Outline ·

[ Standard ] ·

Linear+

cardup MY version

|

TSkolololo

|

Sep 29 2020, 11:30 PM, updated 6y ago Sep 29 2020, 11:30 PM, updated 6y ago

|

New Member

|

Hi, i am working in singapore. I am using the cardup to pay my rental. The cardup will charge to my credit card with some fee ~ 2%. The benefit i get is i can earn the miles or cashback in my credit card. The cardup service also able to pay for utilities, insurance, tax payment etc. There is another similar service which is called ipaymy.

my question is... do we have any similar service provider in malaysia that can pay insurance or car loan by credit card?

Thanks.

|

|

|

|

|

|

MUM

|

Sep 29 2020, 11:37 PM Sep 29 2020, 11:37 PM

|

|

will the cashback given by the CARDUP be more than the 2+% CARDUP charged to the amount to be billed? will the normal cashback given by the credit card still be given if one uses it thru the CARDUP platform? if CAN, then double bonus....X% from CC card then + X% from CARDUP perhaps TS can try post his query in the Credit Cards, Debit Cards, Prepaid Cards and Loyalty Cards forum for more chances of responses https://forum.lowyat.net/CreditCardsDebitCa...andLoyaltyCardsThis post has been edited by MUM: Sep 30 2020, 12:20 AM |

|

|

|

|

|

honsiong

|

Sep 29 2020, 11:45 PM Sep 29 2020, 11:45 PM

|

|

QUOTE(MUM @ Sep 29 2020, 11:37 PM) will the miles earned or cashback given be more than the 2% they charged to the amount to be billed? Yes. Singapore cc cashbacks and rewards are insane. I still use my UOB YOLO here coz 8% cashback for supermarket on weekends, insane. |

|

|

|

|

|

MUM

|

Sep 29 2020, 11:57 PM Sep 29 2020, 11:57 PM

|

|

QUOTE(honsiong @ Sep 29 2020, 11:45 PM) Yes. Singapore cc cashbacks and rewards are insane. I still use my UOB YOLO here coz 8% cashback for supermarket on weekends, insane. did you use the UOB YOLO card thru the "cardup" platform too? |

|

|

|

|

|

woonsc

|

Sep 30 2020, 07:05 AM Sep 30 2020, 07:05 AM

|

|

QUOTE(kolololo @ Sep 29 2020, 11:30 PM) Hi, i am working in singapore. I am using the cardup to pay my rental. The cardup will charge to my credit card with some fee ~ 2%. The benefit i get is i can earn the miles or cashback in my credit card. The cardup service also able to pay for utilities, insurance, tax payment etc. There is another similar service which is called ipaymy. my question is... do we have any similar service provider in malaysia that can pay insurance or car loan by credit card? Thanks. Thanks for the intro! |

|

|

|

|

|

GrumpyNooby

|

Sep 30 2020, 07:12 AM Sep 30 2020, 07:12 AM

|

|

How does this compared to using e-wallet (in Malaysia)?

|

|

|

|

|

|

TSkolololo

|

Sep 30 2020, 09:22 AM Sep 30 2020, 09:22 AM

|

New Member

|

QUOTE(MUM @ Sep 29 2020, 11:37 PM) will the cashback given by the CARDUP be more than the 2+% CARDUP charged to the amount to be billed? will the normal cashback given by the credit card still be given if one uses it thru the CARDUP platform? if CAN, then double bonus....X% from CC card then + X% from CARDUP perhaps TS can try post his query in the Credit Cards, Debit Cards, Prepaid Cards and Loyalty Cards forum for more chances of responses https://forum.lowyat.net/CreditCardsDebitCa...andLoyaltyCardsthanks, i post at there already. i search online,but can't get any similar service. ipaymy can pay rental, but i am finding provider with more service that can even pay house / car loan. i am using to earn miles, so 2% charge to buy the miles is still worth it. some credit card can give higher cash back provided you meet certain amount, so by charging to cardup service, after minus the 2% charge, you will still get something.. |

|

|

|

|

|

MUM

|

Sep 30 2020, 09:30 AM Sep 30 2020, 09:30 AM

|

|

QUOTE(kolololo @ Sep 30 2020, 09:22 AM) thanks, i post at there already. i search online,but can't get any similar service. ipaymy can pay rental, but i am finding provider with more service that can even pay house / car loan. i am using to earn miles, so 2% charge to buy the miles is still worth it. some credit card can give higher cash back provided you meet certain amount, so by charging to cardup service, after minus the 2% charge, you will still get something.. The miles points earned must be used to buy business class air ticket only or economy class air ticket also can? |

|

|

|

|

|

iamshf

|

Sep 30 2020, 09:32 AM Sep 30 2020, 09:32 AM

|

|

Similar to ipay Malaysia?

