Outline ·

[ Standard ] ·

Linear+

Credit Cards Affin Duo Credit Card, great rewards for eWallet

|

geekfiredog

|

Sep 2 2020, 05:03 PM Sep 2 2020, 05:03 PM

|

Getting Started

|

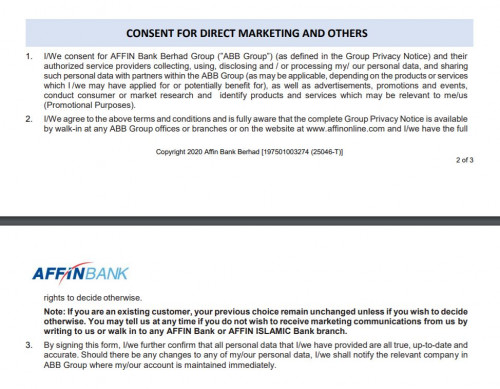

QUOTE(coolguy99 @ Sep 2 2020, 11:48 AM) But isn't this clause in most of the credit card application form? Might be wrong on this. I think for most of the applications, you can choose to opt-out during application. But for Affin bank - it's opt-in by default and you can't opt-out during application, and you can only opt-out later - by then your personal info probably has been sold to god know how many parties. |

|

|

|

|

|

geekfiredog

|

Sep 24 2020, 07:58 AM Sep 24 2020, 07:58 AM

|

Getting Started

|

I prepared all the requirement documents and application form and went to submit at the branch last Tuesday, without realizing that the branch was Islamic banking branch, and was told that this pair of CC can only be applied/processed by conventional banking branch. So happened that branch was being converted from Islamic Banking to Conventional Banking last Friday, so they keep my application form and said will submit after the conversion. Checked the application status through IVR yesterday and was informed that my application has been approved, now waiting for the cards to be delivered, then I can start cancelling my other cards (JOP? FCB?).

|

|

|

|

|

|

geekfiredog

|

Oct 2 2020, 07:45 AM Oct 2 2020, 07:45 AM

|

Getting Started

|

Received my Duo cards a couple of days ago, and the credit limit is one of the highest among the cards I own - just lower than SC JOP if not mistaken.

Based on the cards feature, I probably won't be carrying the cards with me most of the time as I don't think I'll be doing physical transaction (insert / tap / swipe) using either cards.

Mastercard : pretty much useless - just like Visa for MBB 2 cards.

Visa : will just use it to top-up Bigpay / TnG / Boost and spend through these e-Wallets. Not intended to use for online (PBB VS has higher CB rate), and probably move my insurance auto-billing to this card.

|

|

|

|

|

|

geekfiredog

|

Oct 5 2020, 08:26 AM Oct 5 2020, 08:26 AM

|

Getting Started

|

QUOTE(fruitie @ Oct 2 2020, 11:20 AM) So, I just called Affin Bank at 10.46 a.m. for CIP application and I was told an officer will call me back by today. I'm surprised the call came in 5 minutes ago.  He asked me which card I want to use for CIP, I chose Rewards card so that I won't mess up with other cards' transaction as I don't plan to use this card at all. The problem is I haven't activated that CC yet.  So, CS helped me to activate as well. Good job. Everything was done via phone, it will be credited within 3-5 working days. The officer who called said if I'm interested with 0% BT, can straight contact CS and mention his name. This guy is efficient.  Oh ya, my earlier call to CS also checked for my Duo statement date and I was told it is the same as VS. Still considering if it worth the efforts - let say if I put that RM15k to my flexi loan current account, with current effective interest rate of ~ 4%, I probably save ~ RM170 after 6 months. Not worry about my credit rating as I don't plan to take up any loans for the next 6 months or so. |

|

|

|

|

|

geekfiredog

|

Oct 7 2020, 02:17 PM Oct 7 2020, 02:17 PM

|

Getting Started

|

QUOTE(Darren @ Oct 7 2020, 12:43 PM) the cip is 80% from credit card limit right? so for 0% only can apply for 6month? am i mistaken anything? so if i apply n put in fd for 6month then will get free FD interest? You could, and at current FD rate, you will probably earn ~ RM50 - RM100 after6 months with RM15k CIP. This post has been edited by geekfiredog: Oct 7 2020, 02:18 PM |

|

|

|

|

|

geekfiredog

|

Dec 29 2020, 05:52 PM Dec 29 2020, 05:52 PM

|

Getting Started

|

Finally have some time to figure out what’s wrong with my online account access problem, hope it can be resolved this time.

I applied for online account access at one of the branch sometime in mid October – provided my VISA card info, filled up “Retails Internet Transaction Services” form (can’t remember if the form ask for VISA card info) and thumbprint. The person ask if I wanted to try to login for first time using their terminal there and then – I was in a hurry and told her I’ll do it later and left the branch.

Tried First time login the next day – can’t proceed with TAC request with error message “Card Not activated” , but I’ve been using my Duo VISA card for almost 3 weeks. Thinking probably their system is not yet updated with my application, so wait for a few more days and tried again – still the same error message. Wasn’t really urgent for me to have online access, so didn’t call to follow-up.

After about 1 month, tried again – still same error message. Thinking that probably due to my Duo Master card was not activated. Proceed to activate my Master card, still same error. Gave up on my online account access.

Called customer service yesterday, was told that my online account access was registered under Mastercard, not the Visa card info that I provided, and CS asked me to try login with Master card. Didn’t have my Master card with me yesterday, so unable to try with CS still online.

Today – try with both VISA and Master cards – both cards giving same “Card Not Activated” error message. Decided to give a call to CS again, and was finally told that the officer processed my application (Retails Internet Transaction Services form) was using my Master Card info for the processing (even though I never provide the card info to her), and they did not activate online account access for my Master card (I’ve activated my Master card, but the branch didn’t activate the card for online account access). Now Customer Service needs to send a form to the branch to ask them to activate online access for my Master card to allow me to proceed with first time login, and that will takes 3-4 working days.

In short :

- I applied Retails Internet Transaction Services with my VISA card

- Branch officer process my application using Master card info

- Branch officer did not activate my Master card for online internet access

- Customer Service needs to send a form to the branch, requesting the branch to activate my Master card for online internet access, and it takes 3-4 working days

What a mess! Hope everything is sort out this time and I can finally gain access to online account next year 😊

|

|

|

|

|

|

geekfiredog

|

Jan 1 2021, 06:53 PM Jan 1 2021, 06:53 PM

|

Getting Started

|

QUOTE(fruitie @ Jan 1 2021, 02:25 PM) Just noticed I have received RM 30 activation cash back on 31.12 in Visa Duo.  Received RM30 activation cash back as well. Card approved on Sept 22, activated on Oct 01 and 1st transaction on Oct 10. |

|

|

|

|

Sep 2 2020, 11:17 AM

Sep 2 2020, 11:17 AM

Quote

Quote 0.1484sec

0.1484sec

0.41

0.41

7 queries

7 queries

GZIP Disabled

GZIP Disabled