QUOTE(statikinetic @ Oct 28 2020, 09:25 AM)

I use it mainly for the convenience, not the analytics.

It's great to see the data points and figures I'm looking for in one place. Keep in mind the articles it churns out are automated. It's analytics like Fair Value...take it with a big sack of salt.

The reports, revenue and cost numbers are correct as far as I can check it.

big sack of salt. hahahha very nice.

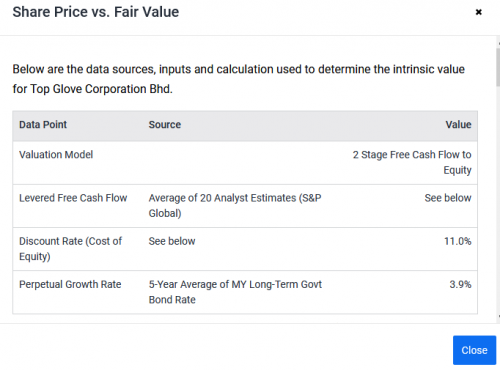

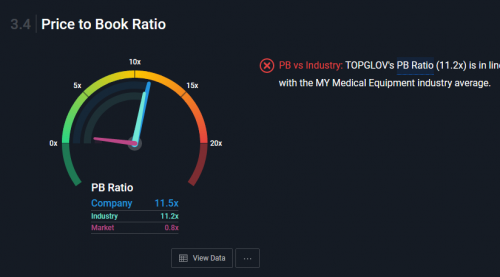

but if the numbers are correct, then it is the valuation methodologies that are different.

perhaps they are more risk adverse and hence has slightly lower valuation?

QUOTE(Eurobeater @ Oct 28 2020, 09:35 AM)

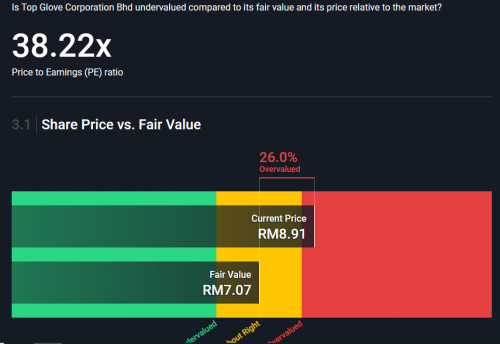

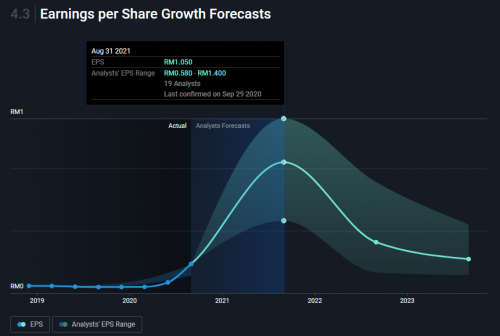

I'm not too suprised at this result if this is true lol. TG is quite overpriced imho, but mana tau their assumptions

I see. Just wonder if Malaysian investors use this as well, since this looks like its geared towards retail investors

Yeah, their articles I noticed all have the same format. Not too surprising since the stock reports appear to be automated as well. The FV thing I'm very unsure since their results often vary a lot vs the FV by the analysts in the local investment banks. Like TG, almost every analyst here predicts the FV to be around RM 10 - RM16. This one predicts it at just around RM7 lol

Valuation is an art, not hard science.

Different people may view value differently, could be their more risk adverse valuation methodologies that causes the difference?

Oct 28 2020, 12:05 AM, updated 6y ago

Oct 28 2020, 12:05 AM, updated 6y ago

Quote

Quote

0.0202sec

0.0202sec

0.63

0.63

5 queries

5 queries

GZIP Disabled

GZIP Disabled