|

|

|

|

|

|

a.lifehacks

|

May 25 2023, 06:33 PM May 25 2023, 06:33 PM

|

Getting Started

|

QUOTE(kolololo @ Sep 29 2020, 11:30 PM) Hi, i am working in singapore. I am using the cardup to pay my rental. The cardup will charge to my credit card with some fee ~ 2%. The benefit i get is i can earn the miles or cashback in my credit card. The cardup service also able to pay for utilities, insurance, tax payment etc. There is another similar service which is called ipaymy. my question is... do we have any similar service provider in malaysia that can pay insurance or car loan by credit card? Thanks. It's here!! https://ringgitplus.com/en/blog/sponsored/h...ith-cardup.htmlIs this a legit platform though? |

|

|

|

|

|

bmxexx

|

Sep 3 2023, 10:46 AM Sep 3 2023, 10:46 AM

|

New Member

|

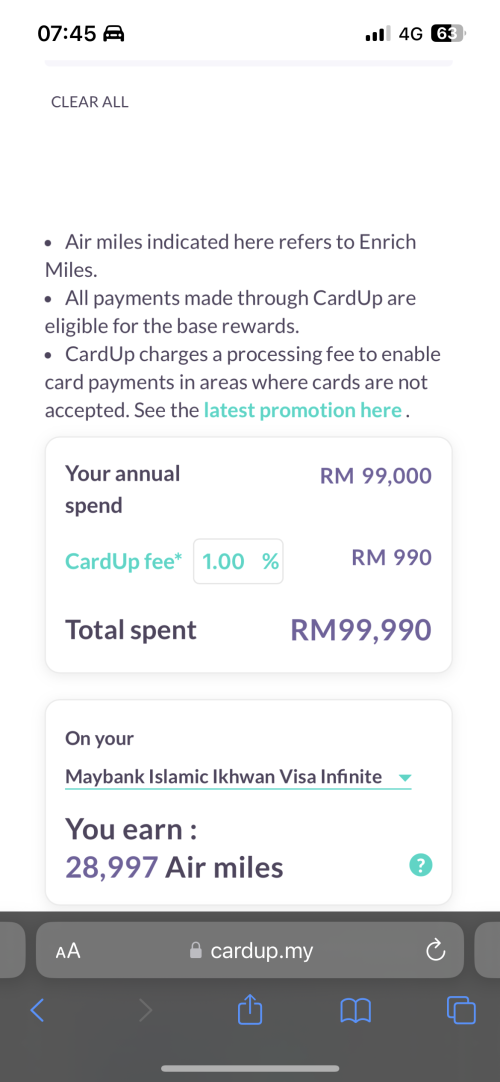

Whats the best credit card to get when using CardUp in Malaysia

After considering the 2% charge for using the service

Right now they only accept Visa, Mastercard and Unionpay. No Amex as of yet.

|

|

|

|

|

|

cklimm

|

Sep 14 2023, 04:47 PM Sep 14 2023, 04:47 PM

|

|

QUOTE(bmxexx @ Sep 3 2023, 10:46 AM) Whats the best credit card to get when using CardUp in Malaysia After considering the 2% charge for using the service Right now they only accept Visa, Mastercard and Unionpay. No Amex as of yet. Alliance bank loh, but only if its counted as online transaction (x8 points), not auto billing (x1 point) |

