote to Gill's previous employer MassMutual to investigate whether or not Gill or the company broke any rules related to his activities in promoting the GameStop stock.[14] A week earlier, Galvin had called for a 30-day suspension of trading in Gamestop securities.[15] Gill is expected to testify to the House Financial Services Committee on February 18, 2021, along with Vladimir Tenev.[16] He is unable to continue posting due to SEC hearings (you can dig up his last post mentioning so) |

|

|

Feb 7 2021, 03:51 PM Feb 7 2021, 03:51 PM

|

Junior Member

297 posts Joined: Aug 2010 |

Dfv hold gme since 2019. Gme is his long game. People made fun of him on his yolo updates in wsb before this. I was too when I saw his updates many months ago. He sold some weeks ago like 600 something. Probably he could use the money to hire the top lawyers if this going to trial or some shit. Quazacolt liked this post

|

|

|

|

|

|

Feb 7 2021, 04:08 PM Feb 7 2021, 04:08 PM

Show posts by this member only | IPv6 | Post

#354

|

Senior Member

7,066 posts Joined: Sep 2019 From: South Klang Valley suburb |

QUOTE(lurkingaround @ Feb 7 2021 @ 11:55 AM) Wrong beliefs can have very bad consequences, eg gullible Retail investors suffering huge losses, eg losing their life savings, macam believing in the fearful/greedy stories of Macau scams. . The prime advocate for the GME/Gamestop short-squeeze at r/Wallstreetbets about 2 months ago, is a Mutual-fund or HF insider, ie #DeepFuckingValue aka Keith Patrick Gill. ....... https://en.wikipedia.org/wiki/DeepFuckingValue "Gill is a Chartered Financial Analyst, formerly employed at MassMutual." And the major shareholders of GME/Gamestop shares at about 100 million shares are/were HF/MF, who bought them at US$5 or less in Aug 2020 or earlier. ....... https://money.cnn.com/quote/shareholders/sh...w=institutional . QUOTE(Quazacolt @ Feb 7 2021, 02:50 PM) That's a perfect example of why it is important to take a holistic approach on how/why a narrative is painted. .https://en.wikipedia.org/wiki/DeepFuckingValue

TLDR:. DFV still holding and lost his millions of gains along with "supposedly gullible retail investors/Macau scams" He is unable to continue posting due to SEC hearings (you can dig up his last post mentioning so) Did DFV show Black-and-white or documentary proof/evidence that he is still holding on to most of his 150,000(= valued at US$750,000) GME shares bought some months ago at about US$5 each.? Did he show proof that he did not cash out most of his 150,000 GME shares at about US$300 each(= his US$750,000 becomes US$30 million) last Friday(= 29 Jan 2021) or this Monday(= 1 Feb 2021).? ....... https://heavy.com/news/keith-gill-roaring-kitty/ . This post has been edited by lurkingaround: Feb 7 2021, 04:24 PM |

|

|

Feb 7 2021, 04:33 PM Feb 7 2021, 04:33 PM

Show posts by this member only | IPv6 | Post

#355

|

Senior Member

5,365 posts Joined: Jan 2007 From: KL Malaysia |

QUOTE(lurkingaround @ Feb 7 2021, 04:08 PM) . He provided screenshot of his broker's account, no cashing out and just losing like 30 millions in red Did DFV show Black-and-white or documentary proof/evidence that he is still holding on to most of his 150,000(= valued at US$750,000) GME shares bought some months ago at about US$5 each.? Did he show proof that he did not cash out most of his 150,000 GME shares at about US$300 each(= his US$750,000 becomes US$30 million) last Friday(= 29 Jan 2021) or this Monday(= 1 Feb 2021).? ....... https://heavy.com/news/keith-gill-roaring-kitty/ . If that's not convincing to you, then I'm sorry I don't have anything further from him |

|

|

Feb 7 2021, 06:14 PM Feb 7 2021, 06:14 PM

Show posts by this member only | IPv6 | Post

#356

|

Senior Member

7,066 posts Joined: Sep 2019 From: South Klang Valley suburb |

QUOTE(Quazacolt @ Feb 7 2021, 04:33 PM) He provided screenshot of his broker's account, no cashing out and just losing like 30 millions in red .If that's not convincing to you, then I'm sorry I don't have anything further from him Please post your source links of the screenshots. . https://www.cnbc.com/2021/01/29/famed-games...al-advisor.html - 2021/01/29/famed-gamestop-bull-roaring-kitty-is-a-massachusetts-financial-advisor " He began sharing his bets with the group in September 2019, posting a portfolio screenshot indicating he had invested $53,000 in the company and had already netted a $46,000 profit. Reuters was unable to confirm this. ... By Wednesday, Gill was up over 4000% on stock and options investments in the company, with his GME position plus cash worth nearly $48 million, according to his Reddit posts. Reuters could not independently verify his profits. ... After online brokerages restricted trading in GME on Thursday, Gill posted that he had lost $14.8 million that day alone, but was still up $33 million overall. That post was met with thousands of replies, with many simply repeating: “IF HE’S STILL IN, I’M STILL IN.” " = this is like the story of the Pied Piper leading impressionable kids walking off a cliff and falling to their death. . This post has been edited by lurkingaround: Feb 7 2021, 06:17 PM |

