Now still at very beginning stage.. market and demand is there

monthly production surge to 5k units now

https://markets.businessinsider.com/news/st...20-9-1029632186

This post has been edited by yehlai: Oct 7 2020, 04:14 PM

NIO - Next iconic auto brand?

|

|

Oct 1 2020, 05:27 PM, updated 6y ago Oct 1 2020, 05:27 PM, updated 6y ago

Show posts by this member only | IPv6 | Post

#1

|

Senior Member

4,539 posts Joined: Feb 2006 From: LocOmoT|oN.L0co|oti0N |

Anyone betting future on NIO?

Now still at very beginning stage.. market and demand is there monthly production surge to 5k units now https://markets.businessinsider.com/news/st...20-9-1029632186 This post has been edited by yehlai: Oct 7 2020, 04:14 PM |

|

|

|

|

|

Oct 2 2020, 03:32 PM Oct 2 2020, 03:32 PM

Show posts by this member only | Post

#2

|

Senior Member

1,074 posts Joined: Sep 2013 |

|

|

|

Oct 2 2020, 04:45 PM Oct 2 2020, 04:45 PM

Show posts by this member only | Post

#3

|

Junior Member

72 posts Joined: Jul 2016 |

Sept month record breaking delivery yet again. pre market price down but let's see how the share price will react when the market open. NIO is one of my long term holding. yehlai liked this post

|

|

|

Oct 3 2020, 12:40 AM Oct 3 2020, 12:40 AM

Show posts by this member only | IPv6 | Post

#4

|

Senior Member

4,539 posts Joined: Feb 2006 From: LocOmoT|oN.L0co|oti0N |

QUOTE(McFD2R @ Oct 2 2020, 03:32 PM) QUOTE(Investor12 @ Oct 2 2020, 04:45 PM) Sept month record breaking delivery yet again. Any concern because it's a PRC company? because government policies change or get hammeredpre market price down but let's see how the share price will react when the market open. NIO is one of my long term holding. This post has been edited by yehlai: Oct 3 2020, 12:41 AM |

|

|

Oct 3 2020, 12:27 PM Oct 3 2020, 12:27 PM

Show posts by this member only | IPv6 | Post

#5

|

Junior Member

182 posts Joined: Jul 2008 From: Azn |

|

|

|

Oct 7 2020, 12:13 AM Oct 7 2020, 12:13 AM

Show posts by this member only | IPv6 | Post

#6

|

Senior Member

4,539 posts Joined: Feb 2006 From: LocOmoT|oN.L0co|oti0N |

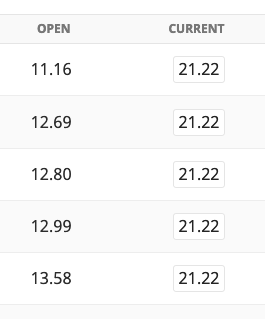

Buy in to hold first

will cont. to buy in batches.. finger cross This post has been edited by yehlai: Nov 25 2020, 08:36 AM |

|

|

|

|

|

Nov 22 2020, 11:02 PM Nov 22 2020, 11:02 PM

Show posts by this member only | Post

#7

|

Junior Member

426 posts Joined: Jun 2008 |

QUOTE(yehlai @ Oct 3 2020, 12:40 AM) PRC government aims to have 20% of the cars on the roads as EV by 2025. So, not only NIO, Xpev and Li Auto are soaring too.In addition, PRC government is using the same strategy like luring Apple to China. Before Apple was produced in China, there was no supply chain and technical capabilities. Most of the Chinese handphones were copy cats. After Apple's investment, the local technical capabilities were upgraded so did the supply chain. Now, by attracting Tesla to Shanghai, the local eco system for the EV would be different. The scenarios would be interesting. It is like GSM (Nokia and Ericsson) vs smart phone (Apple and Samsung Galaxy). The future of automobile could be fossil fuel automobile vs smart EV. My two cents. |

|

|

Nov 23 2020, 09:33 AM Nov 23 2020, 09:33 AM

Show posts by this member only | IPv6 | Post

#8

|

Junior Member

368 posts Joined: Oct 2008 |

nio is riding on tesla's hype now, it doesn't have the tech or production infra like tesla's. it feels like a bubble which how fast its stock price went from USD 8 to USD 50 within 5 months.