|

|

|

|

|

csjm88

|

Nov 2 2023, 03:44 PM Nov 2 2023, 03:44 PM

|

New Member

|

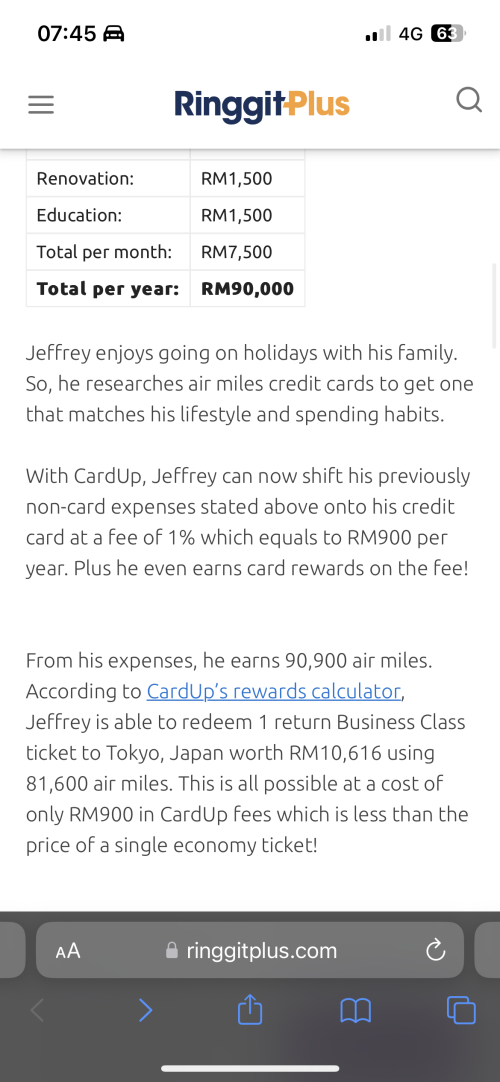

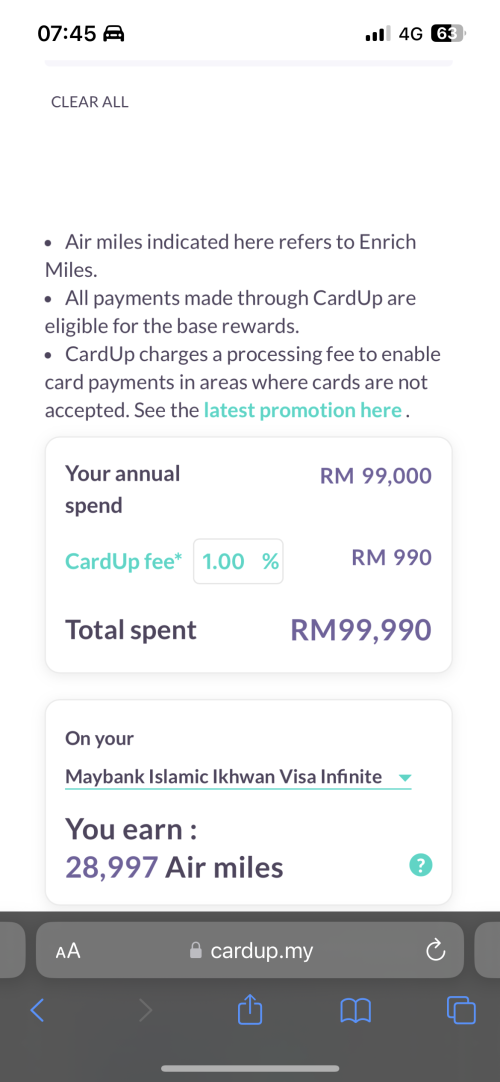

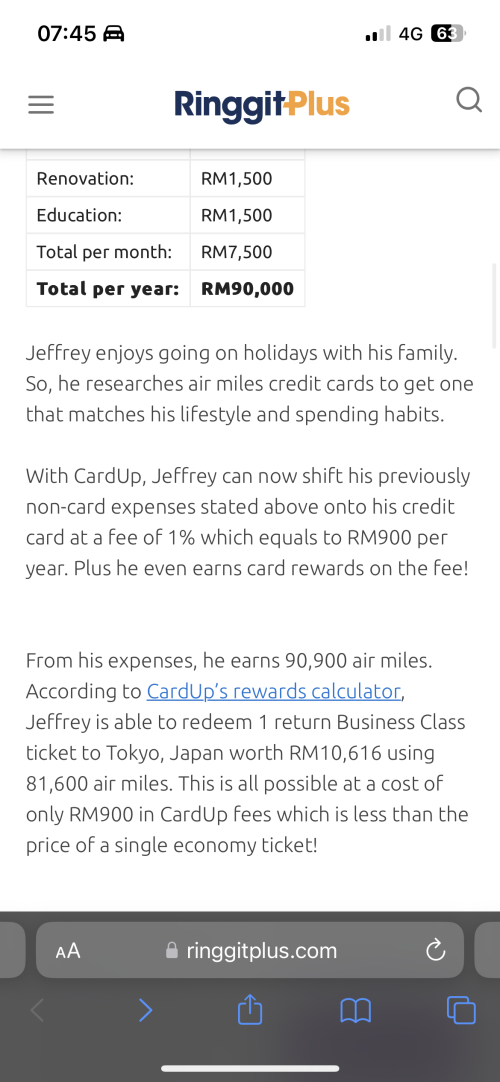

QUOTE(fakhree @ Oct 31 2023, 07:48 AM)   https://ringgitplus.com/en/blog/sponsored/h...ith-cardup.html https://ringgitplus.com/en/blog/sponsored/h...ith-cardup.html Is misleading. The example he show is spending RM90,000 and get 90,000 miles. But when i calculate on spending RM99,000 i only get 28,000 miles Different card, different points rate |

|

|

|

|

|

victorian

|

Aug 21 2024, 08:54 PM Aug 21 2024, 08:54 PM

|

|

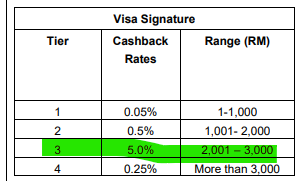

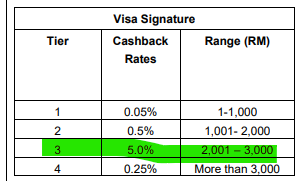

QUOTE(blhc @ Aug 21 2024, 08:41 PM) If looking at cashback with Alliance, CardUp makes sense right to pay mortgage, as long as its below 3k/month? https://www.alliancebank.com.my/Personal/Ca...ure-credit-card do you know how tiered rate works? |

|

|

|

|

|

blhc

|

Aug 21 2024, 09:00 PM Aug 21 2024, 09:00 PM

|

Getting Started

|

QUOTE(victorian @ Aug 21 2024, 08:54 PM) do you know how tiered rate works? "RM1 to RM1000 cash back 0.05% RM1001 to RM2000 cash back 0.5% RM2001 to RM3000 cash back 5% >RM3000 additional cash back 0.25% Should you spend up to tier 3, you will gain cash back of RM55.50 and additional 0.25% if you spend more than RM3000. Therefore, if you spend RM4000, you will enjoy cash back of RM58" Finding the "sweet" amount  |