|

|

Feb 7 2021, 06:40 PM Feb 7 2021, 06:40 PM

Show posts by this member only | IPv6 | Post

#357

|

Senior Member

5,365 posts Joined: Jan 2007 From: KL Malaysia |

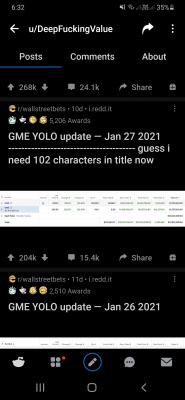

QUOTE(lurkingaround @ Feb 7 2021, 06:14 PM) . Unless you're really that bias, you could just reddit/Google him up?Please post your source links of the screenshots. . https://www.cnbc.com/2021/01/29/famed-games...al-advisor.html - 2021/01/29/famed-gamestop-bull-roaring-kitty-is-a-massachusetts-financial-advisor " He began sharing his bets with the group in September 2019, posting a portfolio screenshot indicating he had invested $53,000 in the company and had already netted a $46,000 profit. Reuters was unable to confirm this. ... By Wednesday, Gill was up over 4000% on stock and options investments in the company, with his GME position plus cash worth nearly $48 million, according to his Reddit posts. Reuters could not independently verify his profits. ... After online brokerages restricted trading in GME on Thursday, Gill posted that he had lost $14.8 million that day alone, but was still up $33 million overall. That post was met with thousands of replies, with many simply repeating: “IF HE’S STILL IN, I’M STILL IN.” " = this is like the story of the Pied Piper leading impressionable kids walking off a cliff and falling to their death. . Nevermind since I'm a nice person, I'll entertain you: https://www.reddit.com/u/DeepFuckingValue

My apologies though, from 47.9 million peak 50500 shares? > 22.1/22.4 million same quantities of shares (he probably did some selling and re buying at lower price, or just hold, I don't know and don't care and quite frankly it doesn't matter) That's only 25.5-25.8 million USD losses, not 30 million. Yeah he's probably autistic/retarded just like most WSB, love the stocks too damn much |

|

|

Feb 7 2021, 06:46 PM Feb 7 2021, 06:46 PM

|

Junior Member

475 posts Joined: Dec 2011 |

QUOTE(lurkingaround @ Feb 7 2021, 06:14 PM) . you go his house ask him open his trading account for you to see hou mei?Please post your source links of the screenshots. . https://www.cnbc.com/2021/01/29/famed-games...al-advisor.html - 2021/01/29/famed-gamestop-bull-roaring-kitty-is-a-massachusetts-financial-advisor " He began sharing his bets with the group in September 2019, posting a portfolio screenshot indicating he had invested $53,000 in the company and had already netted a $46,000 profit. Reuters was unable to confirm this. ... By Wednesday, Gill was up over 4000% on stock and options investments in the company, with his GME position plus cash worth nearly $48 million, according to his Reddit posts. Reuters could not independently verify his profits. ... After online brokerages restricted trading in GME on Thursday, Gill posted that he had lost $14.8 million that day alone, but was still up $33 million overall. That post was met with thousands of replies, with many simply repeating: “IF HE’S STILL IN, I’M STILL IN.” " = this is like the story of the Pied Piper leading impressionable kids walking off a cliff and falling to their death. . dont think you will believe him anyway since you have trust issues *shrug* |

|

|

Feb 7 2021, 06:47 PM Feb 7 2021, 06:47 PM

Show posts by this member only | IPv6 | Post

#359

|

Senior Member

5,365 posts Joined: Jan 2007 From: KL Malaysia |

|

|

|

Feb 7 2021, 07:10 PM Feb 7 2021, 07:10 PM

Show posts by this member only | IPv6 | Post

#360

|

Senior Member

7,066 posts Joined: Sep 2019 From: South Klang Valley suburb |

QUOTE(Quazacolt @ Feb 7 2021, 06:40 PM) Unless you're really that bias, you could just reddit/Google him up? .Nevermind since I'm a nice person, I'll entertain you: https://www.reddit.com/u/DeepFuckingValue

My apologies though, from 47.9 million peak 50500 shares? > 22.1/22.4 million same quantities of shares (he probably did some selling and re buying at lower price, or just hold, I don't know and don't care and quite frankly it doesn't matter) That's only 25.5-25.8 million USD losses, not 30 million. Yeah he's probably autistic/retarded just like most WSB, love the stocks too damn much Could the above be Photoshopped/Edited or from a Demo account.? ....... https://www.investopedia.com/terms/d/demo-account.asp "Demo Account By Will Kenton Updated Jul 28, 2018 A demo account is a type of account offered by trading platforms, which is funded with fake money that enables a prospective customer to experiment with the trading platform and its various features, before deciding to set up a real account funded with the customers actual money. Demo accounts are offered by a wide variety of online trading platforms, including stock trading platforms, foreign exchange trading venues, and commodities exchanges. ... " . |

| Change to: |  0.0280sec 0.0280sec

0.91 0.91

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 27th November 2025 - 09:03 PM |