|

|

|

Nov 23 2020, 12:21 PM Nov 23 2020, 12:21 PM

Show posts by this member only | Post

#9

|

Junior Member

426 posts Joined: Jun 2008 |

QUOTE(thxxht @ Nov 23 2020, 09:33 AM) nio is riding on tesla's hype now, it doesn't have the tech or production infra like tesla's. it feels like a bubble which how fast its stock price went from USD 8 to USD 50 within 5 months. I sat in a NIO SUV when I visited Guangzhou in Dec 2019. I bought the shares at 6 USD in Mar this year after I studied NIO's battery swapping technology. The concept was originally from Tesla. But, Tesla shut down the battery swapping idea. Tesla has came out quite a lot of ideas. But, Chinese companies commercialize them. Of course, my views could be prejudice as I have investments in these Chinese counters. |

|

|

Nov 23 2020, 04:52 PM Nov 23 2020, 04:52 PM

|

Junior Member

297 posts Joined: Apr 2020 |

kelvinlym Thoughts? I hardly seen you talking about EV competitor other than NKLA.

IMHO it's feels like an EV hyped instead of disruptive stocks This post has been edited by Zenph: Nov 23 2020, 04:53 PM |

|

|

Nov 23 2020, 06:18 PM Nov 23 2020, 06:18 PM

|

Senior Member

1,152 posts Joined: Jun 2007 From: Kuala Lumpur |

QUOTE(Zenph @ Nov 23 2020, 04:52 PM) kelvinlym Thoughts? I hardly seen you talking about EV competitor other than NKLA. If one would like to invest in the EV sector, TSLA is still the best choice.IMHO it's feels like an EV hyped instead of disruptive stocks However, here are some of my thoughts on NIO. 1. They are in the premium sector. They also sell a premium lifestyle in China. There are pros and cons. It will be very limited in numbers and reach, so I don't see the growth there. At best they will be like a Chinese Rolls Royce. I don't see signs of them going mainstream yet, if they do, they risk the brand being diluted. The scaling will be tough due to high labour requirements. You can see how they run their NIO houses. It's damn high class, but not sure how they gonna scale. 2. Battery as a service. It seems like a good idea, but I don't think it'll appeal to the masses. I don't think people will like to have to share their battery. Having said that, I think it will be useful with commercial users, but it seems to contradict the brand. Also, how are they gonna scale? There is a battery shortage nowadays, but with battery as a service, you're needed to at least 2x your battery because you definitely need to have batteries on standby at the swapping stations. 3. Technology. So far nothing groundbreaking and no clear leadership in any sector. Although their in car assistant seems nice, but novelty may wear off. We'll see their next launch on NIO pilot soon and then we can judge how far Tesla is in front. Battery swapping is not a technical challenge but more of an economic challenge. 4. What I see moving forward. They will be acquired by BYD or a traditional auto company. This is only what I see and hear from people in China. I have never experienced anything first hand, so I may not have every piece of news available. Hope they can surprise the market with new stuff! Talking about the stock price and fundamentals, if there is no Tesla, I would consider it as they seem promising. However, I will not put that much as I have put in Tesla because of their seemingly limited growth, reach and vision. |

|

|

Nov 23 2020, 11:13 PM Nov 23 2020, 11:13 PM

Show posts by this member only | IPv6 | Post

#12

|

Probation

39 posts Joined: Nov 2020 |

Entered in Jan 2020 after test drove in China. Love the product, the CEO & the Nio Team !

|

|

|

Nov 23 2020, 11:16 PM Nov 23 2020, 11:16 PM

Show posts by this member only | IPv6 | Post

#13

|

Probation

39 posts Joined: Nov 2020 |

QUOTE(kelvinlym @ Nov 23 2020, 06:18 PM) If one would like to invest in the EV sector, TSLA is still the best choice. just FYI. They get govt subsidiary as car value over RMB 300k and battery swap tech. Various govt sector & department concluding police department already driving Nio as their official Smart EV. new orders require to wait 8weeeks as capacity expansion under going. Next year Jan Nio day will introduce Sedan ET7/EE7. still have rooms to go but foreseen roller coaster stock price now. Good luck & may all win together !However, here are some of my thoughts on NIO. 1. They are in the premium sector. They also sell a premium lifestyle in China. There are pros and cons. It will be very limited in numbers and reach, so I don't see the growth there. At best they will be like a Chinese Rolls Royce. I don't see signs of them going mainstream yet, if they do, they risk the brand being diluted. The scaling will be tough due to high labour requirements. You can see how they run their NIO houses. It's damn high class, but not sure how they gonna scale. 2. Battery as a service. It seems like a good idea, but I don't think it'll appeal to the masses. I don't think people will like to have to share their battery. Having said that, I think it will be useful with commercial users, but it seems to contradict the brand. Also, how are they gonna scale? There is a battery shortage nowadays, but with battery as a service, you're needed to at least 2x your battery because you definitely need to have batteries on standby at the swapping stations. 3. Technology. So far nothing groundbreaking and no clear leadership in any sector. Although their in car assistant seems nice, but novelty may wear off. We'll see their next launch on NIO pilot soon and then we can judge how far Tesla is in front. Battery swapping is not a technical challenge but more of an economic challenge. 4. What I see moving forward. They will be acquired by BYD or a traditional auto company. This is only what I see and hear from people in China. I have never experienced anything first hand, so I may not have every piece of news available. Hope they can surprise the market with new stuff! Talking about the stock price and fundamentals, if there is no Tesla, I would consider it as they seem promising. However, I will not put that much as I have put in Tesla because of their seemingly limited growth, reach and vision. |