|

|

|

|

|

victorian

|

Aug 21 2024, 09:02 PM Aug 21 2024, 09:02 PM

|

|

QUOTE(blhc @ Aug 21 2024, 09:00 PM) "RM1 to RM1000 cash back 0.05% RM1001 to RM2000 cash back 0.5% RM2001 to RM3000 cash back 5% >RM3000 additional cash back 0.25% Should you spend up to tier 3, you will gain cash back of RM55.50 and additional 0.25% if you spend more than RM3000. Therefore, if you spend RM4000, you will enjoy cash back of RM58" Finding the "sweet" amount  and how much does cardup charge?  |

|

|

|

|

|

blhc

|

Aug 21 2024, 09:17 PM Aug 21 2024, 09:17 PM

|

Getting Started

|

QUOTE(victorian @ Aug 21 2024, 09:02 PM) and how much does cardup charge?  taking their usual price 2.25% seems like constantly got 1% promotion for awhile just curious why not hearing many ppl mentioning about this service |

|

|

|

|

|

victorian

|

Aug 21 2024, 10:14 PM Aug 21 2024, 10:14 PM

|

|

QUOTE(blhc @ Aug 21 2024, 09:17 PM) taking their usual price 2.25% seems like constantly got 1% promotion for awhile just curious why not hearing many ppl mentioning about this service if 2.25% then you are actually losing out with cc cashback |

|

|

|

|

Sep 29 2020, 11:30 PM, updated 6y ago

Sep 29 2020, 11:30 PM, updated 6y ago

Quote

Quote

0.0197sec

0.0197sec

0.65

0.65

5 queries

5 queries

GZIP Disabled

GZIP Disabled