Outline ·

[ Standard ] ·

Linear+

Credit Cards Affin Duo Credit Card, great rewards for eWallet

|

weejin2000

|

Sep 3 2020, 12:36 PM Sep 3 2020, 12:36 PM

|

|

QUOTE(vin_ann @ Sep 3 2020, 11:21 AM) The bank staff said no add card form. Need fill in new form, with 1 mth pay slip and 3 mths bank statement Got add card form. The form actually serves 2 function: 1. temporary increase in credit limit 2. add additional credit card (just that they haven't updated the Duo option) It is much much easier to fill up. I finish filling up in less than 2 minutes, no need to provide any income document (maybe I got my card less than 1 month ago). BTW, the staff told me credit limit is shared. This post has been edited by weejin2000: Sep 3 2020, 12:37 PM |

|

|

|

|

|

weejin2000

|

May 17 2021, 11:52 PM May 17 2021, 11:52 PM

|

|

QUOTE(victorian @ May 17 2021, 10:03 PM) Anyone got cashback on foodpanda using Affin duo ? Yes, spent over RM110 with foodpanda in the last statement cycle, all transactions got cashback. |

|

|

|

|

|

weejin2000

|

Aug 4 2021, 05:43 PM Aug 4 2021, 05:43 PM

|

|

QUOTE(weiseang72 @ Jul 23 2021, 02:01 AM) do the Duo MasterCard can be cancel and remain Visa? any try before? because my 1st anniversary will be in Oct, if MUST hold 2 cards then i need go spend 12 times in order get annual fees waiver I just called in Call Centre. For the above question, the answer is no from Call Centre, even the SST cannot be waived, but mine SST is going to due only on 21 Sep 2021. Actually I called in because of my Visa Signature SST is going to due on 6 August 2021, but I have three 12 months 0% balance transfer in this card. I suggested that I pay off them today and cancelled tommorrow, call centre said there will be a penalty of RM300, so better pay RM25 than RM300. Bo bian lah, need to pay for the SST for this Visa Signature lah. BTW, I do not need to wait very long to reach CS, I think no queue at all for Affin Bank CS. |

|

|

|

|

|

weejin2000

|

Aug 16 2021, 10:32 PM Aug 16 2021, 10:32 PM

|

|

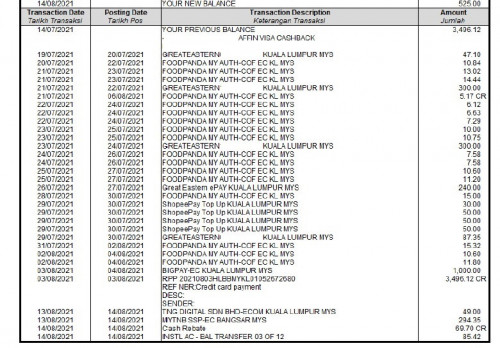

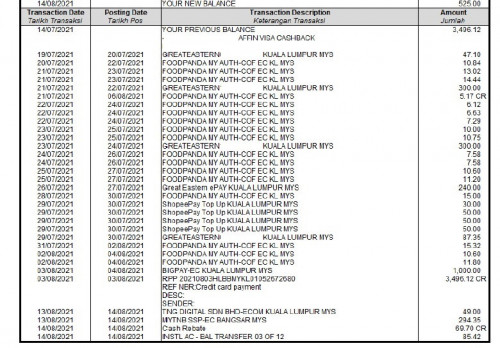

QUOTE(vicng93 @ Aug 4 2021, 04:09 PM) cause the 2.4k was posted on statement date (as I only manage to make those transactions on the day before - so the cb was not reflected in the latest statement). so I'm just wondering for this month, can I only spend rm600 or more than that for this month's cb? Or I can still proceed to spend like normal up to rm1500 or more, since i will only be getting last month's 2.4k cb on the next statement.  sorry just unsure for this kind of scenario... My case almost the same as per above.  if exclude trxs posted on 14/8/2021, TNG Digital & MyTNB, I have spent RM2323.22 x 0.03 = RM69.69 So don't know whether will I get 3% for TNG Digital & MyTNB in the next statement. This post has been edited by weejin2000: Aug 17 2021, 10:45 AM |

|

|

|

|

|

weejin2000

|

Aug 18 2022, 10:45 AM Aug 18 2022, 10:45 AM

|

|

QUOTE(contestchris @ Aug 17 2022, 02:27 PM) Some additional questions about this card: 1) For those paying Great Eastern insurance premium for the auto-billing cashback, do you need to sign up via the special auto debit form, or did you sign up via eConnect website and just click on the checkbox "Use card for subsequent payments"? 2) For the BT, any catch? I've never done BT before. Is it easy to apply? For GE, both form or econnect eligible for cashback. |

|

|

|

|

|

weejin2000

|

Jan 14 2025, 07:26 AM Jan 14 2025, 07:26 AM

|

|

QUOTE(joice11 @ Jan 9 2025, 02:23 PM) hi, just want to confirm is it affin visa cashback card SST can ask for cash rebate? I just asked in late 2024, no campaign or whatsoever for SST. |

|

|

|

|

Sep 3 2020, 12:36 PM

Sep 3 2020, 12:36 PM

Quote

Quote

0.0242sec

0.0242sec

0.19

0.19

7 queries

7 queries

GZIP Disabled

GZIP Disabled