|

|

|

|

|

Nov 24 2020, 09:37 AM Nov 24 2020, 09:37 AM

|

All Stars

17,025 posts Joined: Jan 2005 |

QUOTE(kelvinlym @ Nov 23 2020, 06:18 PM) If one would like to invest in the EV sector, TSLA is still the best choice. Swapping battery is another solution for China's environment. However, here are some of my thoughts on NIO. 1. They are in the premium sector. They also sell a premium lifestyle in China. There are pros and cons. It will be very limited in numbers and reach, so I don't see the growth there. At best they will be like a Chinese Rolls Royce. I don't see signs of them going mainstream yet, if they do, they risk the brand being diluted. The scaling will be tough due to high labour requirements. You can see how they run their NIO houses. It's damn high class, but not sure how they gonna scale. 2. Battery as a service. It seems like a good idea, but I don't think it'll appeal to the masses. I don't think people will like to have to share their battery. Having said that, I think it will be useful with commercial users, but it seems to contradict the brand. Also, how are they gonna scale? There is a battery shortage nowadays, but with battery as a service, you're needed to at least 2x your battery because you definitely need to have batteries on standby at the swapping stations. 3. Technology. So far nothing groundbreaking and no clear leadership in any sector. Although their in car assistant seems nice, but novelty may wear off. We'll see their next launch on NIO pilot soon and then we can judge how far Tesla is in front. Battery swapping is not a technical challenge but more of an economic challenge. 4. What I see moving forward. They will be acquired by BYD or a traditional auto company. This is only what I see and hear from people in China. I have never experienced anything first hand, so I may not have every piece of news available. Hope they can surprise the market with new stuff! Talking about the stock price and fundamentals, if there is no Tesla, I would consider it as they seem promising. However, I will not put that much as I have put in Tesla because of their seemingly limited growth, reach and vision. 1) Most of the China housing doesn't have a private car park. They can't charge it overnight. And the public charging point at the moment is not enough. But at the engineering point, I see the car structure is weak and safety concern. While Tesla uses the battery pack integrates as the body structure. 2) NIO at the moment don't have assembly line or own factory. They are using OEM. That is red flag. 3) In NIO Q3 report, the R&D cost have been reduce. It is a red flag. A growing company require high cost in R&D for edge competitive. At the moment EV sector is support and backed by China gov. So it is booming now. But who will win the race remains to be seen. Invest in short term but long have to be caution. shinozu liked this post

|

|

|

Nov 24 2020, 09:45 AM Nov 24 2020, 09:45 AM

Show posts by this member only | IPv6 | Post

#15

|

Junior Member

488 posts Joined: Jul 2009 From: earth/japan/shibuya Warn: (92%) |

my nio PL is already 400%, gila

|

|

|

Nov 24 2020, 09:52 AM Nov 24 2020, 09:52 AM

|

Senior Member

1,152 posts Joined: Jun 2007 From: Kuala Lumpur |

QUOTE(masahito @ Nov 24 2020, 09:45 AM) Congratulations! EV stocks are rising. However don’t let the price blind you, check if its growth can match its valuation. shinozu liked this post

|

|

|

Nov 24 2020, 09:59 AM Nov 24 2020, 09:59 AM

Show posts by this member only | IPv6 | Post

#17

|

Junior Member

488 posts Joined: Jul 2009 From: earth/japan/shibuya Warn: (92%) |

|

| Change to: |  0.0252sec 0.0252sec

0.41 0.41

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 24th December 2025 - 01:31 AM |